Delaying Enrollment Could Result In A Permanent Penalty

As described above, you can’t reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So it’s understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, it’s important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason you’re delaying is that you are still working and you’re covered by the employer’s health plan. If that’s the case, you’ll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

Exploring Medicare Benefits In 2022

As a federal health insurance program, Medicare stands out among the examples of successful social programs if for no other reason than the fact that it has survived for the past five decades with few significant modifications. To understand how Medicare affects your life as an American citizen, you need to appreciate that that the program was an unprecedented measure in its day. Today, it continues to fulfill a vital need for senior citizens and those with certain disabilities or illnesses. In the following sections, well discuss the history of Medicare, its impact as a social program on the country and what it means to you as an individual.

How Medicaid Can Help With Medical Expenses For Seniors

Larryâs elderly father is struggling to make ends meet. After moving into a senior apartment complex after the death of his wife and living largely off of his Social Security income, his fatherâs finances are tight. Larry is helping to find ways to pay the monthly rental fee, buy groceries, and cover co-pays for his heart medications and his Medicare coverage. His father needs assistance beyond Medicare to cover his growing medical expenses, and Larry has heard about Medicaid, but heâs not sure where or how to find out if his father is eligible.

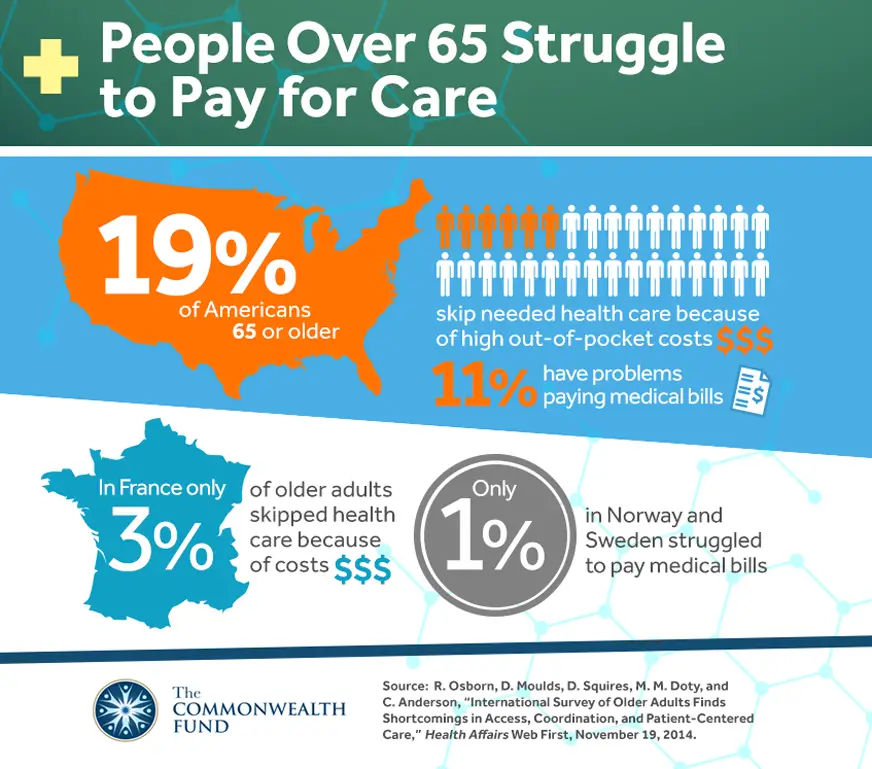

His fatherâs situation is faced by many seniors the Kaiser Family Foundation reports that one in four Medicare beneficiaries spent 30% or more of their income on health expenses in 2006. Making sense of Medicaid can be difficult for seniors and their caregivers. In the midst of an already confusing time, family caregivers often find confusion in the midst of Medicaid forms and filings. However, there are resources available to navigate Medicaid.

- The Area Agency on Aging in your area is a good first stop to learn more about the process for applying for Medicaid. To find your local agency, you can look on the National Association of Area Agencies on Aging website, which lists agencies alphabetically by state.

Additional Resources

Also Check: How To Apply For Medicare Through Spouse

You May Like: Can You Go On Medicare If You Are Still Working

Elderly Pharmaceutical Insurance Coverage

EPIC, administered by the New York State Department of Health, helps many older New Yorkers pay for prescription drugs. It covers those who do not have adequate insurance coverage for prescription drugs and who are not eligible for Medicaid. EPIC is coordinated with Medicare Part D prescription coverage to provide services with additional coverage for prescription medication.

For additional information:

The History Of Medicare

Like any social program, Medicare traces its roots back far beyond the law that put it into place in the mid-1960s. In the early years of the 20th century, the United States government worked with state governments, lobbyists, union representatives and others to form programs that would later evolve into the various social programs we know today.

