Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2022 is $33.37, but costs vary.

Your Part D Premium will depend on the plan you choose. Just like with your Part B coverage, youll pay an increased cost if you make more than the preset income level.

In 2022, if your income is more than $91,000 per year, youll pay an IRMAA of $12.40 each month on top of the cost of your Part D premium. IRMAA amounts go up from there at higher levels of income.

This means that if you make $95,000 per year, and you select a Part D plan with a monthly premium of $36, your total monthly cost will actually be $48.40.

Do Certain People Really Pay More For Medicare

Around 93% of people with Medicare pay the regularly published Medicare premiums. Thatâs $170.10 per month for Medicare Part B and the regular premium for your specific Medicare Part D plan .

But around 7% of folks with Medicare pay more depending on how high their income was on their last tax return.

If youâre part of this wealthier bracket, youâll get an Initial IRMAA Determination notice in the mail from Social Security. That letter will let you know if youâll pay higher Medicare premiums.

If you do have to pay higher premiums, the surcharge will most likely come out of your Social Security benefits. If you aren’t drawing Social Security yet, you’ll be billed by Medicare.

How Your Income Affects Your Health

Stephanie Watson Sabrina Felson, MD

When Pamela D., 70, was diagnosed with chronic lymphocytic leukemia in January 2022, she was in shock. Her first worry was, “Where do I go from here?” Her second was, “How will we afford it?”

The annual cost to treat CLL is about $106,000. Retired and living on a fixed income from Social Security checks and a teaching pension, she and her husband were unsure if they would be able to make ends meet. Even with Medicare coverage and a supplement, the pair found themselves with $5,000 in medical expenses that they could not afford.

“We decided that we would do whatever was necessary, but it’s so frightening,” Pamela says. A generous grant from the HealthWell Foundation, a nonprofit organization that helps with out-of-pocket expenses, helped. So did some pharmacy assistance from The Center for Cancer and Blood Disorders in Fort Worth, TX.

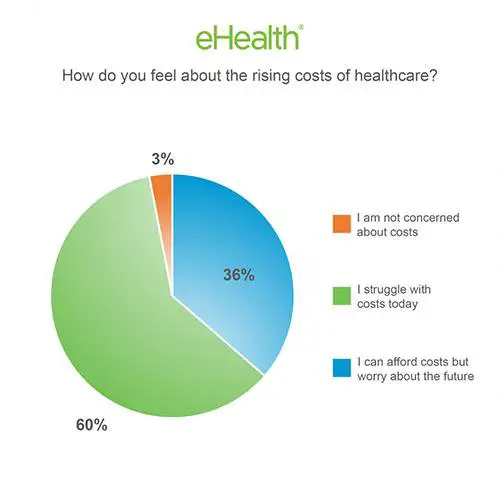

The financial burden is even greater for people who lack supplemental insurance. Almost 10% of older adults with Medicare spend more than 60% of their annual household income on out-of-pocket costs after being diagnosed with cancer.

And for people who donât yet qualify for Medicare, the burden can be even higher. For those without sufficient insurance or income, regular health care can be financially difficult â but for those who get seriously ill, it can become financially impossible.

The Affordable Care Act can help provide insurance, but only if you can afford to pay for it.

Also Check: What Documents Do I Need To Apply For Medicare

Medicare Part B Premiums

For Part B coverage, youll pay a premium each year. Most people will pay the standard premium amount. In 2022, the standard premium is $170.10. However, if you make more than the preset income limits, youll pay more for your premium.

The added premium amount is known as an income-related monthly adjustment amount . The Social Security Administration determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago.

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income.

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. Youll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

How Does Income Affect Monthly Medicare Premiums

Premiums for Part B are standard for most retirees. However, if your annual income exceeds the maximum, youll be required to pay a surcharge.

Stephanie Faris

Key Takeaways

As long as you qualify, Medicare Part A will be free. You will, however, pay for Medicare Part B.

Premiums for Part B are standard for most retirees. However, if your annual income exceeds the maximum, youll be required to pay a surcharge.

The amount of your surcharge depends on your annual income amount for the tax year thats two years prior to the current one.

If you qualify for Medicare, youll probably get Medicare Part A for free. This applies no matter how much money you have going into your bank account each month. But Part A only covers a limited portion of your health care like inpatient care in a hospital or skilled nursing facility care.

For routine doctors appointments, youll need Medicare Part B, which comes with premiums. Youll need to stay below the Medicare maximum income to avoid seeing your premiums increase. If you plan to keep working once youre on Medicare, its worth knowing what those limits are.

Don’t Miss: Is Unitedhealthcare The Same As Medicare

How Your Income May Affect Your Medicare Costs

The federal Medicare program has costs that come with it. There may be premiums, copayments, coinsurance, and deductibles associated with Medicare Part A, Part B, and the optional Part D . If your income is below certain limits, you might qualify for programs that reduce your Medicare costs. On the other hand, if your income is higher than a certain level, you might have to pay a higher Medicare Part B premium and a higher Medicare Part D premium .

