Are Medicare Premiums Tax

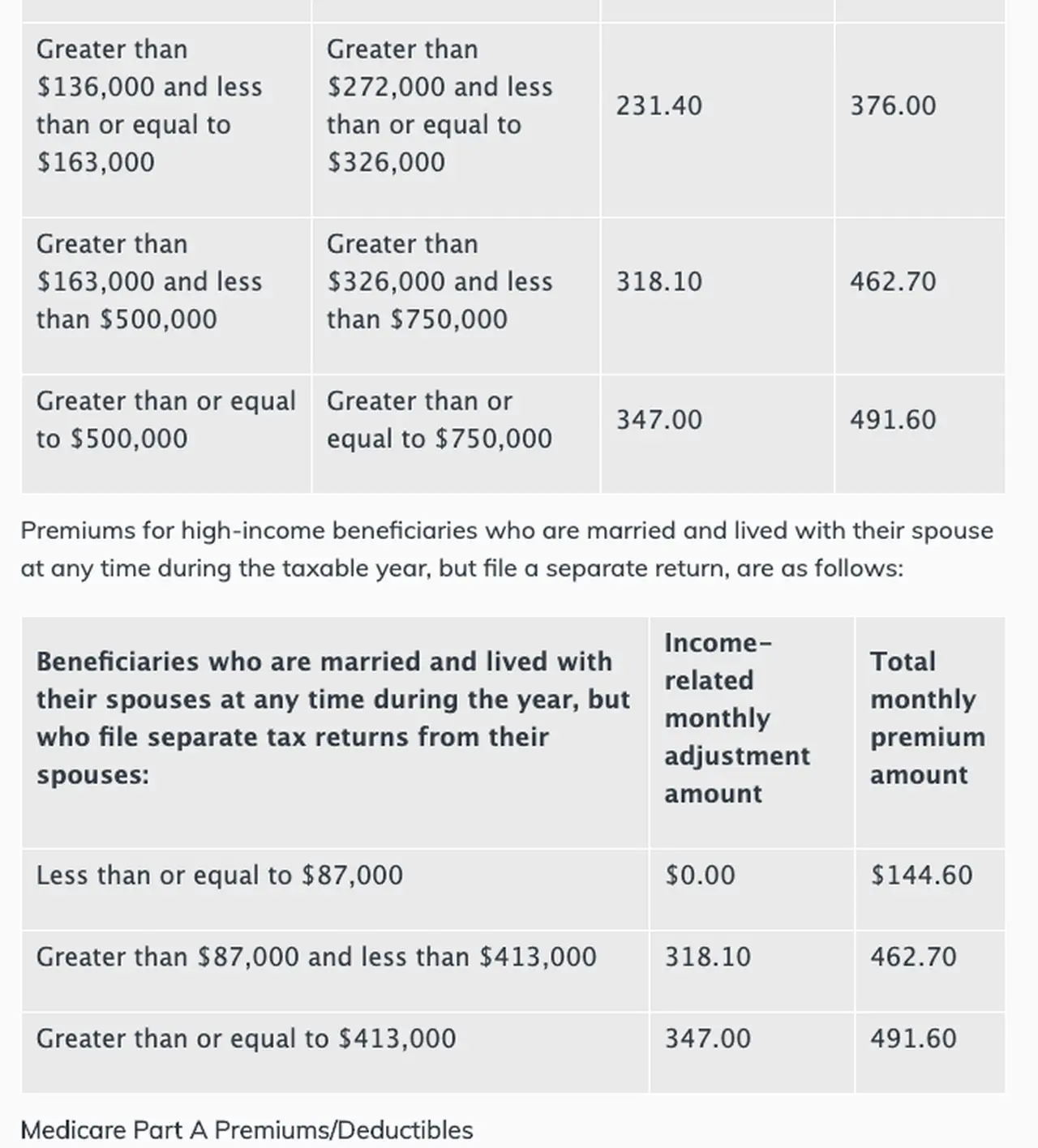

Some of your Medicare premiums are tax-deductible. Medicare Part B and Part D are optional coverage, and you can deduct these premiums as medical expenses on your taxes. Medicare Part A can only be deducted as medical expenses if you voluntarily enrolled in Part A and dont qualify for Social Security benefits.

