Medicare Advantage Vs Medicare Supplement Plans

Home / FAQs / Medigap Plans / Medicare Advantage vs. Medicare Supplement Plans

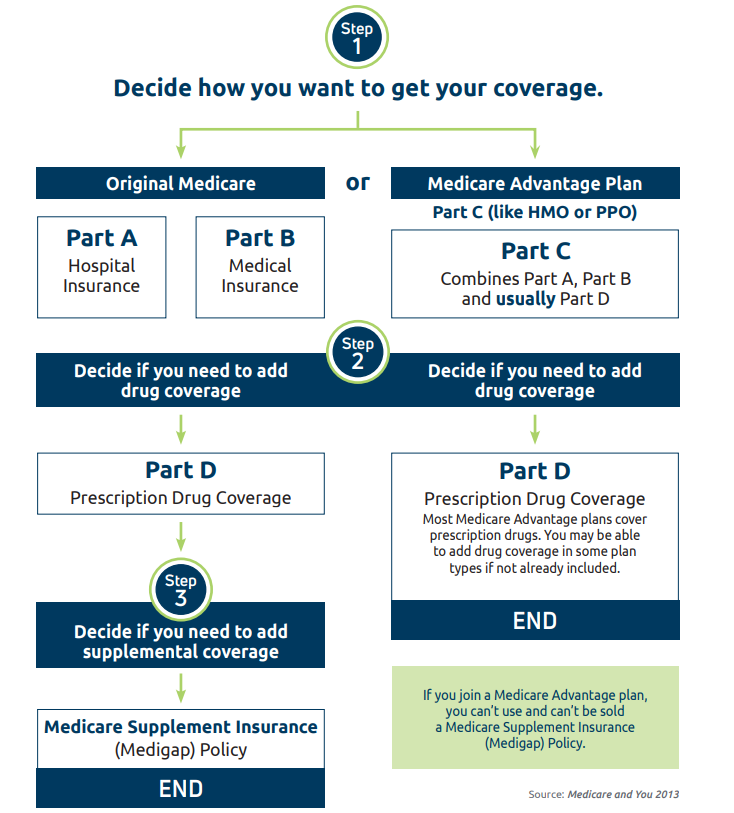

If you are enrolling in Medicare or are looking to change plans, you may wonder which plan is best for you. When deciding which plan to enroll in, you must first choose between a Medicare Advantage plan and a Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

There are many differences between Medicare Advantage vs. Medicare Supplement plans. So, it is crucial to do your research and thoroughly understand how each plan type works before deciding. You are not alone in your research, and we are here to help.

You Cant Enroll In Both Medigap And Medicare Advantage

You cant join a Medigap plan if youre already enrolled in Medicare Advantage. If you enroll in a Medicare Advantage plan, you cant use a Medigap policy to cover your out-of-pocket health care expenses.

Medigap can be only be purchased by people enrolled in Original Medicare. If you have Medicare Advantage and want to join a Medigap plan, you have to switch to Original Medicare before you can buy a Medigap policy. Contact your Medicare Advantage Plan carrier to see if you can disenroll.

If you already have a Medigap policy and want to join a Medicare Advantage Plan, you must drop your Medigap policy.

Which Is Better: Medicare Advantage Vs Medicare Supplement

Medicare does not offer a one-size-fits-all plan. So, the best policy for you is the policy that best meets your healthcare needs.

Medicare Supplement plans are the best option if you want complete reassurance and predictability with your healthcare but are comfortable paying higher premiums in exchange for lower out-of-pocket costs. Whereas Medicare Advantage plans are the best option if you are hoping to save on monthly premiums and receive additional benefits while accepting responsibility for additional out-of-pocket costs at the doctors office.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

For overall ease and reliability, our recommendation is always Medicare Supplement plans. However, we know that may not work for everyone. Our goal is to provide you with your best options regardless of plan type.

- Was this article helpful ?