Medicare Part A and Medicare Part B make up Original Medicare. If youre automatically enrolled in Medicare, as many Americans are when they turn 65, Original Medicare is the type of insurance you get. You can add to this insurance by enrolling in prescription drug coverage through Medicare Part D and/or buying a Medicare Supplement plan to help with Original Medicare costs or you can get your Medicare coverage through a Medicare Advantage plan.

I Am About To Turn 65 And Go On Medicare And My Income Is $120000 I Know That People With Higher Incomes Are Required To Pay Higher Premiums For Medicare Part B And Part D How Will These Higher Premiums Affect Me

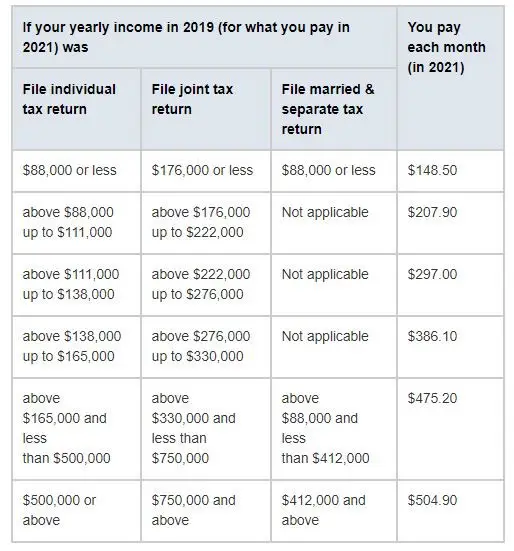

Medicare beneficiaries with incomes above $88,000 for individuals and $176,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return. To determine your 2021 income-related premium, Social Security will use information from your tax return filed in 2020 for tax year 2019. If your income has gone down since you filed your tax return, you should contact Social Security and provide documentation regarding this change. At your current income level, in 2021, you would pay just over $4,300 in annual Medicare premiums combined for Part B and Part D .

Read Also: Does Medicare Cover Transportation To Dr Visits

About The Author: Robert Klein

Robert Klein, CPA, PFS, CFP®, RICP®, CLTC® is the founder and president of Retirement Income Center in Newport Beach, California. The firms motto is Planning, Managing, and Protecting Your Retirement Income. Bob is the creator of FINANCIALLY InKLEINd, a YouTube channel featuring tax-sensitive, innovative strategies for optimizing retirement income. Bob is also the writer and publisher of Retirement Income Visions, a blog featuring innovative strategies for creating and optimizing retirement income that Bob began in 2009.

Bob applies his unique background, experience, expertise, and specialization in tax-sensitive retirement income planning strategies, including fixed-income annuities, Roth IRA conversions, HECM reverse mortgages, and charitable remainder trusts, to optimize the projected longevity of his clients after-tax retirement income and assets. Bob does this as an independent financial advisor using customized holistic planning solutions determined by each clients financial needs.

What Is Counted As Income For Medicaid

Nursing home Medicaid and Medicaid waiver programs in the majority of states will have a $2,000 / month income limit by 2022. Medicaid for the elderly, blind, or disabled is typically covered in the form of an income limit of $841 per month or $1,133 per month .

MAGI is used to calculate a households income by marketplaces, Medicaid, and CHIP. MAGI is a mathematical expression that refers to modified adjusted gross income. You may also be eligible for a tax break if your income is not taxable. Medicaid does not require applicants to include this income. It is preferable to receive less tax credits if your income is high. As your MAGI grows, you will realize how much money you actually make. To calculate your MAGI, you must include foreign earned income in your gross income. The Eligibility Team is a team of government experts who assist you in selecting the best government programs for you.

Read Also: Do You Get Medicare With Ssi

Does Clergy Housing Allowance Count As Income

As long as you pay your fair share of taxes, you can deduct the ministers housing allowance from your gross income.

The Housing Allowance For A Pastor With A Church Income Over $500,000 Is $31,500.

A pastor with a church income of more than $500,000 can expect to receive a housing allowance of $31,500 per year.

Tips For Retirement Planning

- When getting started with retirement planning, it pays to have someone who knows your financial situation. A financial advisor may be able to help. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Retirement planning is easier when you have resources at your disposal to help. SmartAsset has a number of these resources, and theyre free to access on our website. Try using our free retirement calculator and get started saving today.

Don’t Miss: Is Ed Medication Covered By Medicare

Why Did My Medicare Part B Premium Go Up

Medicare costs, including Part B premiums, deductibles and copays, are adjusted based on the Social Security Act. And in recent years Part B costs have risen. Why? According to CMS.gov, The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

Who Will Have To Pay The Extra Amount

When you sign up for Social Security, youll also want to sign up for Medicare. As long as you meet the age and work history qualifications, youll get Medicare Part A for free. But youll also want Part B, which covers your doctors visits and other specific medically necessary services.For Part B, youll pay monthly premiums.These Medicare payments, based on income, can change from one year to the next. In 2022, as long as your 2020 adjusted gross income was $91,000 or less, or $182,000 or less if youre married filing jointly, youll pay only $170.10 per month.

