Medicare Supplement Plan Eligibility

As with Medicare Advantage, Medicare supplement coverage is sold through private insurance companies. Medigap covers co-payments, co-insurance and deductibles in both Medicare Part A and Part B. Does your insurance company offer Medigap coverage to your patients if they have medical conditions? You canât enroll in Medicare Advantage or Medigap plans. You have to decide on either option.

Part A also pays for some home health care and hospice care. Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Medicare Eligibility & Enrollment: Who Qualifies & When

At age 65, you have a full entitlement to Medicare. You can be eligible for this before 62 years old, unless you’ve been diagnosed with a medical condition. Your first enrollment period is three months before your 65th birthday and three months after that.

We verify the facts by evaluating each source for authoritative and relevant information. Then we test them through original reporting from these sources or we validate them with expert testimony.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Also Check: What Is The Average Cost Of Medicare Part B

Medicare Advantage Vs Medigap

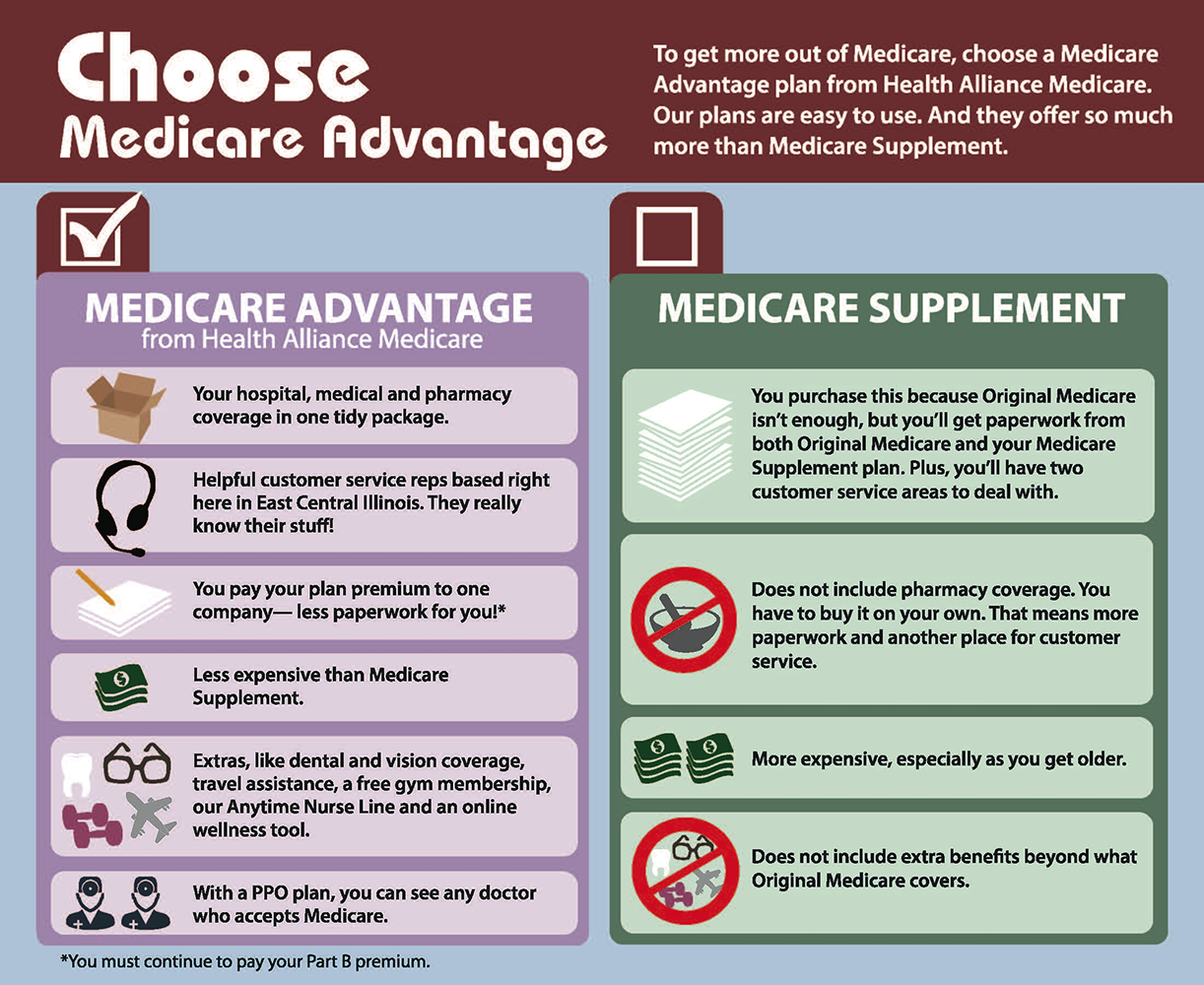

Medicare Advantage plans are sometimes confused with Medicare Supplement Insurance, also known as Medigap. Both are offered by private insurance companies, but the way your expenses are covered is different. As the name suggests, Medigap plans cover the gaps in Original Medicare by covering your share of covered charges. When you seek medical care, most or all of your cost-share will be covered by your Medigap plan. For this, you’ll pay a monthly premium.

Medicare Advantage plans, by contrast, are bundled plans that include the same coverage you’d get with Medicare Part A and Part B , plus often limited coverage for other things, like some dental services or an allowance for some over-the-counter drugs. You may pay a premium for a Medicare Advantage plan, but many are offered at no premium beyond your required Medicare Part B premium. Youll pay copays or coinsurance when you seek medical care. With a Medicare Advantage plan, youll pay out of pocket whenever you see a provider, and theres an out-of-pocket limit of $7,550 on covered care in 2022.

Also, because Medigap policies are standardized, its relatively easy to compare costs. Every Medicare Advantage plan is different, so comparison shopping can be difficult. You cant have both a Medicare Advantage plan and a Medigap plan at the same time.

» MORE: What you’ll pay for Medicare in 2022

Who Is Eligible For A Dual Special Needs Plan

You may be eligible to enroll in a Dual Special Needs Plan if you answer yes to these questions:

Don’t Miss: How Many Medicare Plans Are There

How Do I Enroll In A Medicare Advantage Plan

Every Medicare Advantage Plan has its own requirements and processes, thus theres no single way to sign up. Your first task is to find out what coverage plans are available in your area and compare the benefits of the plans with the benefits youd have in Original Medicare.

For many plans, its possible to complete the enrollment process through the Medicare website. For some plans, you may need to contact the company that administers them and obtain an enrollment form, which you will fill out and return. You can also call Medicare at 1-800-MEDICARE for assistance in choosing your plan.

When you join Medicare Advantage, youll need to give your Medicare number and the date your Part A and B coverage began. Medicare plan providers are not allowed to call you unless youve specifically requested a call, and they should never ask for financial information such as a credit card number over the phone. If someone claiming to be from Medicare does ask for financial information from you, hang up immediately it is most likely a scam.

How Do You Enroll In Medicare Supplement Medicare Advantage And Medicare Prescription Plans

Medigap, Medicare Part C, and Medicare Prescription Drug plans are administered by private insurance companies approved and regulated by Medicare. The company you choose or a licensed agent can help with your enrollment. During your time working, you pay medicare taxes through your employer. Medicare taxes allow this health insurance coverage to be available.

As for finding plans, you can view options on Medicare.gov, where there is also a premium calculator and you can learn more about part coverage. An explanation of each:

You May Like: How Old To Be Eligible For Medicare

Other Ways To Get Medicare Coverage At Age 65

Depending on your eligibility and the amount of premium you have on your plan, you may qualify for coverage from Medicare. The Centers for Medicare & Medicaid Services is providing equitable relief to individuals who could not submit premium-Part A or Part B enrollment or disenrollment requests timely due to challenges contacting us by phone.

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. In most states, insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Read Also: How Is Medicare Irmaa Calculated

What Is Medicare Advantage

Since 1997, Medicare enrollees have had the option of opting for Medicare Advantage instead of Original Medicare. Medicare Advantage plans often incorporate additional benefits, including Part D coverage and extras such as dental and vision as well as additionals supplemental benefits.

