Choosing Between Original Medicare And Medicare Advantage

Now that you understand the basics of each type of plan, youll also want to consider other factors when making your choice:

Which doctor you want to go toWith Original Medicare, you can visit any doctor in the United States that accepts Medicare. With Medicare Advantage, however, you are limited to the providers in your specific network. Most insurance plans have a website where you can check if your doctors are in-network. You can also call the insurance company or your doctor.

Your budgetWhen deciding what options best fit your budget, ask yourself how much you spent on health care last year. Keep this number in mind while reviewing your different plan options. For example, Original Medicare plans do not have an out-of-pocket maximum, but Medicare Advantage plans do. If you need a lot of health care services, A Medicare Advantage plan might help you reduce your overall costs by setting a limit on how much you will pay out of your own pocket in a single year.

How often you travelBecause Medicare Advantage plans have a network of providers within a certain geographical area, you may be limited in your health care options. If you travel frequently or stay in another place long-term and need ongoing care, make sure you can find a provider in-network. Or, make sure you have room in your budget to pay for out-of-network health care services. Many Medicare Advantage plans will cover emergency services while traveling, but not routine care.

Local Conditions And Convenience

In some areas where physicians and hospitals are scarce, its important to check out both the networks of available Medicare Advantage plans and the locations of providers who accept regular Medicare. Are the doctors accepting new patients? Will you have to travel far to see a provider or be treated in an emergency room? Advice from local professionals, neighbors, and licensed insurance brokers can help you find Medicare Advantage plans that do business in your area. Compare plans to find one that may suit your needs.

What Else Do I Need To Know About Original Medicare

- You generally pay a set amount for your health care before Medicare pays its share. Then, Medicare pays its share, and you pay your share for covered services and supplies. There’s no yearly limit for what you pay out-of-pocket.

- You usually pay a monthly premium for Part B.

- You generally don’t need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

Recommended Reading: How Much Is Taken Out Of Ss For Medicare

Changing From Medicare Advantage To Original Medicare

Changing from Medicare Advantage to Original Medicare is a very simple process once youre ready and eligible to switch. There are three ways you can make the change:

Explore Our Plans And Policies

![Medicare Advantage Plans in Oregon [Local Help at No Cost] Medicare Advantage Plans in Oregon [Local Help at No Cost]](https://www.medicaretalk.net/wp-content/uploads/medicare-advantage-plans-in-oregon-local-help-at-no-cost.jpeg)

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: Oregon and Texas.

AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. We’ll provide an outline of coverage to all persons at the time the application is presented.

American Retirement Life Insurance Company, Cigna National Health Insurance Company and Loyal American Life Insurance Company do not issue policies in New Mexico.

Exclusions and Limitations:

Read Also: How Much Is Aarp Medicare Supplement Insurance

Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers.

Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles. Many enrollees have been hit with unexpected costs and denial of benefits for various types of care deemed not medically necessary.

Consider Your Other Costs

Out-of-pocket costs can quickly build up over the year if you get sick. The Medicare Advantage Plan may offer a $0 premium, but the out-of-pocket surprises may not be worth those initial savings if you get sick. The best candidate for Medicare Advantage is someone who’s healthy,” says Mary Ashkar, senior attorney for the Center for Medicare Advocacy. “We see trouble when someone gets sick.”

Don’t Miss: What Does Medicare Supplemental Insurance Cost

Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

Who Can Join A Medicare Advantage Plan

You can generally join one of these Medicare Advantage Plans:

If all of these apply:

- You live in the service area of the plan you want to join. The plan can give you more information about its service area. If you live in another state for part of the year, ask if the plan will cover you there.

- You have Medicare Part A and Part B.

- You’re a U.S. citizen or lawfully present in the U.S.

| Note |

|---|

|

Starting January 2021, people with ESRD can choose either Original Medicare or a Medicare Advantage Plan when deciding how to get Medicare coverage. Learn more. |