You May Like: How Do I Change Medicare Supplement Plans

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

Footnote

Read Also: Can I Sign Up For Medicare Part B Online

High Medicare Star Ratings: Blue Cross Blue Shield

-

Highest average Medicare star rating of a national insurer

-

Most plans offer additional drug coverage in the gap

-

Highmark, a BCBS company, ranked highly for customer satisfaction

-

Excellent value for FL and TX plan members

-

Not available in all states

-

No Medicare Advantage PFFS plans

Blue Cross Blue Shieldâs average Medicare star rating for MA plans with drug coverage is 4.27, well above the industry average of 3.97. This means that, according to the Centers for Medicare and Medicaid Services , BCBS members have a better-than-average experience compared to members of other plans. In fact, BCBS MA plans with drug coverage are the highest-rated nationwide, except for Kaiser Permanente which only offers coverage in eight states.

BCBS also offers excellent value for members in Florida and Texas, based on a review of plans with the lowest out-of-pocket maximums in those states.

The companyâs vast network includes names like Anthem Blue Cross Blue Shield and Highmark. Highmark has a more limited coverage area , but was ranked third by J.D. Power for customer satisfaction.

Medicare Vs Medicare Advantage: Which Should I Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When its time to sign up for Medicare, one of the first and most substantial decisions you face is whether to choose Original Medicare or Medicare Advantage. In 2022, 45% of Medicare beneficiaries have a Medicare Advantage plan, according to data from The Chartis Group. The decision will depend on several factors, including where you live, your current and potential health care needs and your financial situation.

Both options provide coverage for your major medical needs. But your out-of-pocket costs and choices for doctors and hospitals will depend on the program you choose.

Don’t Miss: Where Do I Sign Up For Medicare Part D

How And When To Shop For A Medigap Policy

You can buy a Medigap policy anytime you have Medicare Parts A and B. This insurance doesnt have an open-enrollment period during certain times of year, like Medicare Advantage and Part D plans.

But insurers can reject you or charge more if you have preexisting conditions unless you buy a policy during certain times, such as within six months of enrolling in Medicare Part B if youre 65 or older. Medigap insurers must also offer you a policy regardless of preexisting conditions in other situations, such as if you had been enrolled in a Medicare Advantage plan and you move outside of the plans service area.

If you qualify for Medicare before age 65 because of a disability, federal Medigap rules dont protect you from being rejected or charged more because of your health. But some states have extra protections for people who are younger or older than 65 who might find it difficult to get the lowest prices. Contact your State Health Insurance Assistance Program to find out more about the rules in your area.

You can find out more about Medigap plans available in your area at Medicare.gov or your state insurance department.

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

You May Like: What Does Medicare Part B

Can You Have A Medicare Advantage Plan And A Medicare Supplement Plan

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Learn more about Medicare Supplement

Can I Drop My Medicare Advantage Plan And Go Back To Original Medicare

Yes, but you must do it during one of the open enrollment periods. You can switch back to Original Medicare during the annual Medicare Open Enrollment period from October 15 to December 7. Your new coverage will go into effect January 1. Or, you can switch during Medicare Advantage Open Enrollment from January 1 to March 31. Your new coverage will go into effect on the first day of the month after you ask to join the plan.

Also Check: Does Medicare Cover Medical Massage

Aarp Medicare Plans: Medicarecomplete Or An Aarp Medicare Supplement

The word is out. It just doesnt make sense to enroll in Medicare and not seek additional coverage. Whether you choose a Medicare Advantage Plan or go with a stand alone Part D Drug Plan and a Medicare Supplement, AARP Medicare Plans are worth taking a look at.

Original Medicare entails too much financial responsibility for most people. Medicare was never intended to provide 100% protection from financial exposure due to health related claims, but rather a safety net.

Medicare Part A offers protection from hospital stays, but your share of the cost is high.

- 2013 Part A hospital deductible is $1184 .

- 61st through 90th day requires a $296 per day co-pay.

- 91st day and after $592 per day co-pay.

- Once lifetime reserve days are used, Medicare pays nothing.

Your responsibility for out-patient charges is also steep. Medicare covers 80% of allowable charges and you are responsible for 20% of the charges. Keep in mind that most medical procedures today are performed on an out-patient basis.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Does Plan C Cover In Medicare

What Are Medicare Advantage Plans

Private insurance companies offer and administer Medicare Advantage plans. These plans take on the role of primary coverage for Medicare beneficiaries. Medicare pays these private insurance companies to take on your risk.

