When Does Medicare Not Automatically Start

Medicare will NOT automatically start when you turn 65 if youre not receiving Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. Youll need to apply for Medicare coverage.

Theres no such thing as a Medicare office enrollment in the program is handled by the Social Security Administration . If you have to enroll in Medicare Part A and/or B on your own, you can visit your local Social Security office.

You can also online by following the instructions at the Social Security Administration Medicare Benefits web page. In most cases, signing up online will take ten minutes.

What Do Medicare Supplement Plans Cover

Medigap policies cover the following out-of-pocket costs:4

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up.

- Part B coinsurance or copays.

- Blood .

- Foreign travel emergency .

- Above out-of-pocket limits.

The Part B excess charge is little understood but essential to know. Doctors who accept Medicare assignment agree to rates set by Medicare for covered services. Those who dont can charge up to 15% more than the Medicare-approved amount.

Unless you have a Medigap plan that covers excess charges, you will be responsible for those charges. The alternative? To only use participating doctors, although thats not always easy in an emergency or surgery involving many doctors.

Also, Original Medicare does not cover you outside the U.S. But some Medigap policies do.

Also Check: Do You Have To Resign Up For Medicare Every Year

Example : You Are Contributing To Your Group Health Insurance Plan

In almost all cases, you can save money by switching to Medicare with a Medigap plan if youâre the one contributing to your group health insurance plan.

Health insurance premiums are sky-high, with some plans costing upwards of $800 per month. Medicareâs monthly premium is nowhere close to that, and you can even add on a Medicare Supplement with no chance of reaching that kind of premium.

In sum, you can have much better coverage for a fraction of the cost if youâre paying for your group health insurance and are over 65.

If youâd like a Medicare specialist to help you one-on-one, schedule a free Medicare planner with one of our licensed agents.

Also Check: Can You Have Medicare Before Age 65

You’re Retired But Are Still Covered Under Your Spouse’s Group Health Plan

The penalties that come with not enrolling in Medicare on time only apply if you don’t have access to an eligible group health plan. It may be the case that you’re retired and don’t have employer benefits at all. But if you’re married to someone who’s still working and are on your spouse’s group health plan, the same rules apply — as long as that plan covers 20 people or more, you don’t have to worry about penalties for delaying Medicare.

Of course, if you’re not happy with your spouse’s group health plan — say, you’re being charged a lot to stay on it — then it could pay to look into Medicare. But if your costs under that plan are reasonable and you’re happy with its scope of coverage, then there’s no reason to make changes to your health insurance until your spouse retires and that group coverage goes away.

Medicare may end up being more flexible than you’d expect, at least when it comes to enrollment. Though age 65 is when Medicare coverage begins, if either of these situations applies to you, you may not want to enroll right away.

Can My Employer Force Me To Enroll In Medicare At Age 65

It used to be that turning 65 meant retirement and Medicare enrollment. Nowadays, with more people working past their 65th birthday, there are questions about how Medicare fits into this picture. Here is one.

I am turning 65 and my employer says I must enroll in Medicare. Is this legal?

The answer depends on the size of the company sponsoring the group health plan. If the company has 20 or more employees, it must offer the same coverage to those 65 years or older as it does to younger employees. It cannot force employees to enroll in Medicare or offer any incentives to do so. The employee can choose to keep the group health coverage or drop it and enroll in Medicare.

However, thing are different for a small company. Medicare secondary payer laws dictate that a group plan sponsored by a company with fewer than 20 employees becomes the secondary payer. Medicare would be primary, which means that enrollment in Part A, hospital insurance, and Part B, medical insurance, is necessary. Without Medicare, it would be as though the individual had no insurance.

Employees who work for a company with fewer than 20 employees have two options.

Don’t Miss: How Do You Apply For Medicare Part B Online

Do You Have To Sign Up For Medicare If You Are Still Working

The most common reason for people not signing up for Medicare when they turn 65 is because they are still working. Because theyre still working, theyre likely covered under their employers health insurance plan and are also unlikely to be collecting Social Security retirement benefits.

Being covered under your employer-provided health insurance plan has no bearing on your Medicare eligibility. Medicare works in conjunction with several other types of health insurance including health insurance provided by employers or unions and wont prevent you from enrolling.

However, if you are not collecting Social Security retirement benefits at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually sign up for Medicare when youre ready to enroll.

Many people choose to delay their Social Security retirement benefits until a later age when they can collect the full amount. If you choose to delay your retirement benefits, you must still sign up for Medicare manually once youre eligible in order to avoid any late enrollment penalties .

Some people who are still working sign up for Medicare anyway, because Medicare can work as extra insurance along with an employer group health insurance plan. Some people may decide that Medicare is more affordable than their employers insurance, so they may continue working but disenroll from their group plan and enroll in Medicare instead.

Is It Mandatory To Go On Medicare At Age 65

For some, not enrolling in Medicare can be a poor decision. But, some people wont receive a penalty for delaying enrollment. Lets take a look at a few different scenarios.

Factors that come into play:

Are you retired?

- If retired, you more than likely need to enroll at 65 years of age.

Are you still employed?

- If the company has fewer than 20 employees, you should enroll as soon as possible. If more than 20 employees, you may have options.

Are you happy with your employer group health coverage?

- If youre happy with your coverage, you can keep using it as your primary insurance and use Medicare as secondary insurance.

Your Initial Enrollment Period begins three months before your sixty-fifth birthday and ends three months after you turn 65. Thus, you have seven months to enroll.

If you choose to enroll after your Initial Enrollment Period ends, you could face a penalty. Or worse, delaying Part B could result in having to wait for the General Enrollment Period, which adds to the cost of your late penalty.

