Can I Get Medicare If I Never Worked

Yes, you can still get Medicare if you never worked. Your work history does not impact your Medicare eligibility. The only part of Medicare thats impacted by your work history is the premium you pay for Medicare Part A. In order to get Part A premium-free, you must have paid 10 years of Medicare taxes. If you paid less than 10 years, then you must pay a premium for Part A unless you have low income.

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

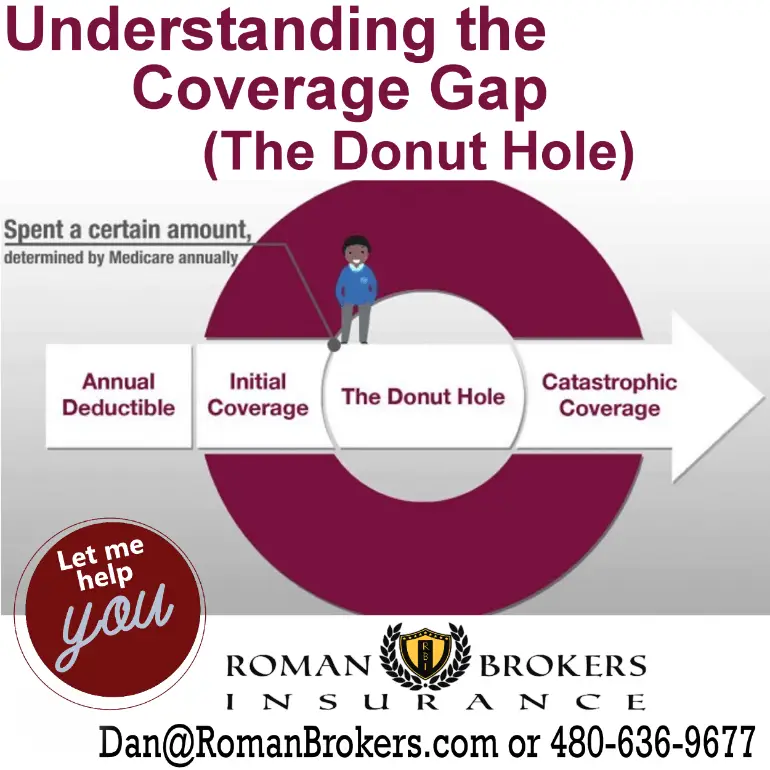

Don’t Miss: What Is A Medicare Coverage Gap

Is Medicare Enrollment Automatic At Age 65

Medicare enrollment is only automatic at age 65 if youre currently collecting Social Security benefits. If not, youll need to affirmatively enroll during your Medicare Initial Enrollment Period. Your Medicare Initial Enrollment Period is a seven-month window that starts three months before your birthday month and will continue for three months after your birthday month.

What Happens If I Miss My Medicare Enrollment

If you miss your initial enrollment period, you can still sign up for Medicare, but you could face late enrollment penalties. Anyone can sign up during the Medicare general enrollment period, which happens from Jan. 1 to March 31 each year. If you meet the qualifying circumstances, you can sign up any time through a Medicare special enrollment period.

Also Check: Does Medicare Cover Inversion Tables

Social Security Cola For 202: Here’s How To Check Your New Increase Amount

Social Security beneficiaries can expect an 8.7% cost-of-living adjustment increase in their benefit amounts next year.

Good news for Social Security beneficiaries: They’re getting a big cost-of-living adjustment increase, that is, an 8.7% increase, in the new year. If you created an online My Social Security account by Nov. 15, you can now see how much extra you’ll be getting — we’ll explain below how to find the document with your COLA increase. If you don’t have an account or you didn’t create one by the November deadline, don’t worry. You’ll receive a letter in the mail with this information.

A My Social Security account will show you your current or expected future benefits, based on your expected retirement age and your work history. You can also get documents for filing your taxes, request a benefit verification letter or change your mailing address and other personal information.

Here’s how to access your Social Security benefits online, and what sort of information and features you’ll be able to access with your My Social Security account. If you receive benefits now, here’s the Social Security payment schedule for December. Also, Supplemental Security Income recipients will get their first increased check in December.

