Can I Get Medicare At Age 55

Like those who retire at 62, those who retire at age 55 are not eligible for Medicare. While you may be eligible for Social Security benefits, this is not the same as Medicare healthcare coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

The only time you qualify for Medicare before age 65 is if you have been diagnosed with specific conditions or have been receiving Social Security disability benefits for 24 months.

Did You Answer Yes To Question 2

If you are still working, then we immediately move to the next question, which is how many employees does the company that you work for have? Your answer will determine whether or not you will need to sign up for Medicare at age 65.

Was your answer, less than 20 employees?

Then you will need to as soon as youre eligible. If you fail to enroll in Medicare when you become eligible while working for a company that has less than 20 employees, you will incur late enrollment penalties. Medicare is primary when you work for a small company, so you need both Parts A and B.

Was your answer, 20 or more employees? Great, then you have options.

Signing Up For Medicare

Many different factors determine when you can sign up for Medicare. For most, the first time they can sign up is when they turn 65. However, there are instances where you can become eligible for Medicare before age 65.

Signing up for Medicare is simple. Three months before the month of your 65th birthday, your initial enrollment window will open. This period lasts through your birthday month and ends on the last day of the third month following.

In total, your initial enrollment period lasts seven full months. This is a once-in-a-lifetime enrollment window that you do not want to miss.

If for any reason, you happen to miss it, there are other opportunities to enroll. Keep in mind that no part of Medicare is mandatory. However, if you dont sign up when youre first eligible, you could incur penalties when you eventually sign up. The only way around the late penalties that result from delaying Medicare enrollment is to have .

Get A Free Quote

Find the most affordable Medicare Plan in your area

Also Check: Are Hearing Aids Covered By Medicare Part B

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first and a secondary payer will only kick in for costs not covered by the primary payer. The secondary payer may not pay all of the remaining uncovered costs, and you may be responsible for any additional balance.

In many instances, if you are age 65 and covered by either a retiree plan or a plan with fewer than 20 employees, then Medicare is your primary payer and private insurance is your secondary. If this is your situation, you should enroll in Part A and B, along with D if your private insurance plan doesnt have creditable prescription drug coverage.

If youre covered by a plan with 20 or more employees, Medicare is often the secondary payer. Medicare may pay costs that your employers plan doesnt.

How To Contact Medicare By Phone

1-800-810-1437 TTY 711. When it comes to subjects like Medicare, keeping up with important dates and deadlines can be difficult, especially if you already have a lot on your plate. Each portion of Medicare has its own enrollment deadlines that largely depend on your situation and eligibility. Its important to keep up with …

Read Also: Is United Healthcare A Good Medicare Supplement

What Do The Different Parts Cover

Medicare Part A covers hospital stays and care, while Part B covers physician fees and other costs associated with diagnosing and treating medical conditions. Medicare Part C, called Medicare Advantage, offers options for extra coverage that may include vision, dental, and wellness care. Medicare Advantage plans cover at a minimum what Medicare Part A and Part B cover . Most MA plans also provide prescription drug coverage. You can only apply for a Medicare Advantage plan if you’re already enrolled in both Part A and Part B. Medicare Part D covers prescription medications. If you have a Medicare Advantage plan with prescription drug coverage, you probably don’t need a separate Part D plan.