Healthcare has been the subject of national debate for nearly a hundred years, dating back to lawmakers during the Prohibition years. It has long represented a perceived need among certain sectors of the population. Social Security programs were put into practice during President Franklin D. Roosevelts terms, owing primarily to the need for economic growth following the Great Depression.

Despite the push for Social Security programs and the implementation of the Social Security Act in 1935, there was still a large gap in coverage for people, specifically older Americans. As we age, we tend to need more medical care and more extensive medical coverage to pay for things, like hospital care, medical treatments, prescription drugs and therapy.

The Johnson administration and lawmakers at the time debated extensively on the concept. How would Medicare help senior citizens? What would such a program look like in reality? How much would it cost? Where would the funding come from? They faced a challenge not only in the construction of the law but in its implementation and how the country would respond.

Don’t Miss: What Medicare Supplement Plans Are Available

Medicare And Medicaid Dual Eligibility

When youre dual eligible, Medicare is primary and Medicaid is secondary. Basically, Medicaid fills in the coverage gaps the way a Medigap plan does. When youre dual eligible, you also may qualify for a Medicare Savings Program.

When you have Medicare, Medicaid, and a Medicare Savings Program, you have full health-care coverage for which you pay nothing out of pocket.

Pro Tip: Medicare generally wont pay for most coverage related to vision and dental work. To learn more, read my guides: Does Medicare Cover Dental? and Does Medicare Cover Cataract Surgery?

Why Are You Forced Into Medicare

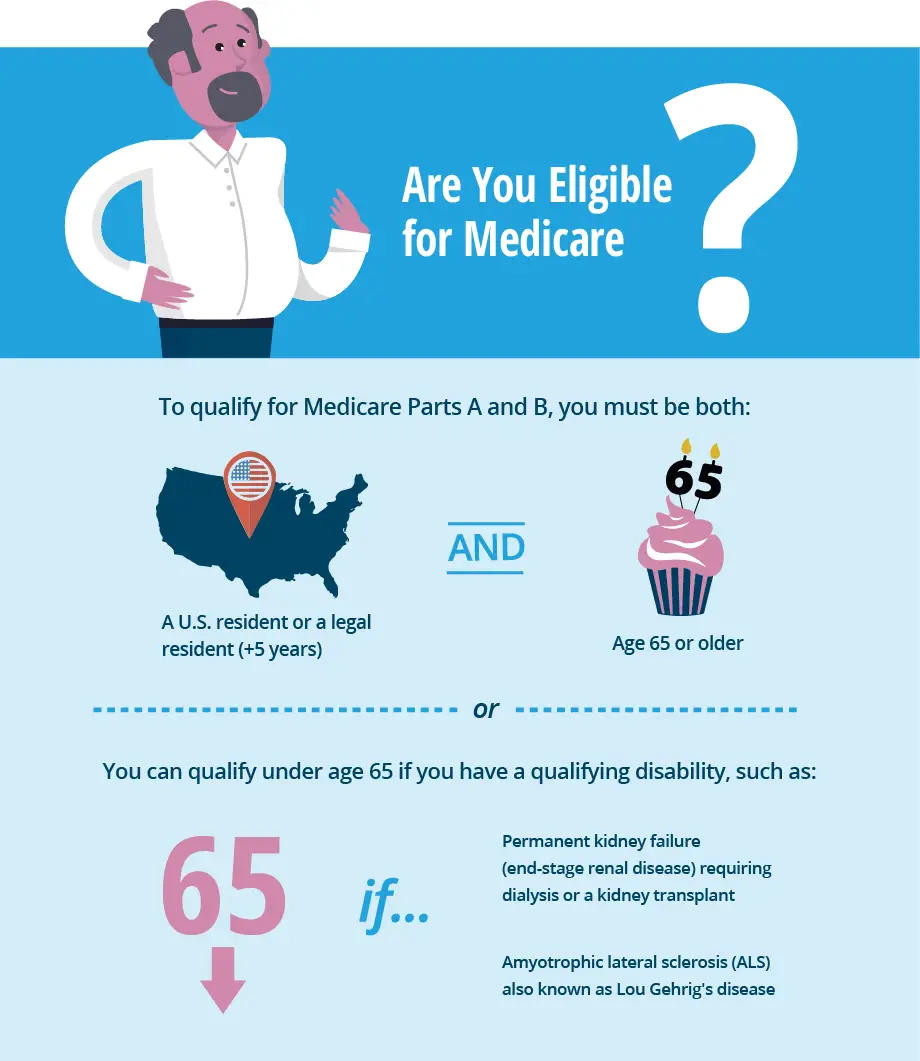

If you or your spouse worked for at least 10 years in a job where Medicare taxes were withheld , you’ll become automatically eligible for Medicare once you turn 65.