Once youve exceeded that Medicare threshold, the amount you pay depends on your income. If you earn between $91,001 and $114,000, your premium will be $238.10. It goes all the way up to $578.30, which applies to single filers earning $500,000 or more in 2020.

You May Like: Who Has The Best Medicare Supplement

Help With Medicare Part A And Part B Costs

Please note that the income and resource limits listed here are for 2016.

If youre disabled or have a low income, you might qualify for a Medicare Savings Program through Medicaid. Besides helping with your Medicare Part A and/or Part B premiums, some MSPs might help with other Medicare Part A and Part B costs, such as coinsurance. There are four types of MSPs, each with different eligibility criteria:

Resources include, but arent limited to, money you have in the bank, stocks, and bonds they dont include certain possessions, such as your home. To find out if you qualify for a Medicare Savings Program, contact your state Medicaid office.

How To Narrow The Gap

One way to narrow the health divide is with government policy, says Paula Braveman, MD, director of the Center for Health Equity at the University of California, San Francisco.

She points to the Earned Income Tax Credit and the more recent Child Tax Credit as examples of programs that are helping people rise out of poverty. These programs give tax breaks and refunds to people of low and moderate income.

Putting money toward our children’s future is important, too. Government investments in education would give children a chance to succeed by allowing them to go to college, Braveman says.

In the meantime, programs are available to help Americans who are struggling to pay for health care, including EITC. Area Agencies on Aging and the Health Resources & Services Administration help seniors find affordable services. And organizations like the HealthWell Foundation, the Pan Foundation, and the National Association of Free & Charitable Clinics reduce financial barriers to health care.

The financial support Pamela has received from the HealthWell Foundation has been critical to her getting the treatment she needs.

âWeâre grateful,â she says. âIâm healthier than Iâve been in a long while. Weâre living life every day. Weâre enjoying our friends and our family.â

Show Sources

American Journal of Public Medicine: “Neighborhood Environments.”

APM Reports: “House poor, pollution rich.”

HealthyPeople.gov: “Access to Health Services.”

Pamela D., patient, Texas.

Read Also: Will Medicare Cover Cataract Surgery

Modified Adjusted Gross Income

How Social Security Determines You Have a Higher Premium We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your âmodified adjusted gross incomeâ . Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as âmarried, filing jointlyâ and your MAGI is greater than $182,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

You May Like: How To Compare Medicare Supplement Plans

Medicare Income Limits 2022

Find Cheap Medicare Plans in Your Area

If your income is above a specific limit, you pay higher monthly rates for both Medicare Part B and Medicare Part D. Medicare Part A and Part C rates are not based on income.

The prices you’ll pay for Medicare Part B and Part D in 2022 are based on income reported on your 2020 tax return. Individuals who earned $91,000 or less and joint filers who earned $182,000 or less won’t pay extra for Part B or Part D.

Medicare prices are tiered for higher incomes. For example, individual tax filers who made between $91,000 and $114,000 pay about 40% more for Medicare Part B, while rates increase by 240% for people earning $500,000 or more.

If your income and other financial resources fall below certain levels, you might qualify for programs that reduce your Medicare costs including monthly premiums, deductibles and coinsurance. These programs each set their own income limits.

How Is The Income Limit Calculated

According to Social Secuity, the IRMA payments are calculated based on how much most beneficiaries pay for the true cost of Medicare Part B.

Most beneficiaries pay about 25% of the true cost for their Part B coverage. For those who meet the first threshold for IRMA payments, they will pay around 35%. For those who make 2nd threshold they pay 50%, for the 3rd they pay 65%, for the fourth they pay 80%, and for the fifth they pay 85%.

You May Like: Do You Pay Copays With Medicare

Medicare Part D Premium

Medicare Part D is optional prescription drug coverage, available as a stand-alone Medicare Prescription Drug Plan that you enroll into to augment your Original Medicare coverage or through a Medicare Advantage Prescription Drug plan.

Although Medicare Part D is offered by private Medicare-contracted insurance companies, the government still sets an income-related monthly adjustment amount. Heres a breakdown of the Medicare Part D payment adjustments . Please note that you typically pay your Part D premium regardless of income level the amount in the far right column is the income adjustment payment.

| Your income if you filed an individual tax return | Your income if married and you filed a joint tax return | Your income if married and you filed a separate tax return | You pay your Medicare Part D premium, plus this amount |

| $85,000 or less | |||

| $72.90 |

Your Medicare Part D income adjustment payment is typically deducted from your monthly Social Security benefit it isnt added to the premium bill you get from the Part D Prescription Drug Plan. If you have to make an adjustment payment, youll get a notice from Social Security.

If youre charged the income adjustment payment outlined above for Medicare Part B but your income has dropped, you can contact the Social Security information and apply to reduce your adjustment amount.