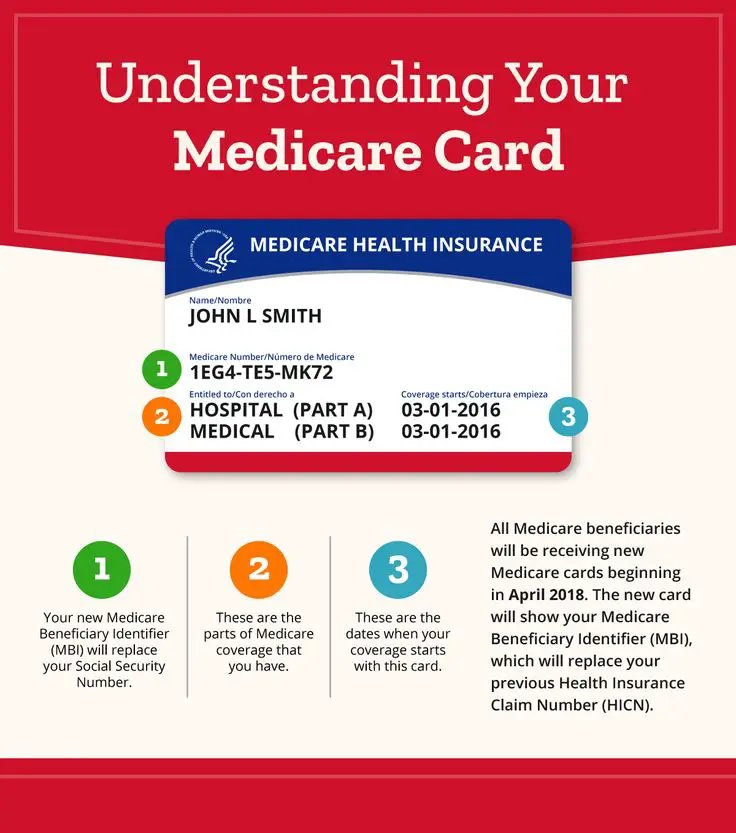

What Happens After I Register For Medicare

After your application is received and processed, a letter will be mailed to you with the decision. If you encounter any questions or problems during the process, you can always contact Social Security for assistance.

Get A Free Quote

Find the most affordable Medicare Plan in your area

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application is approved. Unfortunately, waiting times can be as long as 90 days in some cases.

However, if you automatically enroll in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

