Medical Expenses Under Medicare Part B

Medicare Part B generally covers a wide range of medical expenses. There are rules and restrictions for each. Hereâs just a sample of covered services:

- Doctor visits

- Durable medical equipment

- Preventive services, like certain vaccines

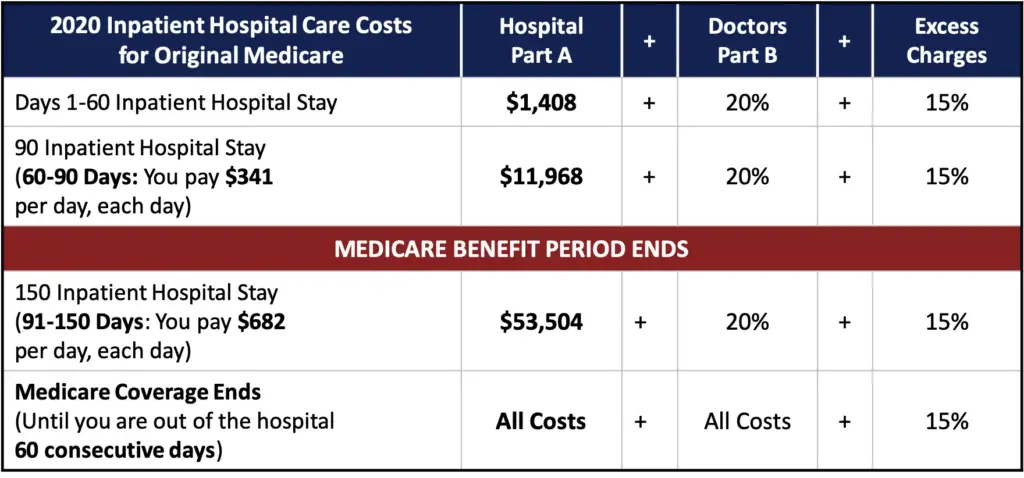

Generally, you pay 20% of the Medicare-approved amount for most Part B covered services after you have paid an annual deductible.

I Turn 65 This Year: How Much Will I Need For Medicare

Q: I turn 65 later this year and Im in good health. How much will Medicare premiums cost, and what other costs will I have? I do not get health insurance where I work.

A: Planning healthcare costs is extremely important, but not an easy task. According to the Kaiser Family Foundation, healthcare expenses, on average, accounted for nearly 15 percent of Medicare household budgets in 2009. But even if youre in good health today, youre not out of the woods. The amount you spend on healthcare not only grows every year, but your need for more healthcare services increases with age.

Since you dont receive health insurance coverage where you work, you will need to enroll in Medicare Part B, which covers doctors and hospital outpatient services when you first become eligible for Part B. That period starts three months before you turn 65, includes the month you turn 65 and ends 3 months after the month you turn 65.

In addition, you will need a plan to cover the portion of costs that Medicare does not pay which are considerable, either a Medicare supplement with a Part D plan for drug coverage or Medicare Advantage plan that includes drug coverage. Spending on Medicare and health insurance premiums comprise the biggest share of healthcare costs, nearly two-thirds of overall senior healthcare spending.

Premiums and coverage details can vary enormously, but here are a few things to consider:

What If You Worked 10 Years Or Less

Most people will qualify for coverage by paying Medicare and Social Security taxes for 10 years through any combination of employers. Youll need to have spent 10 years doing taxable work to enroll in Medicare Part A for free. If youve worked for less than 10 years in the US, youll need to pay monthly premiums for Medicare Part A.

However, if your spouse who is 62 or older has enough quarterly credits or receives Social Security benefits, then youll still qualify. You may also be able to qualify based on your spouses work record if youre widowed or divorced.

Recommended Reading: Does Medicare Cover Miracle Ear

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Read Also: Can I Have Medicare Part B Without Part A

How Much Does Medicare Part A Cost

Medicare Part A usually doesnt require a monthly premium payment if you or your spouse paid Medicare taxes while working. If you have to purchase Medicare Part A, it can cost up to $499 per month.4

What it is: Medicare Part A provides coverage for hospital services and care. This includes expenses for care received during stays in hospitals, skilled nursing facilities, hospice or home health care facilities.