What Is Included In Medicare Part D

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans to supplement traditional Medicare and Medicare Advantage prescription drug plans …

Recommended Reading: How Much Does Medicare Pay For Medical Transport

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

The Increased Maximum Social Security Benefit

Just as the average monthly Social Security payout will increase in 2023, so too will the maximum benefit. For 2022, the top payout was $4,194 but, in 2023, that will jump to $4,555.

One thing about the maximum Social Security benefit is that its all but unattainable for most Americans. For starters, youd have to wait until age 70 to file for benefits, and most retirees file at 67 or even as early as 62. But to get that top amount youll also need to earn at or above the Social Security wage base for the full 35 years that the SSA takes into consideration when calculating your benefit.

While thats certainly possible for those who consistently take home a very high paycheck, in reality, only about 6% of Americans exceed the Social Security wage base in any given year, let alone for 35 years.

Don’t Miss: What Is The Special Enrollment Period For Medicare

Medicare Eligibility Before Age 65

If youre under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for at least 24 months in a row

- If you have amyotrophic lateral sclerosis

- If you have end-stage renal disease . ESRD is permanent damage to the kidneys that requires regular dialysis or a kidney transplant

If youre eligible for Medicare because of any of these circumstances, you may receive health insurance through Medicare Part A and Medicare Part B , which make up Original Medicare. Your enrollment in Medicare may or may not be automatic, as explained below.

What Is The Medicare Eligibility Age

For just about everyone, the Medicare eligibility age is 65. At that point, youll have access to Medicare Part A and are able to purchase Medicare Part B. For some with disabilities or End Stage renal disease, though, eligibility may come at a younger age. Most people are eligible to receive part A without having to pay for it, but there are a few exceptions, which well note in further detail below. For help with healthcare planning and other questions about finances and retirement, consider working with a financial advisor.

Don’t Miss: Why Do I Need Medicare Part C

When To Apply For Medicare: Whats The Initial Enrollment Period

For most people, the Medicare Initial Enrollment Period is a seven-month period. It starts three months before the month you turn 65, includes your birthday month, and goes three more months after that. So if your 65th birthday is in November, your IEP runs from August through February.

Your IEP is different if youre not yet 65, but you qualify for Medicare by disability. For example, you might be automatically enrolled during your 25th month in a row of receiving Social Security disability benefits.

Learn how enrollment works if youre under 65 but eligible for Medicare through disability.

Underage Children Being Raised By Medicare Beneficiaries

In 2010, the Affordable Care Act allowed young adults under the age of 26 to remain on their parents health plans. The problem? This provision does not extend to Medicare. That can put many families on the hook for paying out of pocket for other sources of health care.

- Disabled parents may need to provide health coverage for their children. They will need to access alternate insurance coverage and this is most often through Medicaid. More than 10 million people for Medicaid based on a disability.

- Challenges also arise for grand families and families where children are raised by their grandparents. More than 2.4 million grandparents are responsible for the needs of their grandchildren. Many of these grandparents will be older and on Medicare.

Health insurance marketplace or private insurance plans may be viable options to cover health care for these children.

Also Check: What Do You Need To Apply For Medicare Card

Don’t Miss: Is Medicare Solutions A Legitimate Company

Eligibility For Medicare At Age 60

To understand what eligibility for Medicare might look like at age 60, it helps to understand what eligibility looks like today. Today, you become eligible for Medicare at age 65 as long as you have been a U.S. citizen for at least five years. If you are already receiving Social Security benefits, then you will be automatically enrolled in coverage. Those who are not yet receiving retirement benefits will need to apply for coverage. If the proposed Medicare legislation passes the House and Senate, then here is what you can expect.

You would become eligible for Medicare at age 60 instead of age 65. The five-year U.S. citizenship rule would likely still apply. Since most people are not receiving Social Security benefits at age 60, they would need to apply for Medicare coverage at that age manually. The provisions that allow younger individuals to qualify for Medicare likely would not change.

Younger individuals would still be able to receive Medicare after having been on Social Security disability benefits for at least 24 months. Similarly, younger people who are diagnosed with ALS or ESRD could still sign up for Medicare as well. Remember that Medicare and Medicaid are two completely separate insurance programs. Medicare is administered by the Federal government, and it mostly provides coverage for older individuals. Medicaid, on the other hand, is primarily administered by state governments. It is meant to provide health coverage for low-income individuals and families.

