When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

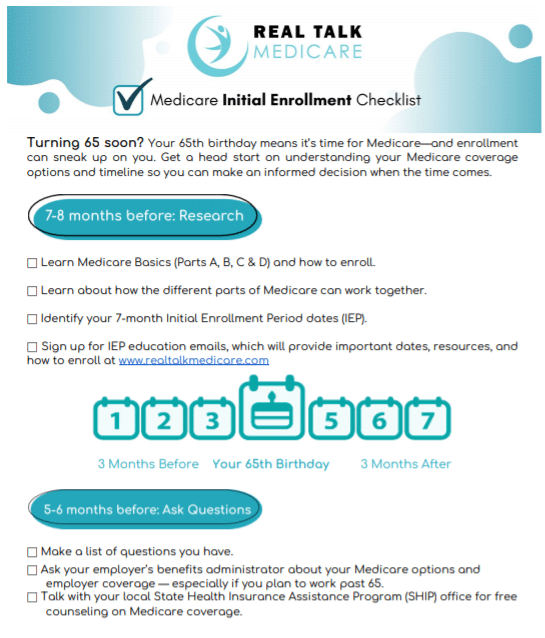

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

What’s Available During Medicare Open Enrollment

Here are the types of Medicare coverage available during the annual enrollment period:

Original Medicare consists of Medicare Part A and Medicare Part B

MedicareAdvantage plans are sold by private insurers as a bundled alternative to Original Medicare. Medicare Advantage plans may offer additional benefits, including some coverage for dental and vision care

MedicarePart D prescription drug coverage are also administered by private insurers. Part D is an optional program that helps cover the cost of your prescription drugs

Medicare Supplement Insurance plans, also known as Medigap plans, help pay your share of out-of-pocket health care costs incurred with Original Medicare parts A and B

Note: If youve claimed Social Security or Railroad Retirement Board benefits before reaching age 65, youll automatically start receiving Original Medicare the month you turn 65. You will be able to opt out of Part B if you have other qualifying health insurance, but Part A comes attached to Social Security benefits.

Medicare Advantage Plans: Enrollment Periods

New to Medicare?

If you recently became eligible for Medicare, through age or disability, you generally have the option to apply for coverage in a close to the date when your Medicare Part A and Part B coverage starts.

Your Medicare Advantage plan cannot start before both your Part A and Part B coverage begins. However, you generally have a period of seven months to apply for coverage in a Medicare Advantage plan.

This means you can apply for coverage in a Medicare Advantage plan three months before, the month of, or within three months after your Medicare Part A and Part B coverage starts. You must be enrolled in Medicare Part A and in Medicare Part B. This period is known as the Initial Coverage Election Period .

Already enrolled in Medicare?

If you did not recently become eligible for Medicare, your enrollment options are different and may be limited to certain times during the year.