How Much Are Payroll Taxes In Tennessee

Tennessee State Payroll Taxes Tennessees income tax is simple with a flat rate of 1%. For the calendar year 2021, Tennessee unemployment insurance rates range from 0.1% to 10%, with a taxable wage base of up to $7,000 per employee per year. New employers pay a flat rate of 2.7%.

How Are Medicare Taxes Used

The Medicare tax helps fund the Hospital Insurance Trust Fund. Its one of two trust funds that pay for Medicare.

The HI Trust Fund pays for Medicare Part A benefits, including inpatient hospital care, skilled nursing facility care, home health care and hospice care. It also pays for administering the Medicare program.

A second Supplementary Medical Insurance Trust Fund receives money from Congress and interest earned on trust fund investments. It pays for Medicare Part B benefits and Part D prescription drug coverage.

Both of these trust funds also pay for administrating the Medicare program and covering the costs of fighting Medicare fraud and abuse.

Recommended Reading: What Is The Coinsurance For Medicare Part B

Medicare Taxes And The Affordable Care Act

The Affordable Care Act was passed in 2010 to help make health insurance available to more Americans.

To aid in this effort, the ACA added an additional Medicare tax for high income earners. This raised the tax from 1.45 percent to 2.34 percent for people with an earned annual income of more than $200,000 .1

The additional tax is the sole responsibility of the employee and is not split between the employee and employer.

If you make more than $200,000 per year in 2022 as an individual filer, the 0.9 percent surtax only applies to the amount you make that is over $200,000. For instance, if you make $300,000 per year, you and your employer each pay the standard 1.45 percent Medicare tax for the first $200,000 you make, and you pay the additional 0.9 percent Medicare tax on the $100,000 that is left.