And unlike Original Medicare, the plans do include a cap on out-of-pocket costs that currently cant exceed $7,550. This out-of-pocket limit only applies to services that would otherwise have been covered by Original Medicare, so it does not include prescription drug costs, which Original Medicare does not cover.

Advantage plans tend to constrain beneficiaries to a limited provider network, and coverage for specific services may not be as robust as it would be with Original Medicare plus supplemental coverage. But Advantage plans, including the cost for Medicare Part B, also tend to be less expensive than Original Medicare plus a Medigap plan plus a Part D plan. This article helps to illustrate the pros and cons of each option.

Will My Medications Be Covered At The Same Level Under The Iyc Medicare Advantage Plan As They Were When I Was An Active Employee

There are some drugs that are covered at a different level or require prior authorization under the IYC Medicare Advantage Plan that did not have these requirements under ETF’s Commercial Pharmacy Benefit. Please check the IYC Medicare Advantage Plan Formulary at https://etf.benefits.navitus.com/ to see if there are changes in coverage to your current medications.

Also Check: Does Medicare Pay For Breast Reconstruction

How Msa Plans Work

The MSA is funded by Medicare, which pays the private insurer to set up the account and deposit the funds. Youll pay a Medicare Part B premium and do not contribute to the MSA. The associated Medicare Advantage high-deductible health plan must provide the same benefits, rights, and protections as Original Medicare, although each plan operates under different costs, rules, and restrictions.

The funds deposited into the plan are not taxable as long as you use them to pay for qualified medical expenses. You can roll unused funds to the next year and earn interest. But if you use funds for nonqualified expenses, youll pay both income tax and a 50% penalty.

Who Is Eligible For A Medicare Msa Plan

Though most Medicare Advantage Plans are eligible to anybody who turns age 65 or is under the age of 65 and receives disability payments through Social Security or the Railroad Retirement Board , the eligibility rules for a Medicare MSA plan exclude certain individuals. You are not eligible for a Medicare MSA Plan if you:

- Are eligible for Medicaid

- Are currently receiving hospice care

- Have health coverage that would cover your intended Medicare Advantage MSA plans deductible, which includes benefits from a union or employer retirement plan

- Are a retired employee of the federal government receiving benefits from the Federal Employee Health Benefits Program

- Live outside of the United States more than 183 days per year

- Have end-stage renal disease there are some exceptions

- Receive TRICARE or Department of Veterans Affairs benefits

Don’t Miss: How Do I Get A Second Opinion With Medicare

How Medicare Advantage Plans Work

Medicare Advantage plans also known as Medicare Part C are required to provide the same benefits as Medicare Part A, which covers hospitalization, and Medicare Part B, which covers doctors visits. Medicare Advantage plans also typically include Medicare Part D prescription drug coverage and may include benefits not covered by Medicare, providing some savings on routine dental care, eye exams and glasses, and hearing aids.

Who Is Dual Eligible For Medicare And Medicaid

To be Medicare dual eligible, you have to meet the requirements for Medicare and your states Medicaid program.

To be eligible for Medicare, you must:

- Be at least 65 years old or having a qualifying disability

- Be a U.S. citizen or permanent legal resident

- Be eligible for benefits through Social Security or the Railroad Retirement Board

Generally speaking, Medicaid provides health insurance to low-income individuals and families, children and pregnant women. The best way to find out if you are eligible for Medicaid is to visit your states Medicaid website.

If you’re eligible for Medicaid and want to find out if you’re also eligible for a dual-eligible Medicare Medicaid plan, you can all to speak with a licensed insurance to find out if you’re eligible. An agent can help you compare the plans that are available where you live and find out what they may cover, which could include benefits like prescription drugs and other services.

Find $0 premium Medicare plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

Recommended Reading: Should I Apply For Medicare If Still Working

Who Qualifies For Medicare

Original Medicare is the federal governments health insurance program comprising Part A and Part B.