Read Also: Does Medicare Cover Accu Chek Test Strips

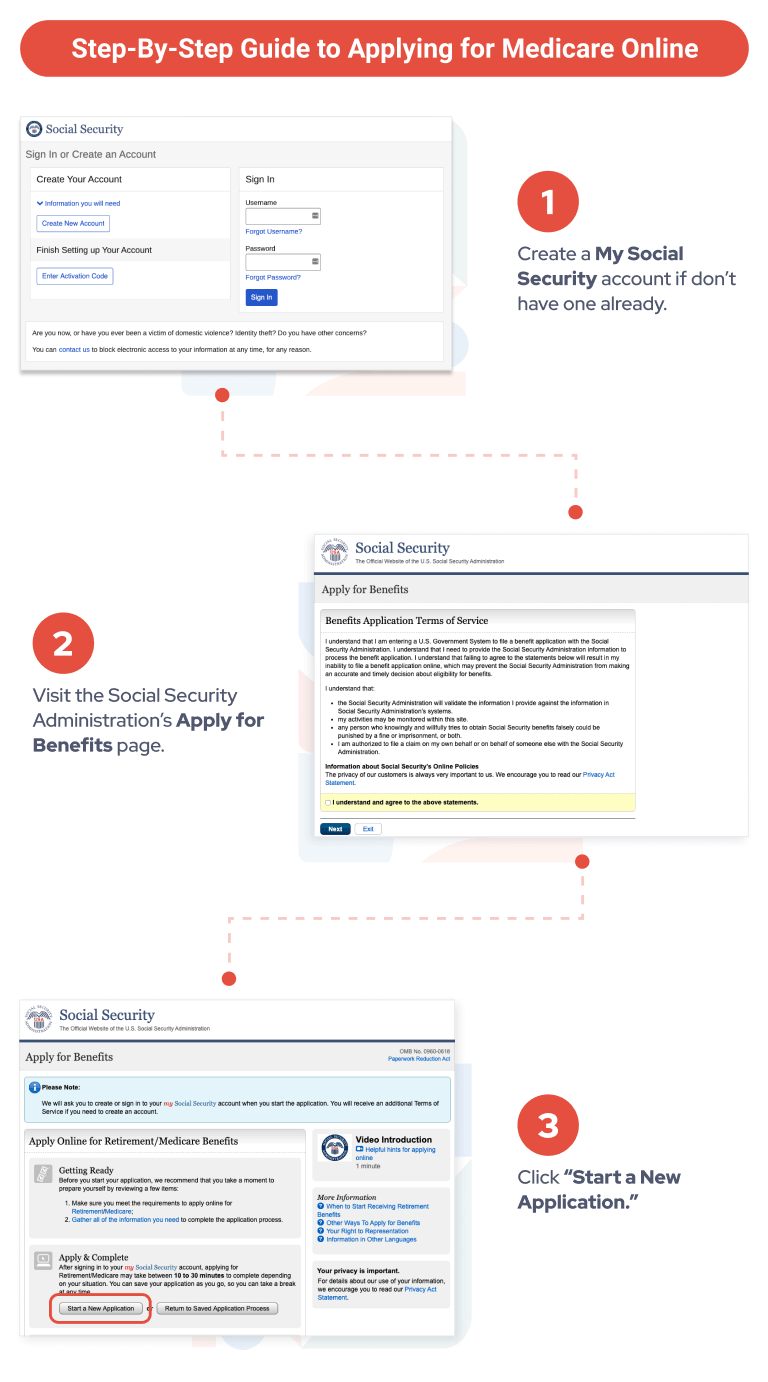

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Signing Up For Medicare Supplement Or Medicare Advantage Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan at any time. However, the best time to enroll is during your Medicare Supplement Open Enrollment Period.

Get A Free Quote

Find the most affordable Medicare Plan in your area

You can enroll in any Medigap plan for which youre eligible, with no health underwriting questions during this time. Thus, you wont face denial due to pre-existing conditions.

If you choose to enroll in a Medicare Advantage plan, it is best to do so during your initial enrollment period. This is the same timeframe as applies to Medicare Part A and Part B enrollment.

You can enroll in any Medicare Advantage plan available in your service area during this window. If you miss this enrollment period, you must wait until the Annual Enrollment Period to enroll in a plan.

Keep in mind, when enrolling in a plan, it is important to note that you are not able to enroll in a Medicare Advantage plan and a Medigap plan at the same time. So, before you enroll, it is essential to compare all options available.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Recommended Reading: How To Choose The Best Medicare Plan

What Are Important Medicare Decisions

Applying for Medicare Parts A and B is the first step. Other decisions related to Original Medicare can be made in the same timeframe:

- Should you enroll in Medicare Part D, which will cover the cost of your medications?

- Should you buy Medicare Supplement to cover expenses that arent included in Original Medicare?

You May Like: Does Medicare Advantage Pay For Hearing Aids

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Also Check: How Do I Qualify For Medicare Low Income Subsidy

Medicare Part A Enrollment Deadlines

Some people get enrolled in Medicare Part A automatically. If you meet one of the following conditions, you may be enrolled in Medicare Part A three months prior to your 65th birthday or during the 25th month of your disability, depending on circumstance:

- You currently receive benefits from the Railroad Retirement Board or Social Security

- You are younger than 65 and have a disability

- You have been diagnosed with amyotrophic lateral sclerosis

- You live in Puerto Rico and draw benefits from the Railroad Board or Social Security

Those who meet the above qualifications wont need to worry about enrollment deadlines.

If you are enrolled into Medicare Part A automatically due to health conditions or retirement status, you dont have to do anything. But if not, your ability to enroll in Medicare begins three months prior to your 65th birthday and ends three months after the month you turn 65. Essentially, you have a total of seven months to enroll in Medicare when you first become eligible.

