Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

Medicare Expert Q& a: Will I Be Automatically Enrolled In Medicare When I Turn 65

- Reviewed byJohn Krahnert

“I turn 65 next year. Will I be automatically enrolled in Medicare? Is there anything I need to do?” Linda M., Springfield, MO

Thanks for writing in, Linda. Ill start answering your question by asking one of my own: Will you be collecting retirement benefits from Social Security or the Railroad Retirement Board for at least four months by the time you turn 65 years old?

I ask because automatic enrollment in Medicare hinges largely on that particular criteria.

Is Medicare Part B Based On Income

Medicare premiums are based on your modified adjusted gross income, or MAGI. … If your MAGI for 2020 was less than or equal to the higher-income threshold $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2022, which is $170.10 a month.

Also Check: What Is Medicare Part B Monthly Premium

What Day Of The Month Does Medicare Coverage Begin

Your Medicare coverage generally starts on the first day of your birthday month. If your birthday falls on the first day of the month, your Medicare coverage starts the first day of the previous month. If you qualify for Medicare because of a disability or illness, in most cases your IEP is also seven months.

Also Check: Does Medicare Cover Hiv Medication

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Also Check: Can You Get Medicare At 60

Get Help Comparing Medicare Advantage Plans Where You Live

If you have any additional questions about the Medicare Advantage plans that may be available where you live, you can call today to speak with a licensed insurance agent who can help you compare plan costs, find out what plans cover your drugs and if youre eligible help you sign up for the right plan for you.

You can also compare plans online for free, with no obligation to enroll.

Compare Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Medicare has neither reviewed nor endorsed this information.

Does Medicare Let You Know If You Need To Enroll

Medicare typically wont let you know that you need to enroll. Its important to know that if you are not collecting Social Security or Railroad Retirement Board benefits and therefore are not eligible for automatic Medicare enrollment, Medicare will not take any steps to contact you or notify you of your enrollment options.

Read Also: Does Medicare Cover Eye Specialists

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

How Do I Apply For Traditional Medicare

If youre not automatically enrolled in Medicare Part A and Part B, you need to sign up. You should enroll during your IEP, or a Special Enrollment Period if you qualify for one. As mentioned above, one example of a Special Enrollment Period might be if you delayed enrollment in Medicare Part A and/or Part B because you had employer coverage.

You typically sign up for Medicare through the Social Security Administration . You can go to the website at ssa.gov. Or, go in person to a Social Security office. You can reach the SSA at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM, in all U.S. time zones.

Read Also: Is Medicare Advantage Part C

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

When Are You Automatically Enrolled In Medicare

There are only three scenarios in which you are automatically enrolled in Medicare:

- You are age 65 or older AND began receiving Railroad Retirement Board or Social Security retirement benefits at least 4 months before turning 65

- You are under age 65 and have received Social Security disability benefits for 24 months

- You are under age 65 and have amyotrophic lateral sclerosis , more commonly known as Lou Gehrig’s disease

If any of the above scenarios apply to you, Medicare enrollment occurs automatically.

You May Like: Does Medicare Pay For Tb Test

I Am Turning 65 In A Few Months And Want To Go On Medicare Will I Be Automatically Enrolled In Parts A And B Or Do I Need To Sign Up

It depends. If youre receiving benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65, you do NOT need to sign up youll automatically get Part A and Part B starting the first day of the month that you turn 65. You should receive your Medicare card in the mail three months before your 65th birthday. If you are NOT receiving benefits from Social Security or the RRB at least four months before you turn 65, you will need to sign up with Social Security to get Parts A and B. To sign up to receive Parts A and B, you can enroll online with Social Security, call Social Security at 1-800-772-1213, or visit your local Social Security office.

