Toni Says: Are Medicare Supplements And Medicare Advantage Plans The Same

Dear Toni:

What is the difference between a Medicare Supplement and a Medicare Advantage PPO plan? I am turning 65 and I am being bombarded with marketing material.

Friends have told me that a Medicare Advantage PPO plan is the same as a Medicare Supplement because both have a network of doctors to pick from. My retiree employer medical plan now has a Medicare Advantage PPO plan, and I am concerned. If a medically catastrophic incident happens, will the medical providers I am now seeing accept this Medicare Advantage

PPO plan? Thanks.

Stephen:

Your friends have given you wrong information regarding Medicare, which could lead you to choose the wrong Medicare plan for your medical situation. Medicare Supplements and Medicare Advantage Plans are completely different types of Medicare policies.

With a Medicare Supplement, there is not a network of any kind you have the freedom to use any health care provider/facility that will bill Medicare. The Medicare Supplement will pay for your Medicare out-of-pocket costs that Medicare Parts A and B will not pay.

With a Medicare Advantage PPO plan, there are lower-cost, in-network providers and facilities as well as out-of-network benefits that will cost you more. In 2022, one popular Medicare Advantage PPO plan has a maximum out-of-pocket ranging from $5,400 to $7,550 in-network while the out-of-network maximum range is $7,550 to $11,300. Some Medicare Advantage Plans also include Part D prescription drug coverage.

Medicare Requires Rehab Therapists To Obtain A Physician

As we discussed in this blog post, Medicare requires that all patients receiving physical, occupational, or speech therapy treatment be under the active care of a physician, which means therapy providers must obtain a signed plan of care certification within 30 days of a Medicare patients initial therapy visit. Now, Medicare does not require that the certification come from the patients primary care physiciannor does it require that therapists obtain certification prior to initiating treatment. That said, to ensure that youll receive payment, youll want to be confident that you can obtain POC certification in a timely manner before providing services. Because MA plans are run by commercial companies, some may adhere to Medicares POC certification ruleand some may not. In fact, while Medicare does not require patients to obtain prior authorization before receiving therapy services, some MA plans do. So, to ensure youre always in compliance, check with the specific MA plan provideras well as your state practice actbefore providing services. As a reminder, if an insurance company and your state practice act have different requirements, you should always adhere to the most stringent rule.

Can You Change From A Medicare Advantage Plan To A Medicare Supplement Plan

During the Annual Enrollment Period, which runs from October 15 to December 7 each year, you are free to reconsider your Medicare coverage. If you decide you want to try a Medicare Supplement plan vs. Medicare Advantage plan, you can make that change during this period.4

Considering Medicare Advantage vs. Medicare Supplement? One is not better than the other. They provide different types of coverage. Finding the right fit for you depends on what kind of Medicare coverage youre seeking, as well as your health care needs. Review all details of plans when shopping and be open to considering alternatives when your needs change.

Also Check: Does Medicare Have A Cap

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur. If you decide that the Medicare Advantage Plan isn’t for you, you have the right under federal law to purchase any Medigap plan if you switch to Original Medicare within 12 months of the date that you joined a Medicare Advantage Plan for the first time.

You may also switch from your Medicare Advantage Plan to Original Medicare during the annual Open Enrollment Period or if you qualify for a Special Enrollment Period. However, you may not be able to purchase a Medigap policy . If you are able to do so, it may cost more than it would have when you first enrolled in Medicare.

Keep in mind that an employer only needs to provide Medigap insurance if you meet specific requirements regarding underwriting . The wait time for Medigap coverage can be avoided if you have what is called a “guaranteed issue right.”

A thorough breakdown of what is considered a “guaranteed issue right,” where an insurance company can’t refuse to sell you a Medigap policy, can be found on the Medicare website.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

Read Also: Is Medicare Advantage A Supplemental Plan

Drug Coverage In Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage . You can join a separate Medicare Prescription Drug Plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- Youre in a Medicare Advantage HMO or PPO.

- You join a separate Medicare Prescription Drug Plan.

Note:

What Is The Average Cost Of Medicare Supplement Insurance

The estimated average monthly premium for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Just like Medicare Advantage plans, its good to shop around65-year-olds stand to save an average of $840 a year with Medicare Supplement Plan G or $648 a year with Plan N if they enroll in the lowest-cost option available in their areas, according to a price comparison analysis by eHealth, Inc.

We continue looking at how private plans and Medicare can be more efficient, effective and equitable for people, says Jacobson. The good story here is in the data. Weve seen pretty consistently that inequities are much smaller in Medicare than any other source of coverage.

| Medicare Advantage vs. Medicare Supplement: Which Is Right For You? | |

|---|---|

| Medicare Advantage | |

|

|

Recommended Reading: Does Medicare Pay For Anesthesia

Medicare Advantage Vs Medicare Supplement Plans

Home / FAQs / Medigap Plans / Medicare Advantage vs. Medicare Supplement Plans

If you are enrolling in Medicare or are looking to change plans, you may wonder which plan is best for you. When deciding which plan to enroll in, you must first choose between a Medicare Advantage plan and a Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

There are many differences between Medicare Advantage vs. Medicare Supplement plans. So, it is crucial to do your research and thoroughly understand how each plan type works before deciding. You are not alone in your research, and we are here to help.