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Read Also: How To Bill Medicare Electronically

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Canceling Your Marketplace Plan When You Become Eligible For Medicare

In most cases, if you have a Marketplace plan when you become eligible for Medicare, youll want to end your Marketplace coverage.

IMPORTANT

Don’t end your Marketplace plan until you know for sure when your new coverage starts. Once you end Marketplace coverage, you cant re-enroll until the next annual Open Enrollment Period .

Your Medicare coverage start date depends on your situation.

You May Like: Does Medicare Cover Foot Doctors

How Could Lowering The Medicare Age Affect Provider Networks For Current Medicaid Enrollees

What is current policy? People may have access to different provider networks in Medicare vs. Medicaid, due to different managed care and network adequacy rules. Once eligible for coverage, Medicare allows enrollees to choose whether to receive benefits under the traditional Medicare program, or enroll in a Medicare Advantage managed care plan. Traditional Medicare offers access to a broad provider network, while Medicare Advantage plans have restricted provider networks. States may require Medicaid enrollees to enroll in managed care, which can further restrict provider networks beyond those that participate in the states fee-for-service Medicaid program.

What are the key policy choices and implications? People could gain access to a broader provider network through traditional Medicare compared to their states Medicaid program. If moving from Medicaid to Medicare, individuals could experience changes in delivery systems and provider networks, depending on whether they opt for Medicare Advantage or traditional Medicare, which could mean disruptions in care.

Giving A Good Income Estimate Is Important

For the income part of the determination, you’ll need to estimate it for 2023 during the sign-up process.

Giving a good estimate matters.

If you end up having annual income that’s higher than what you reported when you enrolled, it could mean you’re not entitled to as much aid as you’re receiving. And any overage would need to be accounted for at tax time in 2024 which would reduce your refund or increase the amount of tax you owe.

“You don’t want a nasty surprise when you do your taxes the next year,” Cox said.

Likewise, if you are entitled to more than you received, the difference would either increase your refund or lower the amount of tax you owe.

Either way, at any point during the year, you can adjust your income estimate or note any pertinent life changes that could affect the amount of subsidies you’re entitled to.

You May Like: What Is Medicare Expansion Mean

How To Learn About Medicare Before Turning 65

MedicareFAQ serves as a learning resource for Medicare beneficiaries and their families. We strive to educate people about Medicare to make informed decisions that benefit the future of their health and finances.

Call the phone number above if youre ready to speak to someone about your Medicare coverage options. You can also use our online rate form to see premium prices for plans near you. We work with beneficiaries across the nation and are glad to help you find the best coverage available.

- Was this article helpful ?

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Read Also: Does Medicare Cover Palliative Care For Dementia

Medicare Eligibility: Age 65 And Other Ways To Qualify

Find Cheap Medicare Plans in Your Area

You become eligible for Medicare at age 65, or beforehand through a disability or medical condition.

In addition, there are other eligibility restrictions based on citizenship, type of Medicare plan, where you live and your work history.

Remember that income does not affect your eligibility for Medicare. But those who have a low income can be dual-enrolled in both Medicare and Medicaid, which can further reduce your medical expenses.

| Medicare eligibility by age | Medicare eligibility by health condition | |

|---|---|---|

| Main eligibility requirement | ||

| Work history requirements | None for enrollment, but there are requirements to determine if you’re eligible for free Medicare Part A | None for those with a disability who automatically get free Medicare Part A, but those with ESRD have a work requirement |

| Location restrictions | No restriction for Parts A and B, but for other Medcare parts, you’re only eligible for the plans offered in your area | No restriction for Parts A and B, but for other Medcare parts, you’re only eligible for the plans offered in your area |

If you qualify for Medicare by age, your initial enrollment period starts three months before your birthday month and ends three months after your birthday month.

If you don’t qualify for Medicare and still need health insurance, you may be eligible for:

- A health insurance marketplace plan: Plans available to all with discounts based on income

- Medicaid/ CHIP: Health insurance for those with low incomes