Report The Death Of A Social Security Or Medicare Beneficiary

You must report the death of a family member receiving Social Security or Medicare benefits. The Social Security Administration processes death reports for both. Find out how you can report a death and how to cancel benefit payments. In addition to canceling SSA and Medicare benefits, find out what other benefits and accounts you should cancel.

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

- The amount of gross pay for the employee for that pay period

- The total year-to-date gross pay for that employee

- The Social Security and Medicare withholding rates for that year

- Any amounts deducted from that employee’s pay for pre-tax retirement plans.

Employee pay subject to Social Security and Medicare taxes may be different from gross pay. This article on Social Security wages explains what’s included and what’s not.

In addition, you will need to know, for each year:

The Social Security Maximum. This is the maximum wages or salary amount for Social Security withholding for that year. Each year the Social Security Administration publishes a maximum Social Security amount no Social Security withholding is taken from employee pay above this amount. Go to this article on the “Social Security Maximum” to find this year’s maximum withholding amount.

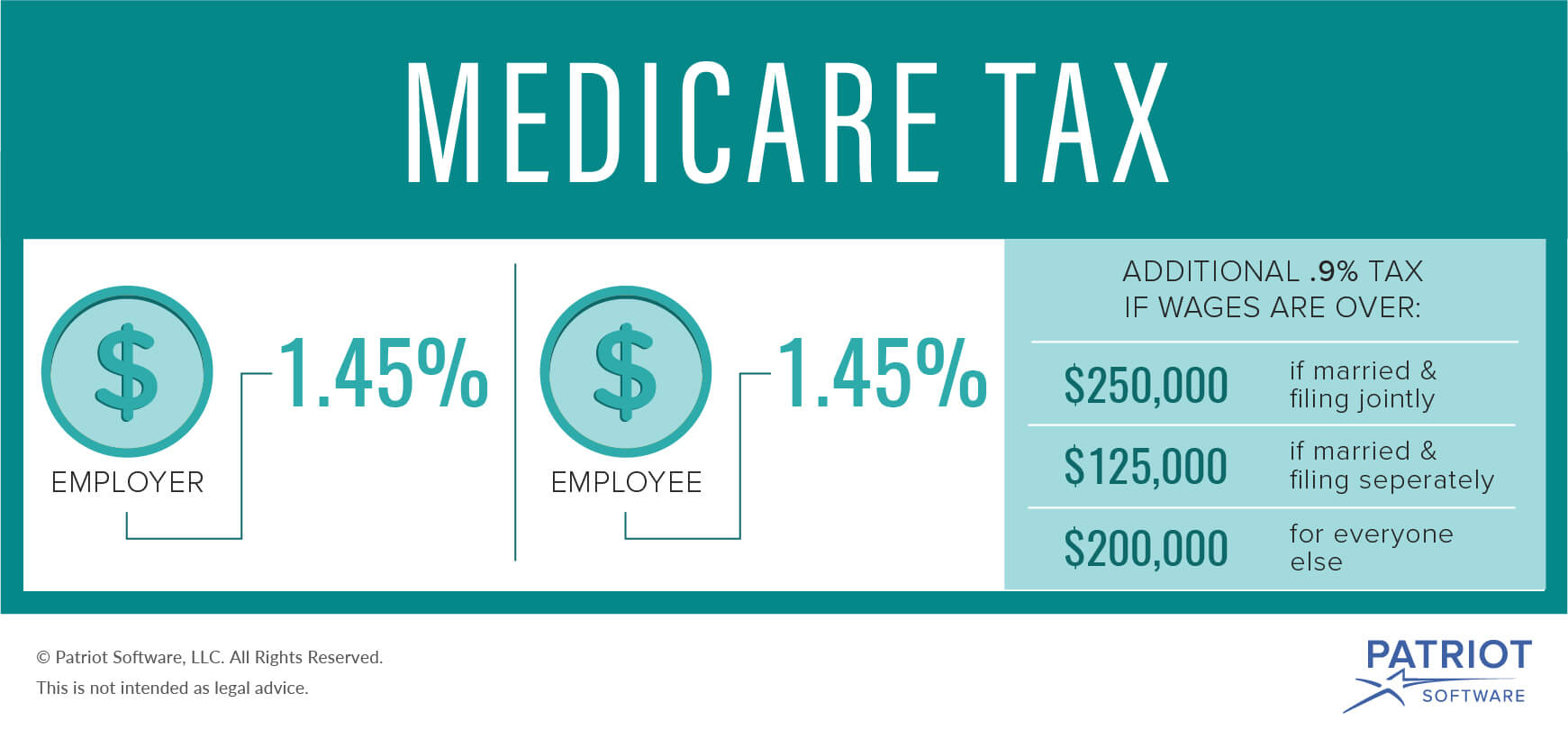

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual’s tax status At the specified level for the year, an additional 0.9% must be withheld from the employee’s pay for the remainder of the year. You must begin deducting the additional 0.9% when the employee’s wages reach $200,000 for the year, no matter what the employee’s marital status is.