Aarp Medicare Plans Are Worth Checking Out

AARP puts their brand on many types of insurance. AARP could lose some of its good will if it chose the wrong partners. One thing they bring to the table is a higher level of customer service. The insurance companies that partner with AARP are held to a higher standard. This is good for the customer.

Dont over look AARP Medicare Plans when deciding which Medicare supplement or Advantage plan to choose. If you are in the market for an Advantage Plan, definitely consider the AARP Medicare Complete Plan. There are 3 AARP Medicare Part D plans to choose from. Do your homework and get the best plan for your health and budget.

Read Also: Is It Too Late To Sign Up For Medicare Advantage

What Is The Difference Between Medicare Plus And Medicare Advantage

Medicare Supplement insurance plans work with Original Medicare, Part A and Part B, and may help pay for certain costs that Original Medicare doesn’t cover. … In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you’re still in the Medicare program.

Medicare Supplement Vs Medicare Advantage: 6 Facts You Should Know

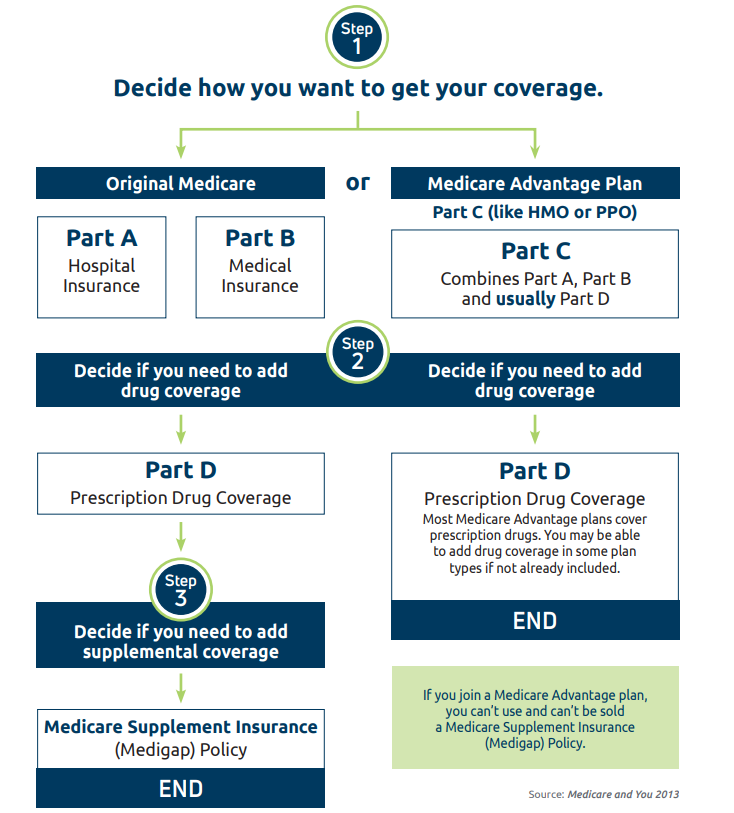

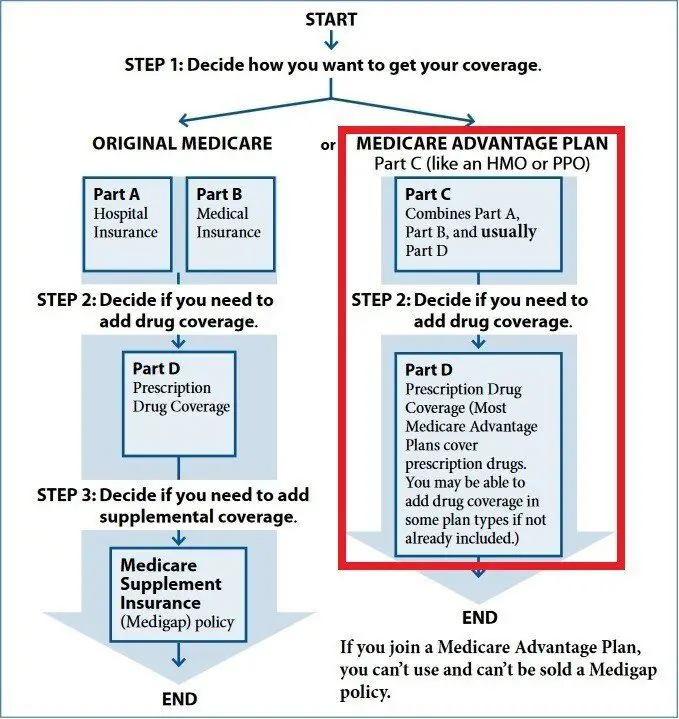

Knowing the difference between Medicare Supplement and Medicare Advantage is not as hard as it seems. The main issue is that âOriginal Medicareâ provides incomplete health coverage, leaving you exposed to many out-of-pocket expenses. There are two different solutions to this coverage problem: Medicare Supplement and Medicare Advantage. You can have one or the other, but not both. Here are the facts you should know about Medicare Supplement vs. Medicare Advantage, according to the official U.S. government website for Medicare.