Don’t Miss: Is There A Copay For Doctor Visits With Medicare

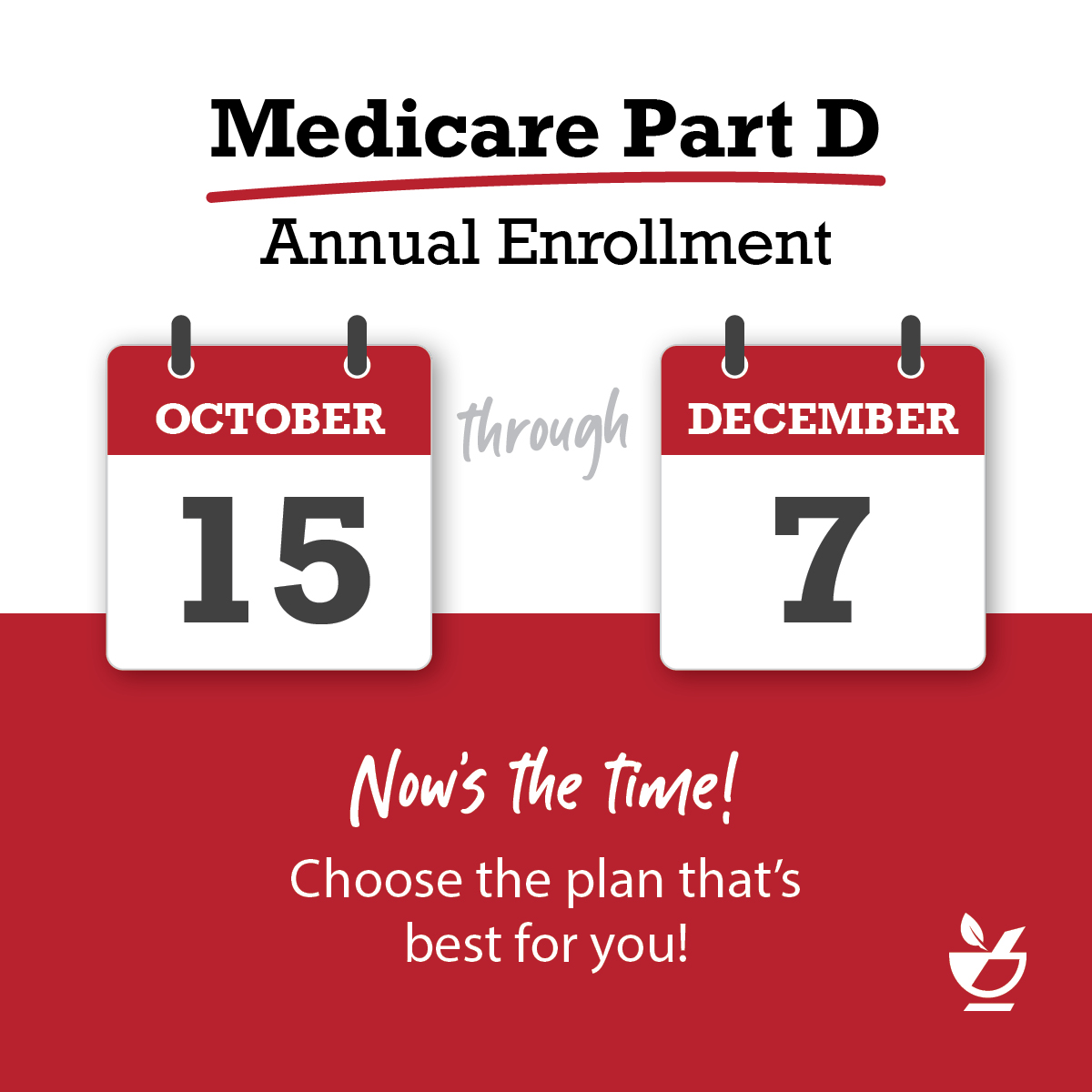

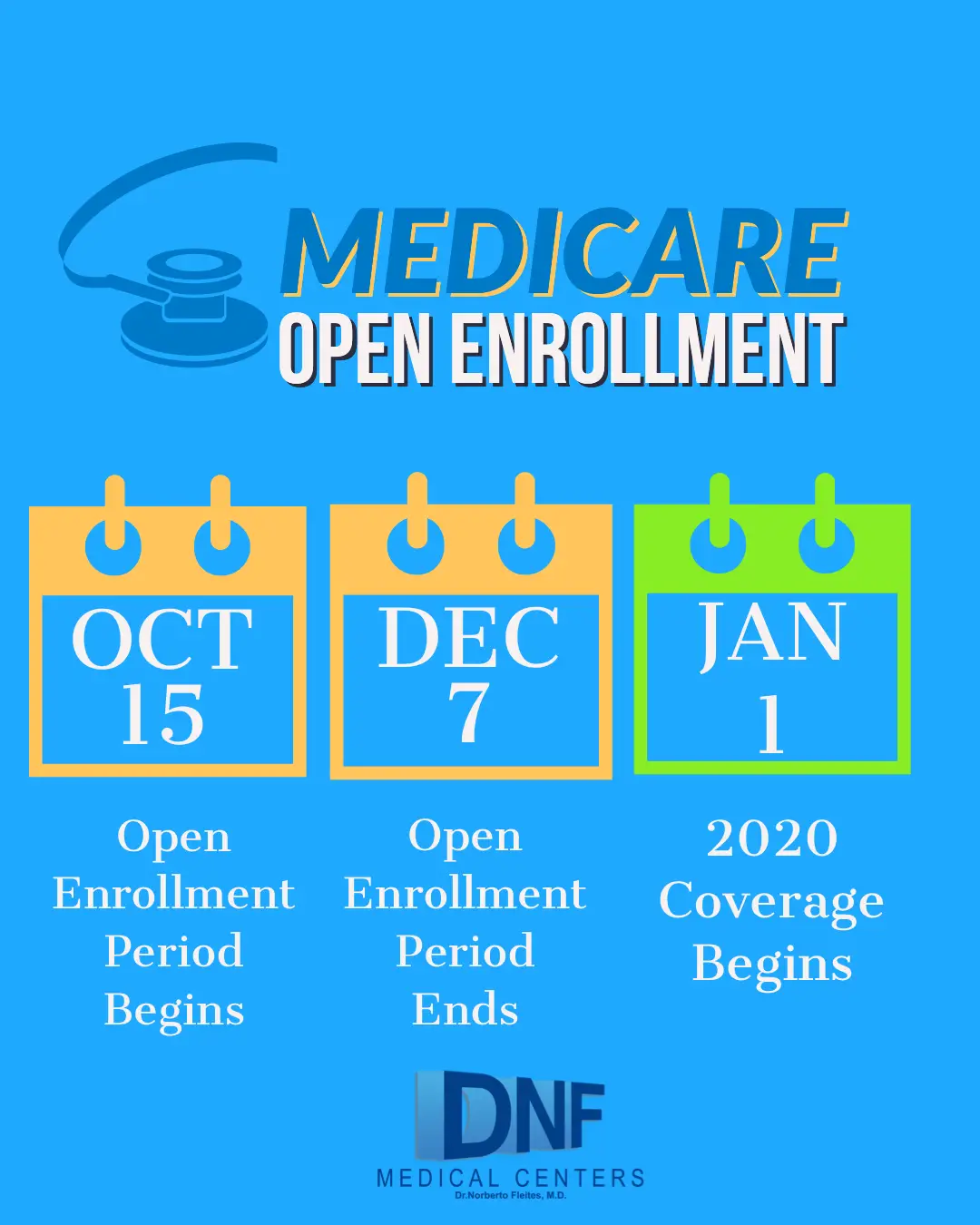

When Is The Medicare Open Enrollment Period In 2020

The annual election period runs from October 15 to December 7 for 2020. Any changes made during that time period would take effect with the 2021 calendar year on 1/1/2021.

The plan information for the plans that can be changed during the election period does not get released until on or around October 1. So any plan information that you see prior to that date would be for the 2020 calendar year plans.

What You Should Know About Medicare Open Enrollment

7 Facts About Medicare Open Enrollment You Should Know

Recommended Reading: Can I Get Glasses With Medicare

You May Like: What Part Of Medicare Covers Diabetic Supplies

What Plan Changes Can I Make During The Medicare Open Enrollment Period

During the Medicare open enrollment period if youre already enrolled in Medicare coverage you can:

- Switch from Original Medicare to Medicare Advantage .

- Switch from Medicare Advantage to Original Medicare .

- Switch from one Medicare Advantage plan to another.

- Switch from one Medicare Part D prescription drug plan to another.

- Enroll in a Medicare Part D plan if you didnt enroll when you were first eligible for Medicare. If you havent maintained other , a late-enrollment penalty may apply.

General Enrollment Period For Those Who Delay Medicare Coverage

Suppose you do not enroll in Original Medicare during your Initial Enrollment Period and do not have creditable coverage in place. In such a case, you will need to wait until the General Enrollment Period to sign up for Original Medicare.

