Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

Medicare Part A : Out

Most people don’t need to pay monthly premiums for Part A. You won’t pay a premium if you or your spouse paid Medicare taxes for at least 10 years while working.

However, you will need to help cover the cost of some fees when you receive care. These expenses come in the form of deductibles and copayments.

If you are admitted to the hospital, you should expect to pay the following:

A deductible is the amount you pay before your insurance pays.

For Part A , the deductible is $1,556 per benefit period.1

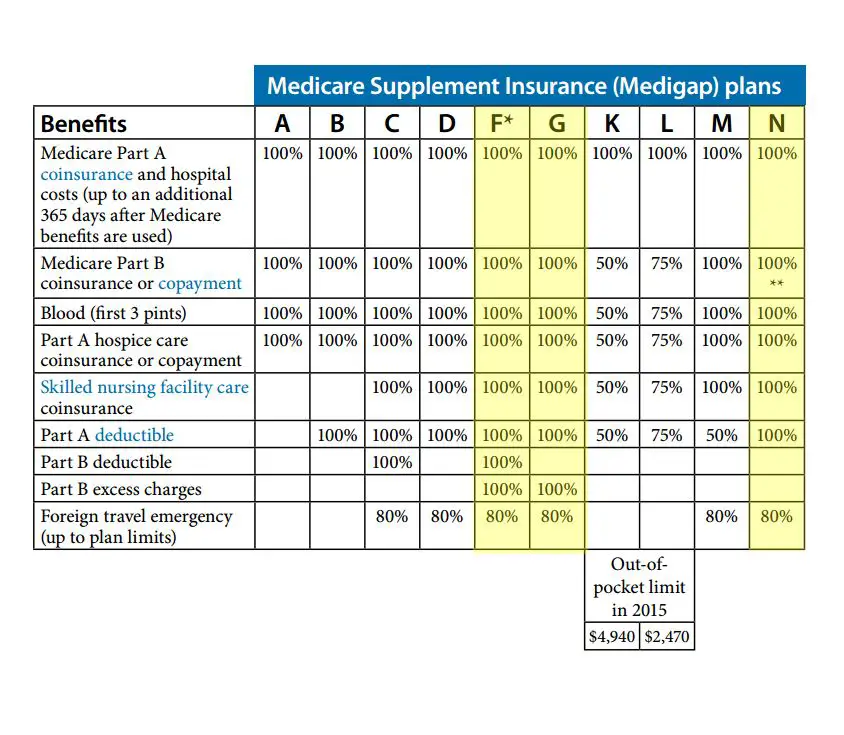

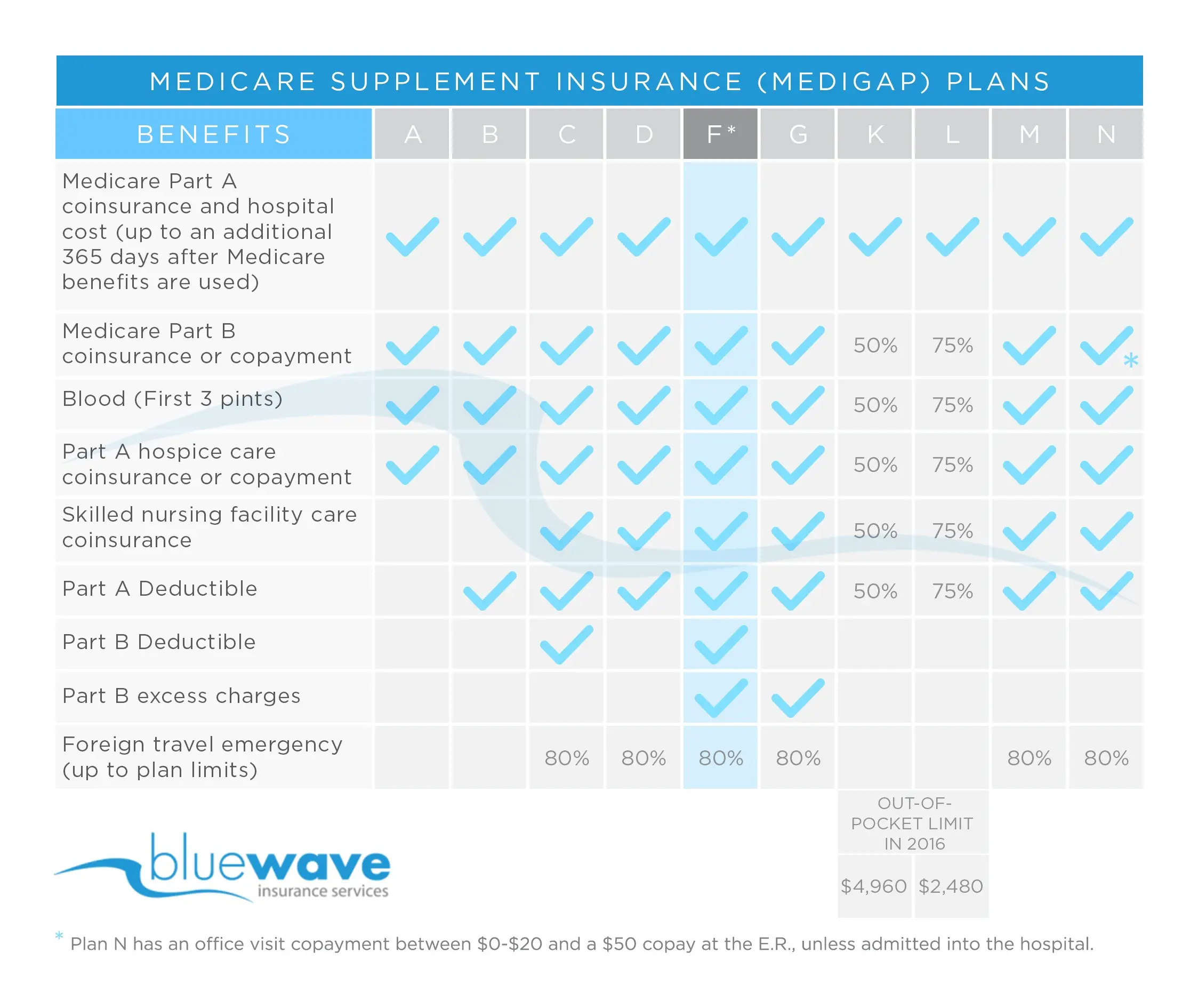

Services Not Covered By Medicare Supplemental Plans

Even though Medigap plans do provide a wide range of covered services, there are a few things that they do not cover. One of the biggest items no longer covered by new Medigap plans is your Medicare Part B deductible. In fact, the law no longer allows new policies to cover this amount. So, since Plan C and Plan F do cover the Part B deductible, they can no longer be sold to new enrollees.

Another big item not provided by Medicare supplement insurance is prescription drug coverage. Your Medigap policy will not provide any payments for prescription drugs. If you need this coverage, then you should consider enrolling in a Medicare Part D prescription drug plan. Part D plans provide coverage for prescription drugs, and they typically require just a copay for most generic medications.

In addition, Medigap does not cover stays in assisted living facilities. Your Medicare health plan does not cover these expenses either, so you will be forced to pay out-of-pocket for those charges. Some charges related to skilled nursing facilities are covered, but the facility must strictly meet the definition of a skilled nursing facility. Assisted living homes are not covered under that definition.

Recommended Reading: What Does Part G Cover In Medicare

Average Cost Of Medicare Supplement Plan G

For our sample quotes, the range for Medicare Plan G monthly premiums across all five zip codes was just under $108.90 to over $270.80. There are higher rates exclusive to places like New York City, which reflect the higher cost of living in general in those locations. The higher end of the range in our samples was just over $200 per month.

| Company |

|---|

| FL |

Medicare Plan G is the most comprehensive Medigap insurance policy available to all Medicare beneficiaries. It will cover most out-of-pocket expenses except the Part B deductible. That includes Part B excess charges, Part A deductible, skilled nursing facility benefits, and Medicare coverage for foreign travel emergency services.

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022:

- An annual deductible of $1,556 for in-patient hospital stays.

- $389 per day coinsurance payment for in-patient hospital stays for days 61 to 90.