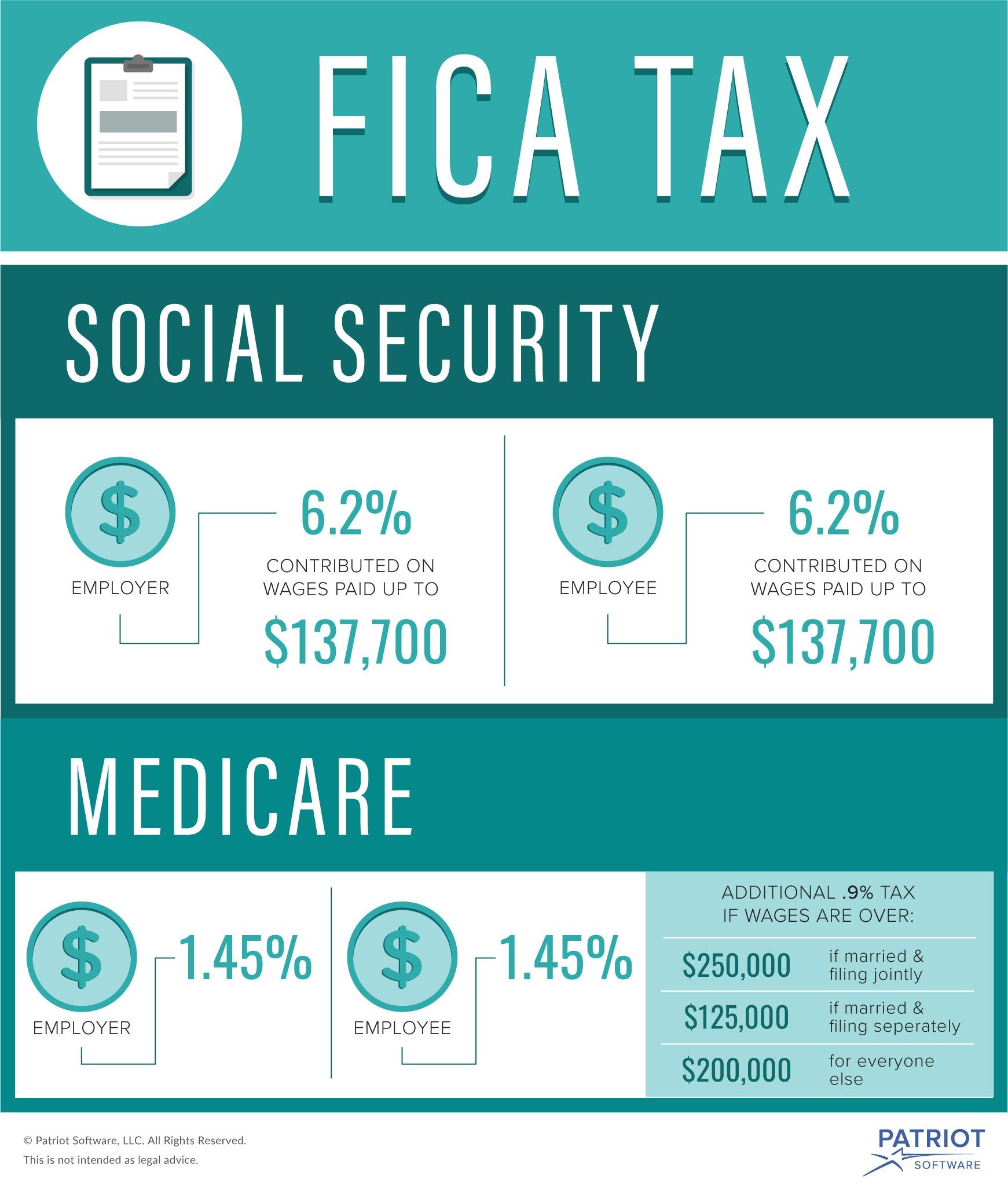

Fica Taxes: The Basics

Every payday, a portion of your check is withheld by your employer. That money goes to the government in the form of payroll taxes. There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act. The funds are used to pay for both Social Security and Medicare. If you own a business, youre responsible for paying Social Security and Medicare taxes, too. Self-employed workers are referred to as SECA taxes based on regulations included in the Self-Employed Contributions Act.

Recommended Reading: When Can You Enroll In Medicare Part D

Depositing And Reporting Taxes

To make Medicare tax deposits, follow your depositing schedule, which is either monthly or semi-weekly. Your schedule is determined by your reported tax liability using a four-quarter IRS lookback period.

Use the Electronic Federal Tax Payment System to deposit Medicare taxes, Social Security, and federal income taxes. Make sure your payments are on time. Otherwise, the IRS can charge you penalties if you make late deposits.

Employers: The Social Security Wage Base Is Increasing In 2022

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $147,000 for 2022 . Wages and self-employment income above this threshold arent subject to Social Security tax.

Background information

The Federal Insurance Contributions Act imposes two taxes on employers, employees, and self-employed workers one for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other for Hospital Insurance, which is commonly known as the Medicare tax.

Theres a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2022, the FICA tax rate for employers is 7.65% 6.2% for Social Security and 1.45% for Medicare .

2022 updates

For 2022, an employee will pay:

- 6.2% Social Security tax on the first $147,000 of wages , plus

- 1.45% Medicare tax on the first $200,000 of wages , plus

- 2.35% Medicare tax on all wages in excess of $200,000 .

For 2022, the self-employment tax imposed on self-employed people is:

- 12.4% OASDI on the first $147,000 of self-employment income, for a maximum tax of $18,228 plus

- 2.90% Medicare tax on the first $200,000 of self-employment income , plus

- 3.8% on all self-employment income in excess of $200,000 .

More than one employer

We can help

Contact us if you have questions about payroll tax filing or payments. We can help ensure you stay in compliance.

You May Like: What’s Better Medicare Or Medicare Advantage

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

How Are Payroll Deductions Reported

When reporting employee tax withholdings and filing the required employer tax payments to the federal government, you typically use the following forms:

These documents can be submitted via paper or e-file. Individual states have their own guidelines for reporting payroll deductions, so its important to check with your local authorities.

Also Check: Does Medicare Pay For Hearing Evaluation

What Percentage Of Social Security Is Taxable In 2019

Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income level of $132,900 to be directed toward Social Security, and 1.45 percent of their paycheck income to be routed to Medicare. Federal tax deductions from paychecks will …

Hospital Insurance Trust Fund

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers, but is also funded by:

- Interest earned on trust fund investments

- Income taxes paid on Social Security benefits

- Medicare Part A premiums from people who are not eligible for premium-free Part A

The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

Also Check: Does Medicare A And B Cover Hearing Aids

Supplementary Medical Insurance Trust Fund

This trust is largely funded by the premiums paid by people enrolled in Medicare Part B and Medicare Part D , but it is also funded by:

- Interest earned on the trust fund investments

- Funds authorized by Congress

The Supplementary Medical Insurance Trust Fund pays for:

- Medicare Part B benefits

- Medicare Part D prescription drug coverage

- Medicare Program administration costs

What Is The Medicare Tax Limit

The Medicare tax is not limited to an annual income cap, although the Social Security tax is. In 2022, the Social Security tax is limited to the first $147,000 you earn.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Also Check: How Much Does Open Heart Surgery Cost With Medicare

What Are Employers Responsible For Regarding Medicare Taxes

Employers are responsible for withholding and reporting Medicare taxes taken from an employees wages. They must also deposit these wages into an authorized bank or financial institution.