The General Enrollment Period runs annually from January 1 to March 31. When you sign up for Medicare during the General Enrollment Period, your coverage goes into effect on the first day of the following month. For example, if you enroll during March, your coverage will become effective on April 1.

Remember, when you enroll in Original Medicare during the General Enrollment Period, you may be responsible for paying late enrollment fees. Yet, this depends on how long you delayed Medicare benefits without creditable coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Don’t Miss: Will Medicare Pay For In Home Caregivers

Choose Coverage For Prescription Drugs

Once youve completed Steps 1 and 2, youre ready to decide about your drug coverage.

Medicare doesnt cover the cost of most prescription drugs. Still, there are two ways to sign up for insurance that will help pay for your medications: If you stay on Original Medicare, Parts A and B, you can buy a standalone policy specifically for prescription drug coverage. This policy is called a Medicare Part D prescription drug plan.

Also Check: Can You Swim In A Pool On Your Period

What Can You Not Change During Open Enrollment

You typically cannot change Medigap plans during the fall open enrollment period.

There are typically only three situations in which you can change your Medigap policy:

- Within your six-month Medigap open enrollment period

- If you are eligible under specific circumstances such as the policy provider becomes insolvent

- If you have guaranteed issue rights

But if you are switching from Medicare Advantage to Original Medicare, you may be able to buy a Medigap policy. However, the company may deny you a plan if you fail its medical underwriting requirements. Or the Medigap company may charge you more for a plan than if youd signed up during your Medigap open enrollment period.