You May Like: What Is Earliest Age For Medicare

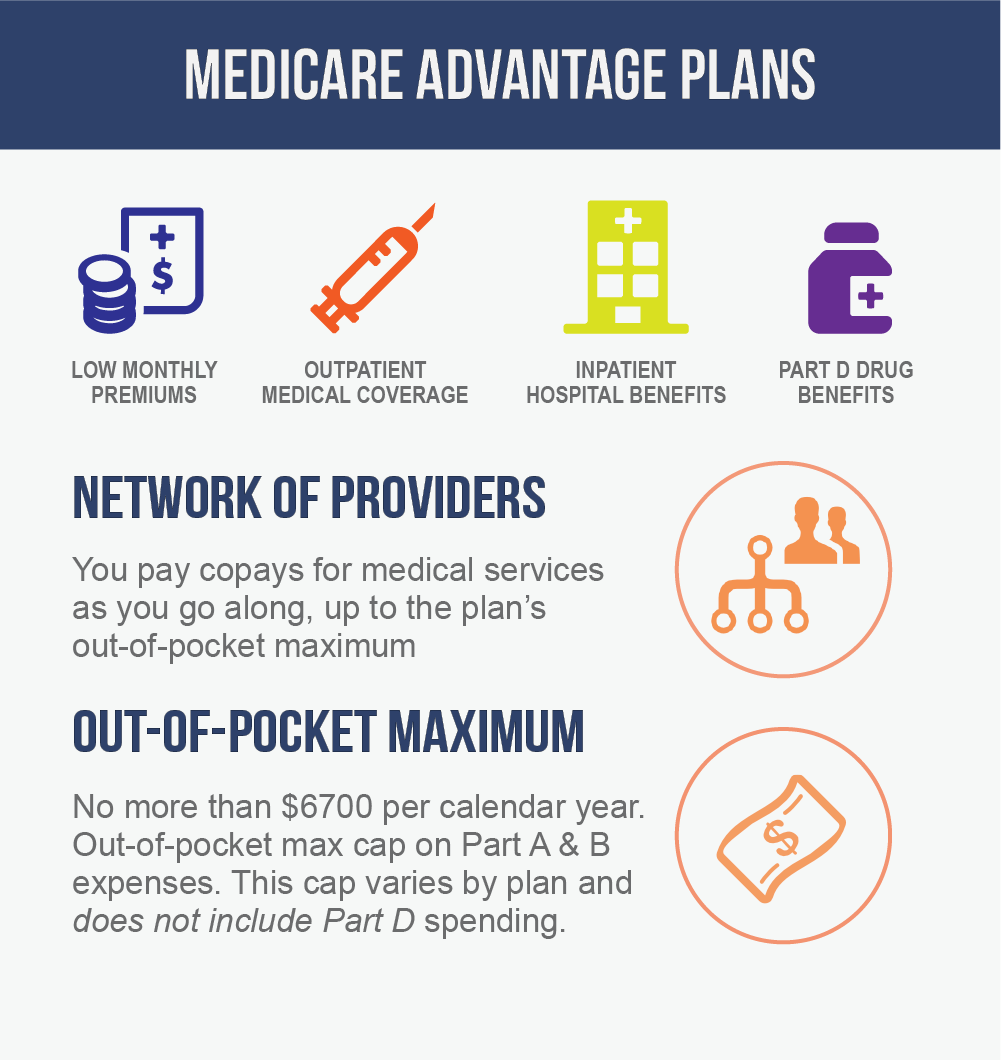

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, youll pay nothing for services Part A and Part B cover.

Which Is A Combination Medicare And Medicaid Option That Combines Medical Social

Which is a combination Medicare and Medicaid option that combines medical, social and long term care services for frail peoplewho live and receive health care in the community. … A medicare- medicaid crossover plan provides both Medicare and Medicaid coverage to ____beneficiares with low -incomes.

You May Like: What Does Original Medicare Mean

What Should I Consider Before Switching To Medicare Advantage

Although the perks can be fantastic, Medicare Advantage does have some downsides. Here are some facts you should know before switching from Original Medicare to Medicare Advantage:

If you dont have a trial right or guaranteed issue rights, you may have a more difficult time buying a Medigap plan if you switch back to Original Medicare.

What Is The Most Popular Medicare Advantage Plan

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Don’t Miss: Can I Sign Up For Medicare Supplement Anytime

With Medicare Advantage You Still Receive Original Medicare Benefits

When you sign up for a Medicare Advantage plan, you do not get rid of your Medicare Part A and Part B benefits. Medicare Part A covers hospital insurance, and Part B covers medical insurance.

When enrolled in Medicare Advantage, you will receive your Part A and Part B benefits through your Medicare Advantage plan except for hospice care, which you will continue to receive through Part A.

In this sense, Medicare Advantage does replace Original Medicare, because almost all of your Original Medicare benefits will be obtained through your Medicare Advantage plan.

Do I Need To Do Anything After I Enroll In A Medicare Advantage Plan

Once you enroll in a Medicare Advantage plan during Annual Enrollment, the plan will work with Medicare to transfer your benefits. You dont have to contact Medicare yourself. Your new plan will begin covering you on January 1.

If you have a stand-alone Part D prescription drug plan or other private Medicare plan, youll need to contact the plan provider directly to dis-enroll. Simply call the number on the back of your insurance member ID card.

When deciding to change to a Medicare Advantage plan, keep the following in mind:

- You may choose a different Medicare Advantage plan or return to Original Medicare during the Medicare Advantage Open Enrollment Period, January 1 March 31.