An employer is also required to match 1.45% of an employees withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

The 0.9% Additional Medicare Tax is applied to employees only, so employers are not obligated to match that tax contribution.

Employers found to be non-compliant with these standards may face criminal or civil sanctions.

What Is Additional Medicare Tax

With the passage of the Affordable Care Act , the United States government mandated an additional Medicare tax for high-income earners. Additional Medicare Tax is a surtax applied to wages, railroad retirement compensation, and self-employment income.

Once an employee earns more than the threshold, employers are responsible for withholding additional Medicare tax on those wages. Employers do not have a responsibility to contribute to the additional Medicare tax rate though there are other taxes employers do pay.

Recommended Reading: Who Is Eligible For Medicare Extra Help

How To Change Your Take

If you’re wondering what percentage of your paycheck is withheld for federal income tax and how you can adjust it it all comes down to Form W-4. To calculate how much you should take out of each paycheck, use aW-4 Withholding Calculator and try a few different tax scenarios to find what works best for you.

Thenew format for the W-4 form introduced in 2020 allows you to indicate how much money you earn from additional jobs or how much your spouse makes to set accurate withholding levels.

- Additionally, you can adjust forchild tax credits, credits for other dependents, and any other relevant tax deductions you plan to take in excess of the standard deduction.

You may be able to simply ask for an additional specific dollar amount to be withheld. The W-4 comes with a worksheet to help you calculate the amount you want to have taken out.

- If you enjoy the thrill ofa large refund, don’t claim any extra deductions or make adjustments for other credits.

- Conversely, the more credits and deductions that you specify, the larger your regular paycheck will be and the lower your refund will be.

Most tax experts advise you not to go for a large refund because that, in effect, means you’re giving the government an interest-free loan. Financial advisors typically recommend that you should maximize your paychecks andinvest the extra money throughout the year.

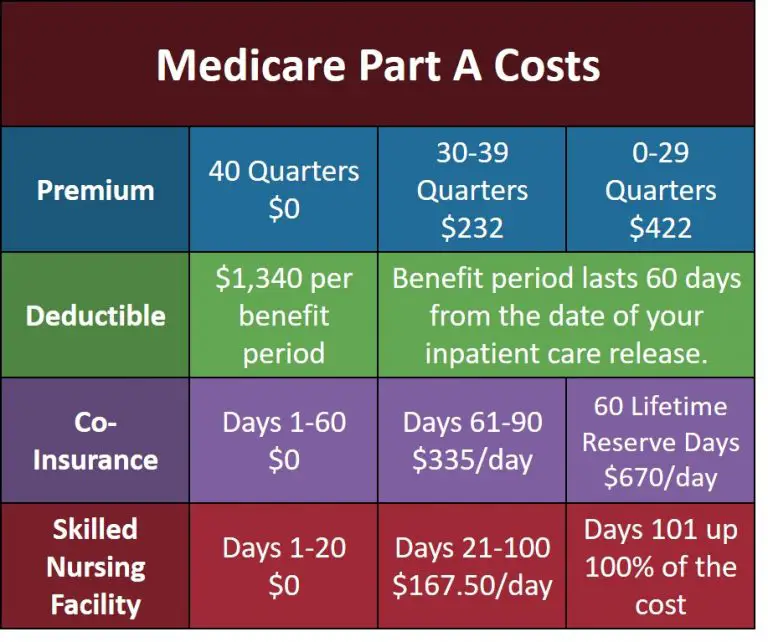

What Is The Medicare Tax Used For

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

Recommended Reading: Why Does Medicare Cost So Much

What Is The Limit On Earnings Subject To The Social Security Payroll Tax

The Social Security payroll tax only applies up to a certain amount of a workers annual earnings that limit is often referred to as the taxable maximum or the Social Security tax cap. For 2021, the maximum earnings subject to the Social Security payroll tax is set at $142,800, an increase of $5,100 from the 2020 level.

