Medicare Deductible: Part B

Medicare Part B benefits include doctors office visits, preventive screenings, and durable medical equipment. For some of these services, a deductible will apply . Often, you will pay 20% of the Medicare-approved amount for a health-care service after this deductible is met. Make sure to check with your doctor and Medicare because each benefits coverage is different.

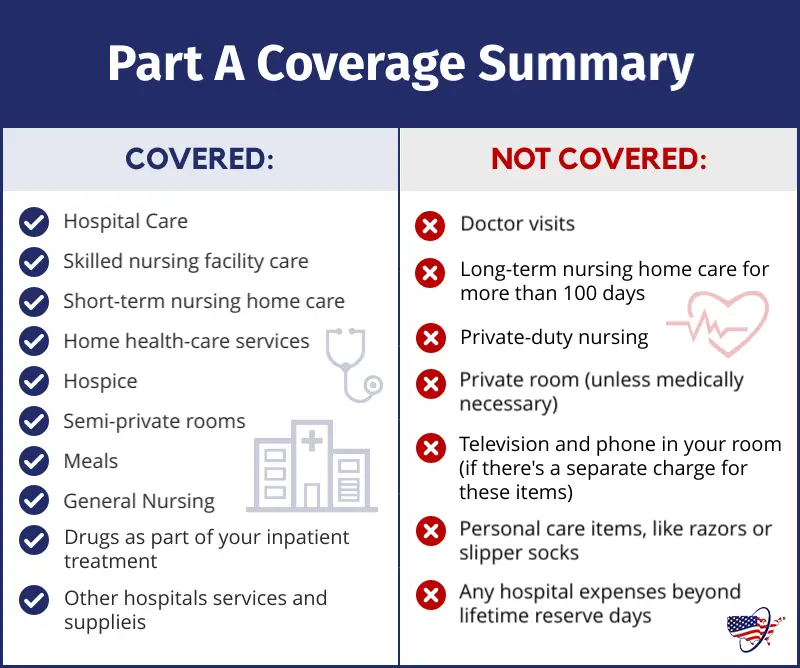

Medicare Deductible: Part A

Medicare Part A benefits include inpatient hospital care, skilled nursing facility care, home health services, and hospice.

For a hospital stay, you usually have to pay the Part A hospital inpatient deductible, which is $1,484 in 2021 for each benefit period. You may have other costs for the specific health-care services you receive while in the hospital. On the 61st day of a hospital stay, you would also start to have coinsurance costs. Your coinsurance costs depend on the length of your stay:

- Days 61 to 90: Daily coinsurance of $371 in 2021 for each benefit period

- Days 91 and over: Daily coinsurance of $742 in 2021 for each lifetime reserve day in each benefit period

- After lifetime reserve days are used up: You pay all costs

For home health-care services, all costs are covered under Medicare Part A for a limited time under certain conditions. However, if your doctor orders durable medical equipment and supplies it as part of your care, youll pay 20% of the Medicare-approved amount for the equipment.

For hospice care, all costs are covered. Some exceptions include:

- If you take prescription medications or similar items for pain relief or symptom control while on hospice. You may be responsible for a copayment of no greater than $5 per prescription drug.

- If you need inpatient respite services. You may need to pay 5% of the Medicare-approved amount for that care.

- If you get hospice care in a nursing home. You typically pay for room and board costs.

What Is The Difference Between Medicare Part A And Part B

-

At-home Intravenous Immune Globulin

-

Vaccines for flu, pneumococcal pneumonia, Hepatitis B, and more

-

Transplant or immunosuppressive drugs if Medicare helped pay for your organ transplant

Most of the time you can expect to pay 20% of the Medicare-approved amount for Part B-covered drugs you receive in a doctors office or pharmacy. This is after youve paid your Part B deductible.

Part A covers drugs, medical supplies, and medical equipment used during an inpatient hospital stay or at a skilled nursing facility.

Part D covers many drugs you would fill at a pharmacy, including brand-name and generic prescriptions. Check your Part D formulary the list of covered drugs for medications that Part B doesnt cover, unless you have comparable drug coverage from another source.