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

Read Also: Can You Get Hearing Aids With Medicare

How Contributions Are Calculated

The FICA tax is your contribution to Social Security and Medicare as a percentage of your salary:

If you’re an employee, then you pay one half of this total your employer pays the other half for you .If you’re self-employed, then you pay the whole total yourself as Self-Employment tax, and then get a tax deduction on half of it as an “adjustment” on your tax return.

Now here’s where it gets a little confusing.What the previous paragraph shows is that being self-employed is like being an employee, but at a lower salary – lower by the FICA “half” that employers pay for their employees.And so, if you’re self-employed, you don’t have to pay FICA on all your salary, just on 92.35% of it.

Lost Or Stolen Federal Payments

Report your lost, missing, or stolen federal check to the agency that issued the payment. It’s usually one of these paying agencies. If your documentation indicates it’s a different agency, and you need its contact information, look in the A-Z Index of U.S. Government Departments and Agencies.

To get an update on your claim, contact the Treasury Department Philadelphia Financial Center at 1-855-868-0151, option 1.

Don’t Miss: How To Sign Up For Medicare In Arkansas

Updating Records And Form W

Dont forget to update your payroll records for each employee you over or underwithheld taxes from. If you dont update your records, you will have inaccurate information for creating Form W-2, Wage and Tax Statement.

Lets say you withheld taxes from an employees wages even after they reached the Social Security wage base. As a result, the information on the employees Form W-2 is incorrect. You already sent Form W-2 to the Social Security Administration and need to fix your mistake.

File Form W-2c, Corrected Wage and Tax Statement to fix reporting errors on Form W-2 if you already sent it to the SSA. On Form W-2c, you must enter previously reported information and the correct information.

Dont make things difficult for yourself. Get guaranteed payroll calculations by using Patriots online payroll software. After you enter employee information, well calculate payroll and income taxes. Want to eliminate your depositing and filing responsibilities? Opt for Full Service Payroll and give our payroll services a go. Get your free trial now.

This is not intended as legal advice for more information, please

Medicare Taxes For The Self

Even if you are self-employed, the 2.9% Medicare tax applies.

Typically, people who are self-employed pay a self-employment tax of 15.3% total which includes the 2.9% Medicare tax on the first $142,800 of net income in 2021.2

The self-employed tax consists of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. If youre unsure of how to do this, a tax professional may be able to help.

Read Also: What Is The Best Medicare Plan To Get

Your Social Security Benefits Could Be Reducedtemporarily

Your age matters here, as well see below, but any reductions that do occur are temporary. The IRS will eventually recalculate your benefit and give you credit for months where you didnt receive a benefit. So, dont let a temporary reduction in payments keep you from returning to work. Heres how the age rules work:

If you havent yet reached your full retirement age between 66 and 67 for people born in 1943 or laterworking could mean temporarily giving up $1 in benefits for every $2 you earn above the annual limit .

Heres an example of how that might look:

You retire early and go back to work before reaching your FRA. Your annual salary is $30,000. Because you are $11,040 over the annual limit, your Social Security benefits are reduced by $5,520.

You retire early and go back to work before reaching your FRA. Your annual salary is $30,000. Because you are $11,040 over the annual limit, your Social Security benefits are reduced by $5,520.

What Is Deducted From A Social Security Monthly Payment

About to retire in ~8 months and live in California. I would like to know what taxes and deductions I should expect to see in my SS payment check the SS office tells me I will receive ~2300, but how would I figure out how much will be the net amount?, for example -are there Medicare, FICA payments, etc? -And if I may slip another question: Are the monthly payments taxable?Thanks and best regards.

Ill answer your second question first:

Are the monthly payments taxable?

Sometimes. To figure it out, you need to calculate your combined income. The formula for combined income is:

Your adjusted gross income + non taxable interest + half of your social security benefits.

If you are married filing jointly, calculate the combined income using both you and your spouses numbers combined.

After youve got that number:

-

If you are single or head of household,

- if your combined income is $25k $34k, 50% of your SS benefits might be taxable.

- if your combined income is more than $34k, up to 85% of your benefits are taxable.

If you are married filing jointly,

If you are married filing separately, up to 85% of your benefits are taxable.

What is deducted from a social security payment?

State taxes are never withheld from Social Security checks.

Recommended Reading: Which Of The Following Is True Regarding Medicare Supplement Policies

Also Check: Does Medicare Cover Dexcom G5

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

Medicare Part B Premiums For Those Held Harmless

Whether a beneficiary is held harmless or not depends on the amount of the standard Medicare Part B premium increase relative to the amount of his or her Social Security COLA in a given year.