In most cases, you qualify for Medicare if youre 65 years of age and either a U.S. citizen or have been a legal permanent resident for five consecutive years.

If youre younger than 65, you may qualify for Medicare if you:

- Have received disability benefits for at least two years through Social Security or the Railroad Retirement Board

- Have been diagnosed with end-stage renal disease or Lou Gehrigs disease

You can check if you qualify for Medicare using the federal governments online eligibility tool.

Do I Need To Enroll In Medicare If I Want Iyc Medicare Advantage

Yes. As is the case today, when retirees or their dependents turn age 65 or first become eligible for Medicare, they must enroll in Medicare Parts A and B. Under the IYC Medicare Advantage Plan, individuals eligible for Medicare and enrolled under a retiree contract must pay or continue to pay their monthly Part B premium. Individuals who stop paying their Part B monthly premium will be moved from the IYC Medicare Advantage plan to the IYC Medicare Plus plan. See Question:Can I change health plans, cancel my insurance or change coverage levels when I or my dependent enroll in Medicare?

Also Check: How Does United Medicare Advisors Make Money

What’s The Best Medicare Advantage Plan

- HMOs: HMOs typically require you to see only providers that are in their network. You usually need to get referrals to see specialists. These plans are usually lower cost.

- PPOs: PPOs have a preferred network of providers that offer discounted prices. You can choose to see doctors out of network for a higher cost.

- PFFS plans: PFFS plans let you see any Medicare-approved health care provider youd like but you agree to pay a set price for services.

- SNPs: SNPs allow people with specific conditions and illnesses to see providers who offer specialized care.

Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers.

Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles. Many enrollees have been hit with unexpected costs and denial of benefits for various types of care deemed not medically necessary.

Also Check: What Income Is Used For Medicare Part B Premiums

What Are The Benefits Of Medicare Advantage

With Medicare Advantage plans, the essential Medicare Part A and Part B benefits except hospice services are automatically covered. If you need hospice services, thats covered under Original Medicare, even if youre enrolled in a Medicare Advantage plan, although CMS debuted a small pilot program in 2021 in which a limited number of Advantage plans are providing hospice services through the Advantage plan rather than through Original Medicare.

Advantage plans also cover urgent and emergency care services, and in many cases, the private plans include Part D prescription drug benefits, and also cover vision, hearing, health and wellness programs, dental care, and various other supplemental benefits. Since 2019, Medicare Advantage plans have been allowed to cover a broader range of extra benefits, including things like home health aides, medical transportation, and the installation of in-home safety devices. Relatively few plans have started offering these benefits as of 2021, but more appear poised to do so for 2022.

Some Medicare Advantage plans also offer giveback rebates, which reduce the amount thats deducted from the beneficiarys Social Security check to cover the cost of Medicare Part B .

Plans that have giveback benefits, also known as premium reduction plans, are not available in all areas, although they are available in the majority of US counties .

Discuss your Medicare Advantage coverage options today with a licensed Medicare advisor. Call

What If I Work Past Age 65

You still have a Medicare enrollment decision to make.

If you plan to keep working or you have employer health coverage through a spouse, you have some options to consider when signing up for Medicare. Depending on your situation, you may or may not be able to delay Medicare enrollment.

Your Initial Enrollment Period happens when you’re turning 65 whether you’re still going to work or not. Be sure to know your IEP dates and plan ahead.

Also Check: How To Change Medicare Plans When You Move

Premiums Paid By Medicare Advantage Enrollees Have Declined Slowly Since 2015

Average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased rapidly as a share of all Medicare Advantage enrollment, corresponding to broader availability of these plans. Average premiums for HMOs declined $2 per month, while premiums for regional PPOs increased $1 per month between 2020 and 2021.

Average MA-PD premiums vary by plan type, ranging from $18 per month for HMOs to $25 per month for local PPOs and $48 per month for regional PPOs. For all MA-PDs, the monthly premium is $21 per month for both Part A and Part B benefits and Part D prescription drug coverage . Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.