If you dont enroll during your Initial Enrollment Period , then you may be charged a penalty fee if you enroll later. Penalty fees are assessed for as many months as you lacked Medicare coverage this sum can add up over time. Numbers and dates tend to run together for some people. So, lets take a look at an example to give you an idea of the reality of Medicare Part A deadlines.

Top 5 Things You Need To Know About Medicare Enrollment

1. People are eligible for Medicare for different reasons.

Some are eligible when they turn 65. People under 65 are eligible if they have received Social Security Disability Insurance or certain Railroad Retirement Board disability benefits for at least 24 months. If they have amyotrophic lateral sclerosis , theres no waiting period for Medicare. Some people with End Stage Renal Disease may be eligible for Medicare. Its important to know the different ways that people qualify for Medicare so you can help current and former employees and their dependents anticipate their eligibility for Medicare so they can make timely and appropriate decisions about their enrollment.

2. Some people get Medicare Part A and Part B automatically and some people need to sign up for them.

People living in the United States and U.S. Territories who are already collecting Social Securityeither disability or retirementare automatically enrolled into Part A and Part B when theyre first eligible. These people will get a packet of information a few months before they turn 65 or receive their 25th month of Social Security Disability or Railroad Retirement Board benefits. At that time, they can choose to keep or decline Part B, but cant decline Part A unless they withdraw their original application for Social Security and pay back all Social Security cash benefits.

3. Enrolling in Medicare can only happen at certain times.

Don’t Miss: Does Medicare Pay For Insulin

Should I Still Check My Medicare Plan Each Year

Yes! Your provider will send you an Annual Notice of Change in the mail, covering any changes to cost, benefits, or service areas that may affect you in the coming year. Its also a perfect opportunity to review your coverage and determine if it still meets your needs.

The Open Enrollment Period for Medicare Advantage runs from January 1st through March 31st of each calendar year. If youre dissatisfied with your coverage or are looking for a new provider, now is the time to make a change.

Can You Delay Medicare Enrollment Even If You Are Eligible

The short answer here is yes, you can choose when to sign up for Medicare. Even if you get automatically enrolled, you can opt out of Part B since it requires a monthly premium. But there are good reasons to join on time when you first become eligible.

A Delay In Coverage Can Result In Increased Costs, Especially Long Term

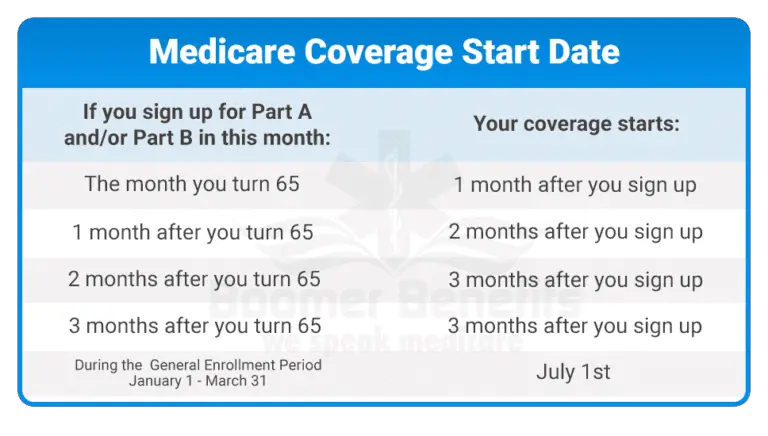

First, signing up during your initial eligibility window guarantees that you have coverage sooner. Waiting to enroll in Medicare until after your 65th birthday can mean waiting for effective coverage for up to three months after you turn 65. Three months might not sound like a long time, but when you need medical care or prescription drugs, that 3-month gap can be expensive.

If you dont sign up at all during your initial eligibility window, then youll have to wait until the general enrollment period to enroll, which runs from January 1 through March 31 each year. Coverage then starts in July.

Heres An Example Scenario:

- You turn 65 in June, but you choose not to sign up for Medicare during your IEP .

- In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesnt start until January.

- You sign up for Parts A and B in January.