Also Check: Does Medicare Offer Gym Memberships

How Much Does Original Medicare Cost

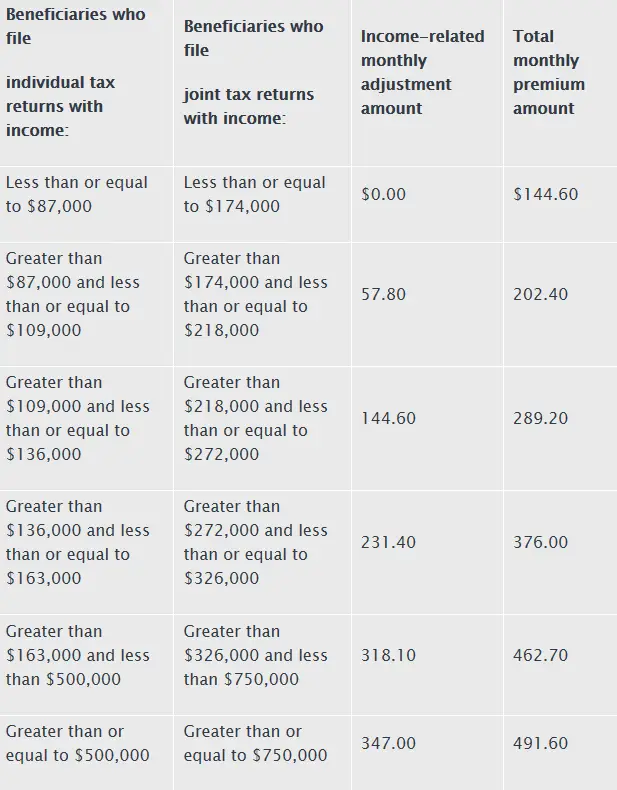

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working. For Part B, most people pay a standard monthly premium, but some people may pay a higher Part B premium based on their income.

The chart below shows the Part B monthly premium amounts for 2018 based on income. If you pay a late-enrollment penalty, this amount is higher.

Looking for Medicare coverage? We offer free, accurate comparisons for Medicare Advantage , Medicare Supplement , and Medicare Prescription Drug plans.

Get an online quote at Medicare.org for Medicare plans that fit your healthcare needs today! Or call TTY 711 to get answers and guidance over the phone from an experienced licensed sales agent.

Related Information:

The Information We Collect And How We Collect It

Personally Identifiable Information. The HealthPlanOne.com website collects two kinds of information that relates to you. The first, and most important to you, is information that is personally identifiable to you. This is information like your name, telephone number, email address, home address and social security number. We do not collect personally identifiable information unless you decide to provide us with it. To be clear, you are never required to provide us with Personal Information but not all of the services we offer will be available to you without that information. For example, we will ask for your contact information if you have requested us to send you information about certain plans or services.

Personal Information also includes information on your health. However, we do NOT ask for and do NOT collect Medical Records from you. Those records remain between you and your doctor.

If at any time you would like to review or update the Personal Information we have collected about you, please contact us and we will arrange for you to do so. While you work with us, you remain in control of all of your personal information at all times.

Don’t Miss: Does Medicare Pay For Hearing Aids

What Does Medicare Plan F Cover

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs and even the Medicare Part B deductible.

Another benefit covered by Plan F is Medicare Part B Excess ChargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These occur when your doctor or specialist does not accept the standard Medicare payment for a service. Medicare allows healthcare providers that do not accept Medicare assignmentAn agreement by your doctor to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance…. to charge up to 15 percent more. Without Plan F, you will pay these costs out-of-pocket.

Plan F also covers your big costs if you are admitted as an inpatient in the hospital or a skilled nursing facility. Your Medicare benefits cover these costs under Part A, but most people are taken by surprise when they see the per-benefit-period deductible. Plan F is one of these insurance plans that protect enrollees from these high out-of-pocket expenses.

Heres a side-by-side Medigap comparison chart:

An Overview Of Aarp Medicare Supplement Plans

AARP Medicare supplement plans are offered through UnitedHealthcare Insurance. Eligible people use these plans to supplement their Medicare plan if they think that their plan may not provide all the health coverage they need. AARP has offered health plans for its group members for more than 50 years.

You May Like: Does Medicare Cover Laser Therapy

Deductibles For Drug Coverage And Medicare Advantage

Deductibles for Medicare Part C, also known as Medicare Advantage plans, and Medicare Part D prescription drug coverage varies based on the plan you purchase. Both Medicare Advantage and Part D plans are sold by private insurers that have contracts with the Medicare program.

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary, all plans must set a limit on your maximum out-of-pocket expenses. This is a total spread across your deductibles, coinsurance and copayments.

For 2022, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs.

Some Medicare Part D prescription drug plans dont have a deductible. Those that do may not have a deductible of more than $480 in 2022.

Prepare for the Medicare Advantage Open Enrollment Period

What Is The Maximum Out

Original Medicare does not have an out-of-pocket limit. You’ll keep paying co-pays and co-insurance regardless of how many services you receive or how much you spend in a plan year. However, Medicare Advantage plans are required by law to have an out-of-pocket maximum. A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

You May Like: Does Medicare Cover Bariatric Surgery

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

What Do Part A And Part B Not Cover

There are some services and items that Medicare Part A and Part B dont cover. If you need any of these services, youll be responsible for paying the costs yourself unless you have additional insurance or a different Medicare health plan that covers them. Some services Medicare doesnt cover include the following:

- Acupuncture

- Most prescription drugs

- Routine foot care

If you require any of these services, you may want to consider switching to a Medicare Advantage Plan that offers additional coverage beyond Original Medicare, which is a common term for Part A and Part B combined. Or, consider adding Part D prescription drug coverage.