These plans can also come with a regional network of doctors and hospitals, meaning coverage from the plan will not travel with you. Additionally, your current doctor may not accept the plan as coverage.

Medicare Advantage plans must offer the same benefits you get from Original Medicare and can also include additional benefits. However, these additional benefits vary from plan to plan. When you enroll in a Medicare Advantage plan, you agree to pay higher out-of-pocket costs in the form of cost-sharing in exchange for a lower monthly premium.

Often, Medicare Advantage plans include prescription drug coverage. While not all plans offer drug coverage, the majority of Medicare Advantage HMO and PPO plans include this additional benefit.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Advantage Plan Benefits

Private insurance companies have a bit more flexibility in designing Medicare Advantage plans, so youâll find more differences between plans. This means you need to be more careful comparing plan options to make sure you donât overlook anything.

As mentioned, Medicare Advantage plans give you the opportunity to get coverage for benefits beyond Original Medicare. This may include routine vision and dental, hearing, and health wellness programs. Normally, under Original Medicare, youâd pay for these services out of pocket unless you have other insurance.

Another benefit of Medicare Part C is that many of these plans also include Medicare Part D prescription drug coverage as part of the plan coverage. Also known as Medicare Advantage Prescription Drug plans, these plans give you the convenience of having all of your Medicare benefits administered through a single plan.

If you enroll in a Medicare Advantage Prescription Drug plan, you will not need to enroll in an additional Medicare Prescription Drug Plan. In fact, if you are enrolled in a Medicare Advantage plan that includes prescription coverage and also enroll in a stand-alone Medicare Prescription Drug Plan, you could be automatically disenrolled from your Medicare Advantage plan.

You May Like: Does Medicare Pay For Skilled Nursing Home Care

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Do You Want The Simplicity Of One Plan To Meet Your Health Care Needs A Medicare Advantage Plan May Be The Answer

Medicare Advantage plans combine Medicare Part A and Part B also known as Original Medicarein a single plan. Most plans include prescription drug coverage. Many plans offer additional benefits and features like routine vision, hearing, dental and fitness coverage not provided by Original Medicare.

With UnitedHealthcare® Medicare Advantage plans you get more care for less, more of the extras you need, and more peace-of-mind.1 Want more for your Medicare dollar? You’ll get it from America’s largest Medicare Advantage plan provider.2

You May Like: What Is The Monthly Premium For Medicare Part B

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Unitedhealthcare Connected General Benefit Disclaimer

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays and restrictions may apply. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

You can get this document for free in other formats, such as large print, braille, or audio. Call Member Services, 8 a.m. – 8 p.m., local time, Monday – Friday . The call is free.

You can call Member Services and ask us to make a note in our system that you would like materials in Spanish, large print, braille, or audio now and in the future.

Language Line is available for all in-network providers.

Puede obtener este documento de forma gratuita en otros formatos, como letra de imprenta grande, braille o audio. Llame al Servicios para los miembros, de 08:00 a. m. a 08:00 p. m., hora local, de lunes a viernes correo de voz disponible las 24 horas del día,/los 7 días de la semana). La llamada es gratuita.

Puede llamar a Servicios para Miembros y pedirnos que registremos en nuestro sistema que le gustaría recibir documentos en español, en letra de imprenta grande, braille o audio, ahora y en el futuro.

Read Also: Does Assisted Living Accept Medicare

Nearly All Medicare Advantage Enrollees Are In Plans That Require Prior Authorization For Some Services

Medicare Advantage plans can require enrollees to receive prior authorization before a service will be covered, and nearly all Medicare Advantage enrollees are in plans that require prior authorization for some services in 2022. Prior authorization is most often required for relatively expensive services, such as Part B drugs , skilled nursing facility stays , and inpatient hospital stays , and is rarely required for preventive services . Prior authorization is also required for the majority of enrollees for some extra benefits , including comprehensive dental services, hearing and eye exams, and transportation. The number of enrollees in plans that require prior authorization for one or more services stayed the same from 2021 to 2022. In contrast to Medicare Advantage plans, traditional Medicare does not generally require prior authorization for services and does not require step therapy for Part B drugs.