The Medicare Part B premium an individual pays when held harmless may affect his or her future Medicare Part B premium amounts. For example, an individual held harmless in a year with no Social Security COLA may pay an increase in Medicare Part B premiums in a later year in which he or she is not held harmless, even if the standard Medicare Part B premium does not increase.

Table 2. Illustration of the Activation of the Hold-Harmless Provision for a Hypothetical Individual Over Time

|

Year |

CRS analysis based on data in 2018 Medicare Trustees Report and 2018 Social Security Trustees Report.

Notes: This chart assumes the individual is eligible for the hold-harmless provision .

a. COLA = Cost-of-living adjustment.

b. This amount is based on the average monthly Social Security benefit amount for a retired worker in 2008 , increased annually by the Social Security COLA.

c. Increase from the previous year.

d. The standard Medicare Part B premium is the premium amount paid by enrollees not held harmless and not subject to high-income-related premiums.

e. Increase from previous year. A negative value indicates a decreased premium.

Also Check: Does Medicare Cover Office Visits

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

What Are The Medicare Part B Premiums For Each Income Group

| File individual tax return |

Source: Medicare.gov

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

This means that the average beneficiary will see never see ten percent of their total income, before accounting for the other health care costs they may have to pay throughout the year.

Deductible increases

In addition to premiums, the CMM also announced an increase to the Part B deductible.

You May Like: What Is Medicare Chronic Care Management

Nonresident Alien Students Only

F-1 and J-1 students are considered nonresident alien for tax purposes during the first 5 calendar years they are present in the U.S. NRA students are not subject to Social Security/Medicare tax withholding while working on campus or while working for off-campus employers under Optional Practical Training or Curricular Practical Training .

Section 3121 of the U.S. Internal Revenue Code specifies criteria by which an international student may be exempt from Social Security/Medicare taxes:

Occasionally off-campus employers of international students on OPT/CPT are unfamiliar with this IRC section and withhold Social Security/Medicare tax in error. International students should follow this guide and work with their off-campus employer to have their portion of Social Security/Medicare tax refunded.

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Read Also: Do You Pay For Medicare After 65

Who Is Eligible For Medicare

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. Its also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease .

While everyone who is eligible can get Medicare when they turn 65, not everyone qualifies for premium-free Medicare. To get Medicare Part A benefits without paying a premium, you must also:

- Be eligible for or currently receive Social Security or Railroad Retirement Board benefits

- Have worked and paid FICA taxes for a specified number of quarters of coverage

The number of quarters you must work to qualify for premium-free Part A varies based on your age and health conditions. For people who qualify by turning 65, its 40 QCs, which are typically earned in 10 years of work people with disabilities accrue credits slightly differently based on when their disability began. If you dont have enough QCs, you can choose to purchase Medicare Part A coverage for an amount based on how many quarters youve worked.

If you dont sign up for Medicare when you first become eligible, you may have to pay a 10% late-enrollment penalty for a specified period.

Supplementary Medical Insurance Trust Fund

This trust is largely funded by the premiums paid by people enrolled in Medicare Part B and Medicare Part D , but it is also funded by:

- Interest earned on the trust fund investments

- Funds authorized by Congress

The Supplementary Medical Insurance Trust Fund pays for:

- Medicare Part B benefits

- Medicare Part D prescription drug coverage

- Medicare Program administration costs

Don’t Miss: What Is The Best Medicare Advantage Plan In Alabama

Using Hsa Funds For Medicare Premiums

Health savings account funds are taken out of your income before taxes. You can use them to pay Medicare premiums for Parts A, B, C, and D. This tax workaround allows you to use your before-tax income to pay for premiums for which youd typically have to use after-tax funds. Please note that you cannot use an HSA to pay for Medigap premiums.

Unfortunately, you are not allowed to add money to an HSA once you join Medicare. But youre certainly welcome to do so before joining.You can then continue to use the tax-free money already in the account to pay for qualified medical expenses, including your Medicare premiums.

Will I Pay The Tax If I Continue Working After I Start Claiming Social Security

You may still be working when you begin drawing Social Security benefits. It may seem counterintuitive to continue paying the tax once you start taking benefits. However, you must pay the Social Security payroll tax as long as you earn wages or self-employment income that isn’t exempt from FICA or SECA taxes.

You May Like: What Income Is Used For Medicare Part B Premiums

What About Part C And Part D

Youll pay your Part C or Part D bill directly to the insurance company. Each company has their own preferred methods, and not all companies accept all payment types.

Generally, you should be able to:

- pay online with a debit or credit card

- set up automatic payments

- mail a check

- use your banks automatic bill pay feature

You might also be able to set up a direct deduction for your retirement or disability payments.

You can contact your plan provider to find out what payment options are available. They can also let you know if theres anything you should be aware of with each payment type, such as added fees or time delays.