Also Check: Will Medicare Pay For Glasses

Can I Sign Up For Medigap During The Aep

You can certainly apply for a Medigap plan during the AEP or at any other time of the year. But unlike Part D and Medicare Advantage plans, there is not a federally required annual enrollment opportunity for Medigap plans.

If you apply for a Medigap plan after your six-month initial enrollment period has passed, however, the Medigap insurer is likely to use medical underwriting to determine your eligibility and premium.

There are 11 states that offer an annual window during which existing Medigap enrollees can select from at least some other plans without medical underwriting, and a few of those states also extend that option to people who are newly enrolling in Medigap.

Whats The Difference Between The Annual Enrollment Period And Medigap Open Enrollment Period

Your Medicare Supplement Open Enrollment Period is not the same as the Annual Election Period in the fall. The latter pertains to Medicare Advantage and Medicare Part D plans and the dates are the same every year. Your Medigap Open Enrollment Period is unique to you, only happens once in your lifetime, and only concerns Medicare Supplement selection.

Many new beneficiaries think they can enroll in a Medigap plan and bypass health questions during the Annual Enrollment Period. However, this isnt the case.

This is one of the biggest misconceptions and causes the most problems for beneficiaries. Its also why its so important to know about enrollment periods. One option during the Annual Enrollment Period is to disenroll from a Medicare Advantage plan and return to Original Medicare. This allows the beneficiary to enroll in prescription drug plan coverage and Medigap.

Read Also: Is It Normal To Have Two Periods In A Month

Don’t Miss: Does Medicare Cover Prrt Treatment

Who Can Use The Fall Medicare Open Enrollment Window

Anyone with Original Medicare, Medicare Advantage, or Medicare Part D may make changes during the Fall Medicare Open Enrollment Period.

However, if you do not yet have Medicare Part A or Part B, this is not your enrollment period. Once your Initial Enrollment Period passes, you will need to wait until the General Enrollment Period to apply for Original Medicare. Then, you may use the Fall Medicare Open Enrollment Period the following year to make plan changes.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Remember, there is no requirement for you to make changes to your plan each year. If you take no action during the Fall Open Enrollment Period, you will continue with the same plan selections from the previous year.

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

Also Check: How Much Medicare Is Taken Out Of Social Security Check

Enroll In Medicare Part D

Your IEP allows you to enroll in Medicare Part D as long as you also enroll in either Part A or Part B at the same time.

Who it is best for

Part D provides prescription drug coverage. If you do not have drug coverage through an employer or Medicare Advantage plan, Part D can help you pay for your medications. Even if you do not currently take medications, having active Plan D coverage can help protect you against drug price increases so long as your coverage remains active.

Late enrollment penalty

If you choose not to enroll in Part D during your IEP and forgo any type of drug coverage for more than 63 days, you may be subject to a late penalty. This penalty adds 1% to your premium for each month you could have enrolled but did not, and this remains for as long as you have Part D coverage.

For example, if you delayed enrolling in Part D for 12 months, you may incur a 12% premium increase as a late enrollment penalty for as long as you have Part D coverage.

How to enroll late if you delayed

If you delay enrollment, you can sign up for a Medicare drug plan during the Annual Enrollment Period .

What Is The Medicare General Enrollment Period

From Jan. 1 to March 31 each year, those who are eligible for Medicare can sign up for the first time, but you may have a late penalty if you’re signing up after your initial enrollment period.

The Medicare general enrollment period is for new enrollees who do not have any type of Medicare. If you want to change parts of your existing Medicare coverage, youâll probably need Medicare open enrollment in the fall. During general enrollment, you’ll have the same options as during initial enrollment â you can sign up for Medicare Part A, B, C or D. Starting in January 2023, the coverage you select will begin on the first day of the month after you sign up.

However, enrolling in Medicare after your initial enrollment period means you could pay a penalty. This isn’t a one-time fee. Instead, it’s an increase in your monthly costs based on how long you didn’t have coverage.

You May Like: What Are Income Limits For Medicare

Faq: What Are The Different Medicare Parts And Plans

Original Medicare Part A provides you with inpatient coverage and home health care.

For example, if you were admitted to hospital for surgery your expenses would fall under Part A.

Medicare Part B deals with outpatient or general care and can include medical tests, services, or items that you receive while not an admitted patient.