Medicare Part B Costs

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Medicare Part B does have a monthly premium, which is $170.10 per month.â¯This monthly premium tends to go up a little bit each year. Also,â¯if you have a high income, your premium will be higher.

This means itâs important to make sure you really need Medicare Part B, because if you donât, youâre paying for insurance you arenât using.

We always recommend individuals who are working past the age of 65 to contact us to make sure their current insurance setup is appropriate.

Medicare Part B does have a deductible, but itâs much cheaper than youâre probably used to seeing â itâs only $233 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

Recommended Reading: Does Medicare Pay For Dental Visits

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Medicare Part D Costs

For aâ¯Medicare Part D plan, also called a Prescription Drug Plan , the monthly cost varies depending on the prescriptions you take.

The average monthly premium for a Medicare Part D plan is around $30 per month in 2022.

If you do take medications, youâll have other costs, like a deductible, copays, and coinsurance.

We recommend that youâ¯follow our Medicare Part D Cheat Sheet to determine your actual drug plan costs.â¯You can do this directly on Medicare.gov.

â.

Don’t Miss: How Much Is Medicare Deductible For 2021

I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

The Lowdown On The Best And Most Cost

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Planning for retirement includes obtaining appropriate and affordable healthcare coverage. In that respect, for Americans 65 and older, any conversation about healthcare must include Medicare. Eligibility at age 65 means that health insurance becomes more affordable.

When you retire, its important to understand how Medicare works and how you can get the best and most cost-effective coverage. Many retirees wonder how to determine whether they need all four parts of Medicare. Questions about Medicare costs, supplemental insurances, and enrollment periods often arise as well.

You May Like: Are Medicare Advantage Premiums Deducted From Social Security

How Much Does Medicare Part D Cost

The average monthly premium for a stand-alone Part D plan is $33.00.3 The exact cost of your Part D coverage will depend on the plan you choose.

What it is:

Medicare recipients can choose to add a Part D Prescription Drug Plan to Original Medicare.

- If a Medicare Advantage plan does not include drug coverage, you may not add a Part D plan to it. In fact, enrolling in a PDP un-enrolls you from your Medicare Advantage plan.

- However, if your Private Fee-for-Service plan does not have drug coverage, you can add coverage without losing your Medicare Advantage plan.

Compare Medigap Plan Costs In Your Area

Bear in mind that the premium averages listed above are just that averages. There may be plans available in your area that cost less than the average listed above for your age.

Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates.

A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan that fits your coverage needs as well as your budget.

Compare Medigap plan costs in your area.

Don’t Miss: Does Medicare Pay For Air Evac

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

Read Also: When Does Medicare Start For Social Security Disability

Need Help Affording Medicare

Medicares out-of-pocket costs premiums, deductibles, copays and coinsurance can easily result in a large tab each year. If youre struggling to meet those expenses, you might be eligible for federal and state assistance.

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as dual eligibles.

Other programs are designed for beneficiaries with incomes that are too high to qualify for Medicaid but who still have trouble paying their health care bills. Each program has specific income and asset limits and eligibility requirements that are adjusted annually.

- The Qualified Medicare Beneficiary program helps pay for Part A and Part B premiums as well as deductibles, coinsurance and copays. If you qualify for this program, you automatically qualify for the Extra Help prescription drug program to help you with the out-of-pocket costs of your medicines. This program has the lowest income threshold of the four.

Coronavirus testing

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there.

Your state Medicaid program or State Health Insurance Program also known as SHIP can provide enrollment assistance and more details on the income caps and other eligibility criteria.

More on Medicare

How Much Does Medicare Advantage Cost Per Month

In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Don’t Miss: Is Dental Care Included In Medicare

When Does Medicare Not Automatically Start

Medicare will NOT automatically start when you turn 65 if youre not receiving Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. Youll need to apply for Medicare coverage.

Theres no such thing as a Medicare office enrollment in the program is handled by the Social Security Administration . If you have to enroll in Medicare Part A and/or B on your own, you can visit your local Social Security office.

You can also online by following the instructions at the Social Security Administration Medicare Benefits web page. In most cases, signing up online will take ten minutes.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

Also Check: How To Find A Medicare Number For A Patient

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $274 per month in 2022 those whove paid less than 30 quarters in Medicare taxes will pay $499 a month in premiums.1

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Also Check: How Much Is Medicare B Cost