Also Check: Is Bevespi Covered By Medicare

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Im Working Past 65 But My Health Coverage Is From My Spouses Employer

A pretty common situation to face, if your health care coverage is from a spouses employer, you may be able to delay Medicare or you may need to enroll when you first become eligible. In this case, the employer still needs to have 20 or more employees. However, the big difference is that employers can have rules for covered dependents 65 and older that may require the individual to get Medicare at 65 in order to remain on the employer plan.

Therefore, if you have employer coverage through a spouses employer, you need to ask the employers benefits administrator directly about your Medicare enrollment choices.

Recommended Reading: Are Synvisc Injections Covered By Medicare

Is Medicare Part A Mandatory

Technically, no Medicare Part A is not mandatory.

If you dont sign up for Medicare Part A, however, you must withdraw from all federal benefits programs. That means you cannot receive Social Security or Railroad Retirement Board benefits. You must also repay any benefits you have already received if you decline Medicare. This is one reason why most people keep their Part A coverage once their eligible.

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years .

Most beneficiaries qualify for premium-free Part A. Enrolling in Medicare Part A does not kick you off your existing health coverage.

Medicare works with other types of insurance, such as employer coverage, VA insurance and Tricare. If you are still working and have quality health insurance provided by your employer, you can have coordination of benefits to cover your health care costs.

- If your employer has fewer than 20 employees, Medicare will be the primary payer. That means Medicare will pay first for any covered care you receive, and then your employer insurance will pick up the rest of the services covered by that plan.

- If your employer has 20 or more employees, your employer insurance will pay first and Medicare will serve as the secondary payer to pick up any additional covered services.

Some Medicare beneficiaries have to pay a premium for their Part A coverage.

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Read Also: What Is The Cost Of Medicare Part C For 2020

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Do I Need To Get Medicare Drug Coverage

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, dont go 63 days or more in a row without Medicare drug coverage or other .

If you have other drug coverage: Ask your drug plan if its creditable drug coverage.

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information you may need it when youre ready to join a Medicare drug plan.

|

If you: |

|---|

Recommended Reading: Does Aetna Follow Medicare Guidelines

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

If the employer does require you to enroll in Medicare, then Medicare automatically becomes primary and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan only pays for services that it covers but Medicare doesnt. Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage.

Its therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability. If so, find out exactly how the employer plan will fit in with Medicare. If not, ask for that decision in writing.

Note that in this situation, signing up for Medicare Part B when you also have employer insurance will not jeopardize your chances of buying Medigap supplemental insurance after the employment ends. When Medicare is primary to the employer plan, you have the right to buy Medigap with full federal protections if you do so within 63 days of the employer coverage ending.

Also Check: What Is Medicare Advantage Premiums Part C

How To Cancel Your Marketplace Coverage

If youre the only person on your Marketplace application, you can cancel the whole application.

If you and your spouse are enrolled on the same Marketplace plan, but youre the only one eligible for Medicare, youll cancel Marketplace coverage for just yourself. This way any others on the Marketplace application can keep Marketplace coverage. Find out how here.

Do Seniors On Social Security Have To Pay For Medicare

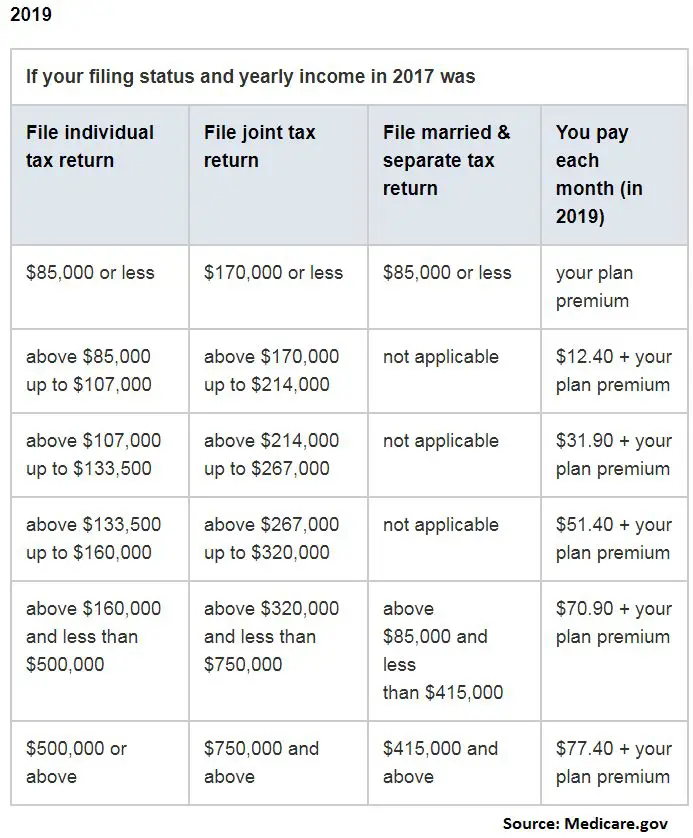

Social Security and Medicare are both federal programs, so itâs easy to see why they would intersect somehow. Because individuals have to pay their dues for Medicare, most plans are income dependent.

While Medicare Part A is normally $0 premium, Medicare Parts B and D require monthly payments that are based on an individualâs household income.

To determine the amount that an individual owes for Medicare, Social Security analyzes their income and benefits from the past two years, on an individual basis.

Read Also: Can You Have A Medicare Advantage Plan And Va Benefits

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you can’t reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So it’s understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, it’s important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason you’re delaying is that you are still working and you’re covered by the employer’s health plan. If that’s the case, you’ll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.