For example, if you went to the doctor to get your leg bandaged, the associated costs would be Part B expenses.

Medicare Advantage Plan: Also known as Part C, this plan gives you all the coverage of Original Medicare with some additional benefits not covered by Parts A and B, such as vision care, dental cover, and sometimes even prescription drug coverage.

Medicare Part D has to do with prescription drugs coverage and covers the cost of medication you take at home or which is self-administered.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period runs between January 1 and March 31 each year. Individuals enrolled in a Medicare Advantage plan are allowed to make a one-time change to go to another Medicare Advantage plan or return to Original Medicare. Coverage begins the first of the month following the month you make the change.

Recommended Reading: What’s The Cost Of Medicare Part B

How To Get Ready For Medicare Advantage Open Enrollment

Whether you recently enrolled or have had your Medicare Advantage plan for years, you can take this opportunity to confirm – or change – your plan choice. Think about your experiences using your plan and review your plan benefits. How does your plan stack up in the following areas?

- Your doctor and other providers are in the plan network.

- Your prescription drugs are on the plan formulary.

- You are comfortable with your costs, including premiums, deductibles, copays, and coinsurance.

- You have the additional coverage that you want for things like dental, vision, and hearing care.

- You are happy with your plan’s additional benefits such as fitness programs, mail-order pharmacy, nurse line, and other wellness services.

If you decide to make a change, you have from January 1 – March 31 to do it. You can explore other plan options. Your new plan benefits will be in effect for the rest of the year.

Find Medicare Plans That Fit Your Needs*

Get coverage now!

* By shopping with our third-party insurance agency partners. You may be contacted by a licensed insurance agent from an independent agency that is not connected with or endorsed by the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1800 MEDICARE to get information on all of your options.

Home> Medicare Open Enrollment 2023 Guide

You May Like: Does Medicare Part A Cover Prescriptions

Who Is Eligible To Enroll In A Medicare Supplement Plan

To be eligible for Medigap, you must first be eligible for Original Medicare and enrolled in Part A and Part B .

There are three ways you can become eligible for Medicare:

- You turn 65 years old.

- You have a qualifying disability and receive Social Security Disability Insurance for at least 24 months.

- You have certain illnesses, such as end stage renal disease or amyotrophic lateral sclerosis .

Losing Creditable Drug Coverage Through No Fault Of Your Own

If you had a Medicare Advantage plan with prescription drug coverage which met Medicares standards of creditable coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage .

Additionally, if you wish to disenroll from a Medicare Advantage plan with drug coverage and enroll in another form of creditable coverage such as VA, TRICARE or a state pharmaceutical assistance program, you may do so whenever you become eligible for enrollment in the new coverage.

Also Check: What Is A Wellness Visit For Medicare

Understanding The Medicare Initial Enrollment Period

During your Medicare Initial Enrollment Period, you can enroll in Medicare Parts A, B, C, and D. Learn how the IEP works, what you can do during this period, and what options are available if you miss your Initial Enrollment Period.

The Initial Enrollment Period for Medicare is when you become eligible to receive Medicare benefits after turning 65. Medicare is a public health insurance program that helps reduce the cost of healthcare services for individuals over 65 and those with eligible disabilities. For those new to Medicare, learn how the Initial Enrollment Period works.

Original Medicare consists of two parts: Part A and Part B. Part A covers hospital-related costs, while Part B handles care such as doctors visits, exams, or lab tests. Other Medicare options include:

- Medicare Advantage, also called Part C

- Medicare drug coverage, also called Part D

- Medicare Supplement insurance, also called Medigap insurance

Medicare-approved private insurance companies offer Medicare Advantage plans and often bundle Parts A, B, and D with additional services such as dental or vision. Medigap plans are offered by private insurance companies as a way to supplement your existing Original Medicare coverage.

Be Wary Of Ads Pushing Plans

Also, If you consider enlisting the help of an agent or broker, be sure they take the time to weigh all the coverage options available in your area from various insurers. And think twice before responding to a TV commercial.

Medicare officials recently cracked down on aggressive and potentially misleading sales tactics from third-party marketers with some new rules, but you may still be exposed to the tamer ads and end up in a plan that wouldn’t have been the best option if all were considered.

“The commercials and phone calls can be hard to ignore during this time of the year, but be cautious of the fine print,” Roberts said. “Many plans seem great on the surface, but you’ll want to look at all the plan details before enrolling.”

Don’t Miss: Do Oral Surgeons Accept Medicare