- Your coverage starts in July, over a full year from when you turned 65.

Penalty Fees For Not Enrolling On Time

Don’t Miss: Will Medicare Cover Lasik Surgery

How Do You Apply By Phone

Call 772-1213 or TTY 325-0778 between 7 a.m. and 7 p.m. from Monday through Friday.5 Keep in mind that this process takes longer because forms have to be mailed to you, which you then complete and send back. At peak times, applying for Medicare by phone could take a month or more.

If you worked at a railroad, you can enroll in Medicare by calling the Railroad Retirement Board at 772-5772 or TTY 751-4701, 9AM 3:30PM, Monday Friday.

Applying For Medicare In Person

Although applying in person is not as convenient as applying online or over the phone, it has an advantage over the other methods: you can bring your precious documents to the office, where theyll stay securely with you the whole time.

This is the best option for some folks, like legal permanent residents, for example. Foreign birth certificates or immigration documents are not only costly but also difficult to replace, and the Social Security Administration even asks you not to mail them.

If you want to apply in person, heres what the process looks like for you:

You May Like: Is It Too Late To Change Medicare Advantage Plans

Will The Medicare Age Be Raised To 67

In recent years, the proposal to raise the Medicare eligibility age to 67 began to gain traction. However, many are actually in favor of lowering the Medicare age below 65 rather than pushing it back to 67.

As of now, there has not been any indication that either of these proposals will become law. The standard Medicare enrollment age is currently 65 and there are no plans of changing that in the near future.

Get A Free Quote

Find the most affordable Medicare Plan in your area

- Was this article helpful ?

What Is Your Medicare Special Enrollment Period

If you have delayed Medicare Part B enrollment due to being on an employer plan, once you leave your employer, youll have an eight-month Special Enrollment Period to sign up for Medicare. This Special Enrollment Period will start the month after you leave employment, or the month after your group health coverage ends, whichever happens sooner.

You will not be assessed any late enrollment penalties if you sign up during this time period. This eight-month special enrollment period is also available if you are covered under your spouses employer plan.

Once you are enrolled in Medicare coverage, you will have the chance to review and change your Medicare plans each fall during Medicare open enrollment, which is the Annual Enrollment Period . Changes made during this period from Oct. 15 through Dec. 7 take effect the following year on Jan. 1.

Also Check: How Many Quarters Do You Need To Qualify For Medicare

When Do I Sign Up For Medicare

There are multiple times per year when you may be able to sign up for Medicare. You can sign up during your Initial Enrollment Period: a seven-month span beginning three months before you become eligible and extending three months afterward.

If you need to change your plan or have missed your Initial Enrollment Period, you can also sign up during the Annual Enrollment Period from October 15th through December 7th of each calendar year. Those looking to change their Medicare Advantage or Medicare Part D plans can do so during Open Enrollment from January through March.

Enrolling In A Medicare Advantage Plan During A Special Enrollment Period

If you missed the other enrollment periods, you generally have to wait for the next Annual Election Period. However, there are certain special circumstances that could qualify you for a Special Enrollment Period, such as:

- You moved out of your current Medicare Advantage plans service area.

- You are eligible for Medicaid.

- You qualify for the Extra Help program, which assists with the cost of your prescription medications.

- You are receiving care in an institution, such as a long-term care hospital or skilled nursing facility.

- You want to switch to a Medicare Advantage plan with a 5-star overall quality rating.

Also Check: Which Of The Following Consumers Would Be Eligible For Medicare

Ask These Questions Before You Delay Medicare

Whether or not you can delay Medicare past 65 when youre working really depends on a few simple questions.

1. Do you have employer health coverage?

2. Does your employer have 20 or more employees?

3. Is the coverage considered creditable?

If you can answer Yes! to all the above, you likely qualify for a Medicare Special Enrollment Period and can delay enrolling without penalty. Whats the next step? and information sent directly to your inbox.