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

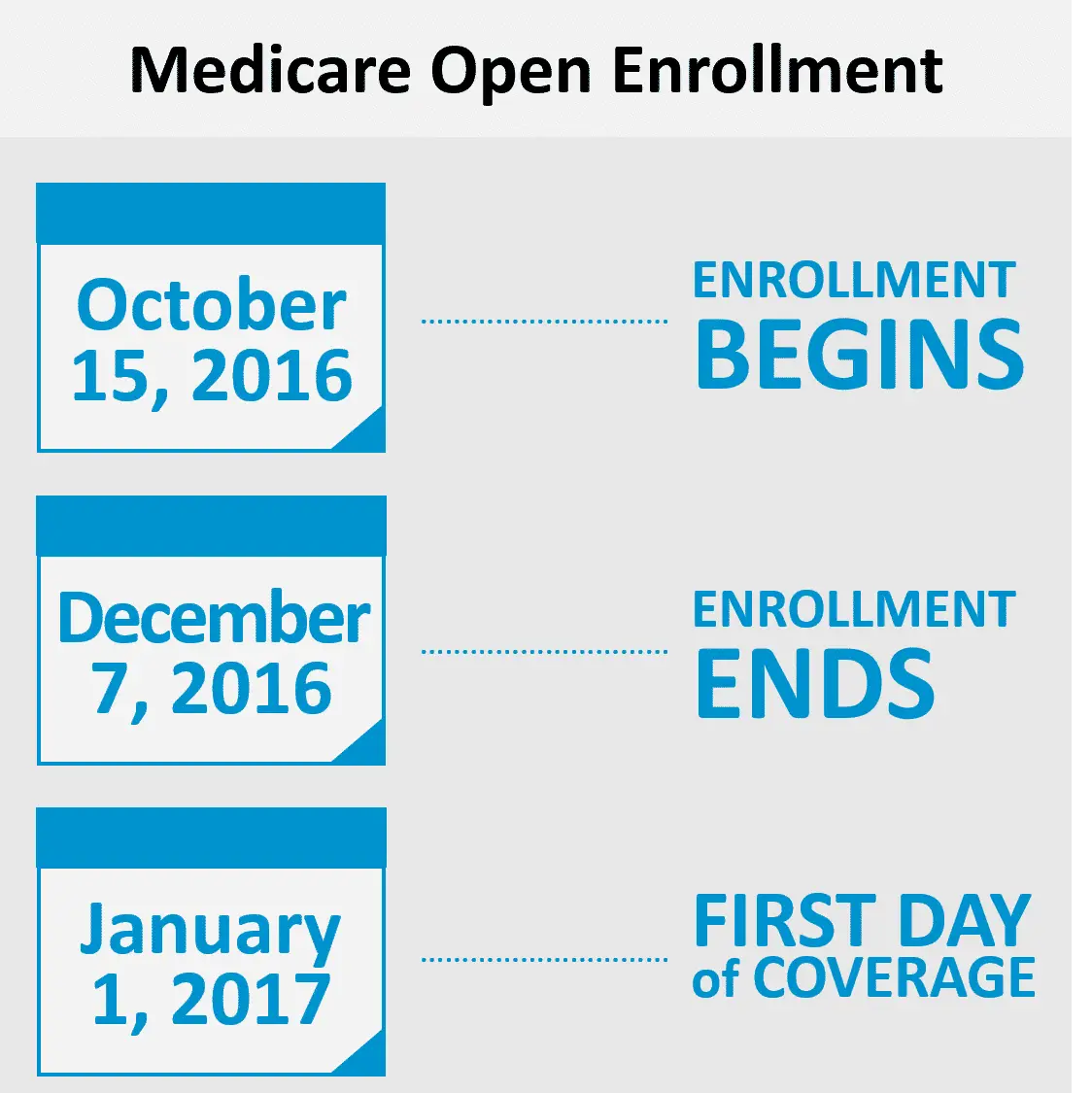

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

Read Also: How Does Medicare For All Work

What If Youre Still Working At 65

If youre still working at 65 and receiving health insurance through your employer, you may still need to sign up for Medicare. If your company offers health insurance and has fewer than 20 employees, your health insurer will refuse to pay for costs that Medicare would have covered. Signing up for Medicare will ensure that those costs are covered.

If your company has more than 20 employees, its still a good idea to enroll in free Part A coverage right away. Your coverage will be free since you already paid Medicare taxes. However, if you have a Health Savings Account, you wont be able to contribute to it once you enroll in Medicare, even if you only enroll in Part A.

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you cant reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So its understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, its important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason youre delaying is that you are still working and youre covered by the employers health plan. If thats the case, youll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

Read Also: Is The Medicare Helpline Legit

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Does Medicare Part A Come Automatically

Yes. You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you’re automatically enrolled, you’ll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

Also Check: How Long To Get Medicare Card

Automatic And Facilitated Enrollment For Part D

People who qualify for full Medicaid benefits or other qualifying low-income subsidy programs may face another type of automatic enrollment regarding prescription drug coverage.

This process is referred to as automatic enrollment for people who are dual-eligible for both Medicaid and Medicare and as facilitated enrollment for people who qualify for an LIS.

If you are enrolled in Original Medicare, CMS will enroll you in a prescription drug coverage plan if you do not choose one yourself. The plan they choose for you will be a benchmark plan that offers basic coverage and has a monthly premium less than the states regional thresholds.

If you are enrolled in a Medicare Advantage plan that does not have prescription drug benefits , the insurance company that offered your chosen plan can change you to one that does .

If that company does not offer an MA-PD, they may enroll you in one of their standalone Part D plans. The catch is that the insurance company has to select the lowest cost option for combined Part C and Part D premiums.

There may be reasons you do not want to sign up for a Part D plan . You can always opt out of a plan.

Alternatively, you may want to pick a more extensive plan than the one assigned to you. You can change to a plan of your choice during one of the quarterly special enrollment periods for Medicaid and Extra Help beneficiaries, or during the annual Medicare open enrollment period.

Enroll In A Medicare Supplement Plan

As mentioned, Part B only covers 80% of the expenses associated with your medical needs. This still leaves beneficiaries exposed to 20% of these costs. While this is a significantly less number than the total cost, depending on how often you visit the doctor, the costs may add up. For this, we recommend enrolling in a Medicare Supplement plan. Some Medicare Supplement plans will cover the remaining 20% at full cost, meaning you wont be responsible for any out-of-pocket costs. We know that understanding the ins and outs of Medicare, and selecting the right supplement plan for your needs can be intimidating. Were here to help guide you through this process, and ensure that youre happy with your coverage year after year. If you need assistance with your Medicare plan, give us a call at to speak with one of our experts.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Recommended Reading: Is Keystone 65 A Medicare Advantage Plan

Which Providers Cannot Enroll In Medicare

Many people who are turning 65 will be enrolled automatically in both parts of Original Medicare. Whether you are one of them depends on your situation. You’ll be automatically enrolled in Medicare Part A and Part B: If you are already getting benefits from Social Security or the Railroad Retirement Board