Recommended Reading: Does Medicare Cover Walking Canes

What Is Included In Medicare Part D

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans to supplement traditional Medicare and Medicare Advantage prescription drug plans …

Original Medicare Vs Medicare Advantage: Providers

A final key difference to consider when choosing between Original Medicare and a Medicare Advantage plan is what health care providers you can see.

With Original Medicare you can go to any hospital and see any doctor or provider within the U.S. who accept Medicare. You do have limited coverage in foreign countries, though.

With Medicare Advantage, most plans have a network of doctors and providers you can see. If you go outside the plans network, its likely youll have to pay more to do so. However, emergency and urgent care are covered nationwide. You also have limited coverage in foreign countries, though some plans may offer special foreign coverage or travel benefits.

Read Also: Will Medicare Pay For Drug Rehab

What Are Medicare Supplement Plans

Medicare Supplement plans are also offered by private insurance companies, and can help you pay out-of-pocket costs for services covered under Medicare Part A and Part B. Different Medicare Supplement plans pay for different portions of those costs, such as copayments, coinsurance, and deductibles. Medicare Supplement plan benefits are standardized across most of the country.

Some Medicare Supplement plans may extend coverage to emergency care you receive while traveling outside the United States , or to doctors charges that exceed Medicares approved amount . You can learn more about these standard plan types here.

Most Medicare Supplement plans let you visit any doctor who accepts Medicare assignment. Theres one type of Medicare Supplement plan, called a Medicare SELECT plan, that might require you to use providers in the plan network.

How Original Medicare And Medicare Advantage Differ

Since the 1990s, Medicare recipients have been able to choose private health plans as an alternative to original Medicare. These health plans, once called Medicare Part C, are now known as Medicare Advantage.

Most Medicare recipients still choose the original program, but in 2019, 34% of Medicare beneficiaries opted to enroll in Medicare advantage. In 2016, 29% of new Medicare beneficiaries chose an Advantage plan during the first year of enrollment. The two programs offer similar benefits, but there are some important distinctions.

You May Like: Is Passport Medicaid Or Medicare

What Types Of Medicare Advantage Plans Are Available

There are various kinds of Medicare Advantage plans, such as HMO, PPO, and Private Fee-for-Service plans. HMOs and PPOs each have certain characteristics, whether they are part of a Medicare plan or part of a regular health plan.

For example, an HMO plan typically comes with lower costs but requires you to see providers within a network and get referrals before you see a specialist. A PPO plan typically costs more, but offers more flexible options for seeing providers and may not require any referrals to see specialists.

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing then your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries are better off with Original Medicare paired with regular Medicaid as secondary coverage if their providers accept those programs, but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

Also Check: Are You Required To Get Medicare At 65

Covered Services In Medicare Advantage Plans

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs and some vision, hearing, and dental services . Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

How To Choose Between Original Medicare And Medicare Advantage

There are pros and cons to both Original Medicare and Medicare Advantage. The right choice depends on your unique situation. Consider the following:

- Costs: May include an annual deductible, monthly premium, and copays or coinsurance. Don’t forget to factor in the cost of a Part D plan if you’re leaving an MA-PD plan for Original Medicare, as well as out-of-pocket expenses for any other items that were included with your Medicare Advantage plan. If you plan to join a Medigap plan, factor in those costs and savings as well.

- Coverage: If you’re used to getting certain services with your Advantage plan, such as routine eye exams and prescription lenses, don’t forget to factor in your out-of-pocket costs for any services not included with Original Medicare.

- Network: Most people who have Medicare Advantage belong to either an HMO or PPO, which means they have a provider network. Original Medicare is accepted by 93 percent of primary care doctors. Advantage plan members, though, usually have to work within a provider network. And if you travel a lot, it’s unlikely your plan will pay for anything other than emergency care.

Comparing your Medicare plan options is easy with our Find a Plan tool. Just enter your location and coverage start date to review Medicare Advantage, Part D, and Medigap plans in your area.

Read Also: When Does One Qualify For Medicare

Original Medicare Vs Medicare Advantage

It’s important to learn about the differences in coverage, cost and care provider rules because these will impact how you decide which option is best for you. Read below to learn about each in detail below.

Comparison between Original Medicare and Medicare Advantage| Original Medicare | |

|---|---|

| Includes hospital coverage + medical coverage | Combines hospital coverage + medical coverage + additional health benefits under one plan |

| Does not provide prescription drug coverage | Often includes prescription drug coverage |

| Does not provide additional health benefits | Can include additional health benefits – dental, vision, hearing, fitness |

| Provided by the federal government | Provided by private insurance companies with varying benefits, costs and coverage options based on location and provider |