When the tax dedicated to Social Security was first implemented in 1937, it was capped by statute at the first $3,000 of earnings . Since 1975, the taxable maximum has generally been increased each year based on an index of national average wages. Each year, about 6 percent of the working population earns more than the taxable maximum, which has been the case since 1983.

Medicare Tax For Self

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

However, you may get a break.

You determine your SE tax using IRS Schedule SE on either Form 1040 or 1040-SR. You may then deduct the employer-equivalent amount of your self-employed tax half of the total amount from your gross income.

Who Has to Pay the Self-Employment Tax?

- Anyone whose self-employment earnings are $400 or more .

- Anyone who had church employee income of $108.28 or more.

- You must pay regardless of age and even if you are receiving Social Security or Medicare benefits.

Also Check: Can Spouse Receive Medicare Benefits

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65PDF and Notice 2021-11PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

How Fica Taxes Are Calculated

To calculate the FICA withholding for employees, you must take the employee’s gross pay and multiply it by the employee rate of 7.65%. There are two important points you must watch in your calculations:

- You must ensure that each employee’s total gross pay for the year does not exceed the Social Security maximum for the current year because you can’t deduct more than the maximum Social Security amount each year.

- You must also ensure that the additional Medicare tax is withheld on the earnings of higher-paid employees when their earnings reach $200,000 in a year.

Read Also: Does Medicare Supplemental Insurance Cover Pre Existing Conditions

Withholding For The Additional Medicare Tax

The Additional Medicare Tax applies when a taxpayers wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

This $200,000 rule can result in underpayment when a taxpayer holds two jobs, neither of which pays more than the threshold amount, so neither employer withholds for this additional tax.

Employees are accustomed to having Medicare taxes withheld from their wages by their employers, and to having the right amount of Medicare tax withheld. But the rules for AMT withholding are different from the rules for calculating the regular Medicare tax. This can result in an employer withholding an amount thats different from the correct amount of tax that will ultimately be owed.

The number that employees arrive at when they calculate the AMT on their tax returns might or might not match up with what was withheld from their earnings. An employee is liable for the Additional Medicare Tax even if the employer doesnt withhold it.

Its best to figure out in advance what your additional Medicare surtax will be, if possible, and then cover this tax cost. You can do this in a few ways:

If An Employee Is Exempt From Paying Social Security And Medicare Taxes Are They Responsible For Telling Their Employer

Your employer should determine if you need to pay FICA taxes. But if you already know that youre exempt, then it may be a good idea to bring it up with your employer. That way, they can get the appropriate paperwork to prove exemption status.

Just know that most people pay FICA taxes. There are exemptions for certain people, such as students working at their college or some city employees, but these are not common. Almost everyone pays into the system.

Read Also: What Does Regular Medicare Cover

Read Also: How Much Is Taken Out For Medicare

When Do You Get Medicare If You Are On Social Security

Youll get Medicare automatically if youre already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, youll be enrolled in Medicare three months before your 65th birthday. Youll also be automatically enrolled once youve been receiving SSDI for 24 months.

People Enrolled In Both Social Security And Medicare Have Their Premiums Automatically Deducted From Their Monthly Check

If you receive Medicare health insurance benefits and Social Security retirement benefits at the same time, you can have your Medicare premiums automatically deducted from your Social Security check each month. This can save a lot of time and energy, as you wont have to worry about paying your premiums manually.

Don’t Miss: Does Medicare Pay For Glucose Meters And Test Strips

Change The Employee’s Payroll Record

The employer will deduct the overpayment of Social Security taxes from your payroll tax record. The W-2 Form for an employee who earns more than the income cap should show the total amount of pay earned for the year as well as the income cap. Medicare wages will be the same as the total amount of pay.

Why Is Medicare Taken From Your Paycheck

What Does Medicare Mean on my Paycheck?

- If your paycheck is directly deposited into your checking account you will be given a pay statement with all the itemized deductions.

- If you receive a paycheck, there will a pay stub attached or included with the check that itemizes all of your deductions. …

- Standard Federal Income Tax is based on your gross earnings and number of exemptions.

You May Like: Does Medicare Pay For Biopsy