Recent immigrants are not eligible for Medicare, but once they’ve been legal permanent residents for five years and are at least 65, they have the option to purchase Medicare coverageas opposed to getting Medicare Part A for freewhich is the same option available to long-term U.S. residents who, for one reason or another, don’t have a work history that gives them access to premium-free Medicare Part A . Note that immigrants who go on to work for at least 10 years in the US do then become eligible for premium-free Part A Medicare if they’re 65 or older, just like anyone else who has paid into the Medicare system for at least a decade.

Once you become eligible for premium-free Medicare Part A, you have to enroll in Medicare Part A or you forfeit your Social Security benefits. Most individuals are unwilling to forfeit their Social Security benefits, and thus accept the enrollment into Medicare. Note that you’re only required to accept Medicare Part Awhich is premium-free if you’re receiving Social Security benefitsin order to retain your Social Security benefits. You are allowed to reject Medicare Part Bwhich has a premiumif you choose to do so, although you could be subject to a late enrollment penalty if you choose to enroll in Part B at a later date. .

Recommended Reading: Does Medicare Pay For Mobility Scooters

Other Ways To Get Medicare Coverage

If you do not qualify on your own or through your spouses work record but are a U.S. citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by:

- Paying premiums for Part A, the hospital insurance. How much you would have to pay for Part A depends on how long youve worked. The longer you work, the more work credits you will earn. Work credits are earned based on your income the amount of income it takes to earn a credit changes each year. In 2022 you earn one work credit for every $1,510 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium $499 in 2022. If you have 30 to 39 credits, you pay less $274 a month in 2022. If you continue working until you gain 40 credits, you will no longer pay these premiums.

- Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay. In 2022 the amount is $170.10 for individuals with a yearly income of $91,000 or less or those filing a joint tax return with $182,000 in income or less. Rates are higher for people with higher incomes.

- Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

You can enroll in Part B without buying Part A. But if you buy Part A, you also must enroll in Part B.

You can get Part D if youre enrolled in either A or B.

Coverage When Signing Up During Your Initial Enrollment Period

By signing up for Medicare Part A and Medicare Part B duringyour initial enrollment periods first 3 months, your coverage will start onthe first day of your birthday month.

- Example: If your 65th birthday is May 7, 2020, and you sign up for Medicare between February and April of 2020, your coverage will begin on May 1, 2020.

If your birthday falls on the first day of themonth, your coverage starts on the first day of the month before your birthdaymonth.

- Example: If your 65th birthday is October 1, 2020, and you sign up for Medicare between June and August of 2020, your coverage will begin on September 1, 2020.

Dont Miss: Can I Draw Medicare At Age 62

Also Check: Who Qualifies For Medicare In Texas

Best If You Have A Low Income

Medicaid is the most affordable plan for seniors and retirees who have a low income.

The Medicaid public health insurance program provides free or affordable insurance for those who are eligible. Even if you’re over age 65 or enrolled in Medicare, you can qualify for dual enrollment in both Medicaid and Medicare. This will give you access to certain types of Medicare Advantage plans including a Medicare-Medicaid Plan or a Dual Eligible Special Needs Plan .

Qualification criteria for Medicaid vary by state. In 12 states, you’ll meet the Medicaid income qualification if you earn less than 100% of the federal poverty level . That’s less than $13,590 per year for an individual and less than $18,310 for a couple.

In 38 states and the District of Columbia, the expanded Medicaid program allows you to meet the income qualification if you earn up to 138% of the FPL. Excluding Alaska and Hawaii, you could be eligible in states with expanded Medicaid if you earn less than $18,754 as an individual or $25,268 as a couple.

Seniors over age 65 who have incomes that are too high to qualify for Medicaid may be able to use a combined calculation of income and medical expenses to qualify. The Medicaid “spenddown” program lets you subtract your medical expenses from your income, and this reduced amount can be used to see if you qualify for Medicaid.

Long Term Care Benefits

Medicare is the primary medical care insurance for a large number of seniors. Many are shocked to discover that Original Medicare , also called Traditional Medicare, does not cover costs for most types of long-term care, including Alzheimers and dementia care. When it does pay, it is only in a very limited capacity. While Traditional Medicare is not a long-term care solution, there are benefits for seniors with recoverable conditions on a short-term basis. Also, as mentioned previously, some Medicare Advantage Plans now offer some home and community based long-term care benefits under specific circumstances.