- After day 91 there is a $778 daily coinsurance payment for each lifetime reserve day used.

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

Don’t Miss: Will Medicare Pay For Ymca Membership

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set premium costs. Which method insurance companies use to arrive at their premiums can affect your costs in the short term or the long term.

Here is how the rating systems work.

Also Check: How Do Providers Verify Medicare Coverage

What Is The Average Cost Of Medicare Supplement Insurance Plans In Each State

There are 10 standardized Medicare Supplement Insurance plans available in most states.

Plan G is available in most states and is one of the most popular Medigap plans. Medigap Plan G is, in fact, the second-most popular Medigap plan. 22 percent of all Medigap beneficiaries are enrolled in Plan G.2

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018.3

- Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.

- The highest average monthly Medigap premiums were in New York, at $304.72 per month.

| State |

|---|

| 25 |

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2022 is $170.10.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2022, your income amount is calculated from your 2020 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

Don’t Miss: Why Does Medicare Not Cover Shingles Vaccine

Medicare Part C Costs

If you choose to get Medicare Part C, which is also calledâ¯Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However,â¯you still must pay the $170.10 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors.â¯In general, MA premiums are quite low, and sometimes theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting in to an MA plan.â¯You can read about the pros and cons of Medicare Advantage here.

Since 2015 The Highest Share Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings

For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating most contracts cover multiple plans.

In 2022, nearly 9 in 10 Medicare Advantage enrollees are in plans with a rating of 4 or more stars, an increase from 2021 and the highest share enrolled since 2015. An additional 3 percent of enrollees are in plans that were not rated because they are in a plan that is too new or has too low enrollment to receive a rating. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year. The star ratings displayed in the figure above are what beneficiaries saw when they chose a Medicare plan for 2022 and are different than what is used to determine bonus payments.

Recommended Reading: When Can I Enroll In A Medicare Supplement Plan

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Additional Costs To Know

There are some additional things to know about the costs associated with a Medicare Supplement Insurance plan.

- Two plans, Plan F and Plan G, have a high-deductible option available in some areas. The high-deductible version of these plans has a lower monthly premium than the standard version in exchange for a deductible. The plans coverage does not begin until the deductible has been satisfied. The deductible for these plans in 2022 is $2,490 for the year.

- Two plans, Plan K and Plan L, feature an annual out-of-pocket limit. Once the beneficiary has reached the out-of-pocket limit for covered services, the plan pays 100% of the cost of covered care for the remainder of the year. The 2022 out-of-pocket limits are $6,620 for Plan K and $3,310 for Plan L.

- While Plan N covers 100% of the cost of the Medicare Part B coinsurance, the plan requires a copayment of up to $20 for certain office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

Also Check: How Old You Have To Be To Get On Medicare

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Average Cost Of Medicare Advantage Plans In Each State

| State |

Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. He is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Ashlee Zareczny

Ashlee Zareczny is the Compliance Supervisor for MedicareFAQ. As a licensed Medicare agent in all 50 states, she is dedicated to educating those eligible for Medicare by providing the necessary resources and tools. Additionally, Ashlee trains new and tenured Medicare agents on CMS compliance guidelines. Ashlee is a Medicare expert who specializes in Medicare Supplement, Medicare Advantage, and Medicare Part D education.

Read Also: How Does Bernie Sanders Pay For Medicare For All

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

Medicare Supplemental Insurance Costs For 2022

The average cost of a Medicare supplement insurance plan in 2022 ranges anywhere from $50 to $500 per month. The average Medigap plan in 2022 will cost you about $150 per month. You might be wondering why there is such a wide range in this cost. To fully understand the cost of Medicare supplement insurance, it helps to understand exactly how it works. First, Medigap policies are administered and sold by private insurance companies. While these are standardized plans in most states, these insurance companies are allowed to set their own prices for the plans. These prices can be based on your age, gender, location, medical history, and other factors. In addition, there are ten different types of Medigap plans available. Each provides different coverage details therefore, they all have different costs. Here are more details about the different costs you can expect with Medigap.

You May Like: What Is Uhc Medicare Advantage

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information