You May Like: Does Medicare Cover Diagnostic Mammograms

How Much Does A Medicare Advantage Plan Cost

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 .

Medicare Part Bs coinsurance and the deductible is $203, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment like glucometers, walkers, hospital beds and more.

What gets many people into financial trouble is not following the rules of their plan, such as using an out-of-network provider or facility or getting products or services from a supplier not approved by Medicare.

Sometimes, patients urgently need this medical equipment and arent thinking about reading the fine print, says Baethke. This is why its so important to understand Medicares DME requirements from the beginning.

Nebulizers, for instance, are DME commonly used to treat conditions that cause difficulty breathing, such as asthma and COVID-19. If your doctor recommends one, Medicare requires you to get the machine through a Medicare-approved supplier. Not doing so will mean a denied claim from your Medicare Advantage insurerand a sizable surprise bill.

To learn more about your costs in specific Medicare Advantage plans, contact the plan or visit Medicare.gov/plan-compare.

Aarp Medicare Plans: Medicarecomplete Or An Aarp Medicare Supplement

The word is out. It just doesnt make sense to enroll in Medicare and not seek additional coverage. Whether you choose a Medicare Advantage Plan or go with a stand alone Part D Drug Plan and a Medicare Supplement, AARP Medicare Plans are worth taking a look at.

Original Medicare entails too much financial responsibility for most people. Medicare was never intended to provide 100% protection from financial exposure due to health related claims, but rather a safety net.

Medicare Part A offers protection from hospital stays, but your share of the cost is high.

- 2013 Part A hospital deductible is $1184 .

- 61st through 90th day requires a $296 per day co-pay.

- 91st day and after $592 per day co-pay.

- Once lifetime reserve days are used, Medicare pays nothing.

Your responsibility for out-patient charges is also steep. Medicare covers 80% of allowable charges and you are responsible for 20% of the charges. Keep in mind that most medical procedures today are performed on an out-patient basis.

You May Like: Is It Too Late To Change Medicare Advantage Plans

How Are Medicare Supplement Plans Different

Medicare Supplement plans are also offered through private insurance companies. Yet, they must include the same coverage regardless of carrier. Medicare Supplement plans pick up the remaining cost-sharing for which you would normally be responsible with only Original Medicare.

Medicare Supplement plans give you the ability to predict your costs. Because all plans have the same benefits, you will always know your out-of-pocket limits. When enrolled in a Medicare Supplement plan, there is no network of doctors to which you must adhere. You can receive coverage from any doctor or hospital that accepts Original Medicare across all U.S. states and territories.

Additionally, some Medigap plans such as Medicare Supplement Plan G cover excess charges in states that allow them. Meaning if the doctor does not accept Medicare assignment, you will not need to pay extra because your Medigap plan protects you.

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Recommended Reading: Are Hearing Aids Covered By Medicare Part B

Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

Medicare Supplement Vs Medicare Advantage: Whats Covered

Medicare Advantage plans replace Original Medicare . When you buy a Medicare Advantage plan, the insurance company not Medicare provides all your health coverage. You dont lose any benefits. In fact, most Medicare Advantage plans include extra benefits for routine vision and dental care. Nearly all include Part D prescription drug coverage.

In exchange for these extra benefits, you have to follow your plans rules. These guidelines often include using only approved network providers and getting prior authorization for certain tests and procedures.

Medicare Supplement plans complement Original Medicare. These plans cover most of your out-of-pocket costs with Part A and Part B. You still get your health insurance from Medicare, but your Medicare Supplement plan pays your deductible and coinsurance.

You usually dont get any extra benefits with Medicare Supplement plans. If Medicare doesnt cover a service, neither will your Medicare Supplement plan. Some plans do offer stand-alone vision and dental plans for an extra monthly premium. A few plans even include extra benefits at no additional cost.

Medicare Supplement plans dont pay your out-of-pocket costs with Part D. If you buy a Part D plan, youre responsible for the deductible and coinsurance.

Medicare Supplement plans dont have restrictions such as provider networks and prior authorization. You can use your plan with any provider that accepts Medicare.

You May Like: How To Find A Medicare Doctor

Which One Is Better

Both Medicare Advantage and Medigap provide advantages and disadvantages.

Some advantages of Medicare Advantage include:

- More coverage and benefits, which can include services like gym memberships, long-term care, and disability equipment

- An all-in-one plan which covers Medicare Part A, B, and D

Some disadvantages of Medicare Advantage include:

- Having to make sure your preferred provider is in your plan

- No coverage while traveling

- A likelihood of higher out-of-pocket and emergency costs

Some advantages of Medigap plans include:

- Fewer out-of-pocket expenses

- Access to all providers who accept Medicare

- Coverage while traveling overseas

Some disadvantages of Medigap plans include:

- Higher monthly premiums

- Having to navigate the different types of plans

- No prescription coverage

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Need Help With Medicare?

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Also Check: Does Medicare Cover Tdap Vaccine