Skilled Nursing FacilitiesMedicare will pay for 100% of the cost of care up to 20 days at a skilled nursing facility and approximately 80% of the cost up to 80 more days. The care must be for recovery following an in-patient hospital stay.

Assisted Living CommunitiesMedicare does not cover any cost of assisted living. It will pay for most medical costs incurred while the senior is in assisted living, but will pay nothing toward custodial care or the room and board cost of assisted living. Some Medicare Advantage plans may pay for personal care assistance for persons residing in assisted living or memory care, but will not contribute towards the cost of room and board.

Adult Day CareOriginal Medicare does not pay for adult day care services, but some Medicare Advantage plans may cover the cost.

Read Also: How To Switch Back To Traditional Medicare

Automatic Enrollment For Medicare

For those that are already drawing Social Security when you turn 65, your Medicare will automatically become effective the month your birthday and you will receive your Medicare card about 3 months before your 65th birthday. If you would like to only have Medicare Part A become effective or not have any part of Medicare become effective you will have to send in a request to Social Security and they will disenroll you form the Medicare Part you choose. Keep in mind that without creditable coverage you will start to accrue a penalty for not having Medicare active when first eligible .

You May Like: Methadone Clinics That Take Medicaid

Additional Ways To Get Help With Medicare Costs

If you are not considered low income and therefore not eligible for Medicaid, you can enroll in a Medicare Advantage plan also known as Part C. When you opt for Part C, a private carrier pays for your health care instead of Medicare.

Medicare Advantage plans all come with their own cost-sharing. A rule of thumb: the lower your monthly premium, the higher your cost-sharing. You still need to set aside extra funds to cover your medical costs in order to protect your retirement savings.

The other option to help cover cost-sharing is to enroll in a Medigap plan. Medigap plans come with a monthly premium, but they cover significantly more than a Medicare Advantage plan. They also do not have all the limitations Medicare Advantage plans come with.

Did You Know: To learn more about the differences between these types of coverage, read my guide: Medicare Advantage vs. Medigap.

Dont Miss: Does Medicare Pay For Visiting Nurses

You May Like: Does Blue Cross Offer Medicare Advantage

Medicaid Cuts Would Jeopardize Coverage For Seniors

Millions of Medicaid beneficiaries would lose coverage, and hundreds of billions of dollars in federal Medicaid funding would be cut, under congressional proposals to impose a rigid and increasingly inadequate cap on federal funding for state Medicaid programs. Such proposals would effectively end states option to expand Medicaid under the ACA, threaten health care for large numbers of low-income Medicaid beneficiaries, and leave seniors particularly at risk of going without needed care.

Such Medicaid cuts would:

This report was prepared with support from the Commonwealth Fund.

What Is Medicare Advantage

Medicare Advantage is also known as Medicare Part C. These plans are administered by private medical insurance companies who are in contract with Medicare to provide benefits. Parts A and B are combined under one policy.

Medicare Advantage must cover all Medicare-approved services, and some companies may offer additional benefits, like vision, hearing, and dental options.

The medical insurance plans offered through private companies can include:

Medicare Part D offers prescription drug coverage.

Private medical insurance companies offer part D plans as standalone policies.

Coverage for prescription medication can be included within Medicare Advantage plans. However, a person cannot opt for a standalone policy in addition.

Medicare Part D is an optional benefit. If a person decides not to enroll when they are first eligible, a late enrollment penalty may occur.

An individual can find a prescription drug plan within their local area using Medicares online Find a Medicare Plan website.

Medicare plans that help pay for some out-of-pocket expenses are known as supplementary insurance or Medigap plans.

Types of out-of-pocket expenses covered may include:

Also Check: How Long Do You Have To Sign Up For Medicare

The Impact Of Baby Boomers On Medicare

We would be remiss if we didnt point out some of the controversies or negatives surrounding Medicare. All social programs garner debate over time due to different factors. In Medicares case, expansion has led to questions about future funding and long-term viability of the program. An increasing number of enrollees due to the retiring and aging Baby Boomer generation adds fuel to the fire in the debate about Medicares future.

Baby Boomers, the generation of people born primarily during the decade following World War II, are aging into Medicare at a remarkable pace. Approximately 11,000 new people enroll in the Medicare program every single day. Over the next 20 years, the total number of Medicare enrollees is expected to double. Baby Boomers not only work more physically demanding jobs, but they also live longer than their parents did. Its a perfect storm of factors that could derail Medicares future.

Fortunately, improvements in medical science and access to better preventive care may help offset the cost of health insurance and medical care for Baby Boomers. The ACA, signed into law by former President Obama, strives to help America get healthier. It also promotes early diagnosis by encouraging better preventive care for all insured people, including and especially seniors.