Learn more about Original Medicare versus Medicare Advantage.

Read Also: What Age Do You Register For Medicare

An Example Of The Medicare Part B Deductible

Here’s an example that illustrates how the 2022 Medicare Part B deductible works:

- You come down with an illness in March, 2022. You visit your doctor for an evaluation, and you are billed $150 for the visit. This is the first medical care covered by Part B you have received in 2022.

- You will be responsible for the full $150 for your appointment since you have not yet satisfied your 2022 Part B deductible.

- In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $200 for the appointment.

- You will be responsible for paying the first $117 of the $200 for the appointment out of your own pocket, because that is how much is left on your deductible.

- After the $117 is paid, you have reached $233 in out-of-pocket spending for covered Part B services in 2022. You have reached your deductible and you will now be responsible for any Part B coinsurance charges.

Should you need any more health care for the remainder of 2022, you will only have to pay 20% of the Medicare-approved amount for anything that is covered under Part B .

There is no annual out-of-pocket spending limit for Medicare Part A or Part B.

How High Will The Medicare Part B Deductible Get

Getty

Every year we find ourselves smack dab in the middle of the annual enrollment period before the Centers for Medicare and Medicaid Services releases the costs associated with Medicare for the following year. Even though we want to give our clients as much information as we can in September, we are often limited by access. However, there are a few ways we can make relatively accurate assumptions about where certain parameters of Medicare coverage are headed.

The board of trustees for Medicare releases a report each year that outlines the financial stability and trajectory of Medicare. This report is extremely thorough and makes some assumptions about the future costs of such things as the Medicare Part B premium and deductible, Medicare Part A deductible, income-related monthly adjustment amount and so on.

Just to outline how accurate some of these numbers have been, in the 2019 meeting, they estimated the 2020 Part B deductible would be $197. Ultimately, when released, it was $198. So, as you can see, though it isn’t perfect, it is a good indicator of things to come. We are very careful when discussing these numbers, due to them not being “set in stone,” but we often release them as board-estimated numbers so that our clients and anyone looking to us for information are as informed as we are.

2020: $198

2024: $248

2025: $263

Recommended Reading: When Can I Change My Medicare Prescription Drug Plan

What Is Covered By Medicare Part A

Put as simply as possible, Part A is the more generic parts of what you would assume health insurance is for, so aspects relating to any time you might spend in hospital. These therefore include inpatient care in hospital, skilled nursing facility care, nursing home care, hospice care and home health care.

Important Facts About Medicare Plan F:

- Its important to note that Medicare supplements are not standalone policies. You must have both Medicare Parts A and B to qualify.

- You pay for your Medicare Part B and Medigap separately. If you or your spouse did not work the full 40 quarters required, you will also pay for your Part A coverage.

- Each person needs their own Medicare supplement policy. These policies only cover one person. However, many companies offer a household discount.

- Medicare Plan F is offered through private insurance companies and only those authorized to sell in your state can provide this policy.

- Health problems do not disqualify you from a Medigap policy if you enroll during your 6-month individual enrollment period. During this period, you have guaranteed issue rights and cannot be turned down. You may continue to renew these indefinitely if you pay the monthly premium.

- If you have a Medicare Advantage plan it is illegal for an insurance company to sell you a Medigap plan. The only exceptionIn a Medicare Part D plan, an exception is a type of prescription drug coverage determination. You must request an exception, and your doctor must send a supporting statement explaining the medical reason for the… is if you are going back to Original Medicare.

You May Like: Does Medicare Cover Fall Alert Systems

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Can You Get Insurance To Help Cover Part A And Part B Expenses

As youve seen in this article, Medicare Part A and Part B generally come with out-of-pocket costs for you to pay. Did you know that you might be able to buy a Medicare Supplement insurance plan to help cover those expenses? There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance.

You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: How Do You Apply For Extra Help With Medicare

How Does Medicare Plan G Work

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Medicare Plan G is a supplemental policy, meaning it’s not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits would pay for health services you need. Once those benefits are exhausted, Plan G pays for any remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don’t have Plan G, then you’ll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.

Your Plan Could Change Its Premiums

The official U.S. government website for Medicare reports that, even though private insurers must follow Medicare’s rules for coverage in their Medicare Advantage plans, they each individually set the fees they charge for premiums, deductibles, and services.

Each private insurer offering Medicare Advantage plans can alter the fees associated with their plans once a year. This means that your plan could offer a reduction in your Part B costs one year, and then change it the next.

These changes can only take place once a year, on January 1. Be sure to review any alterations to your plan after this date.

Also Check: How Much Money Is Deducted From Social Security For Medicare