Is There A Special Enrollment Period For Extra Help

When you qualify for Extra Help, you also qualify for a continuous SEP. You can drop, join or switch plans one time during each period January through March, April through June, and July through September.

You cant make changes from October through December with this Special Enrollment Period. When making a change, the new policy will go into effect on the first day of the next month.

Important Dates And Information About When You Can Enroll

Choosing a Medicare Advantage plan can be tricky, especially when you have so many options. Depending on the type of plan in which you want to enroll, the time of year, and when you became eligible for Medicare Part A and Part B, your options may be limited. Keep reading to find out about the rules for Medicare enrollment periods.

Whats A Special Enrollment Period For Medicare Part B

The Special Enrollment Period for Part B of Medicare gives you the option to delay enrolling when you first become eligible without incurring a lifelong penalty. You must meet at least one of the eligibility requirements below to qualify for a Part B SEP.

Eligibility Requirements for a Special Enrollment Period for Part B:

Youll need to print and mail the following two forms to Social Security:

The CMS L564 form will need to be completed by your employer. You can also upload the completed forms to your My Social Security account.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Also Check: How Do I Sign Up For Medicare Supplemental Insurance

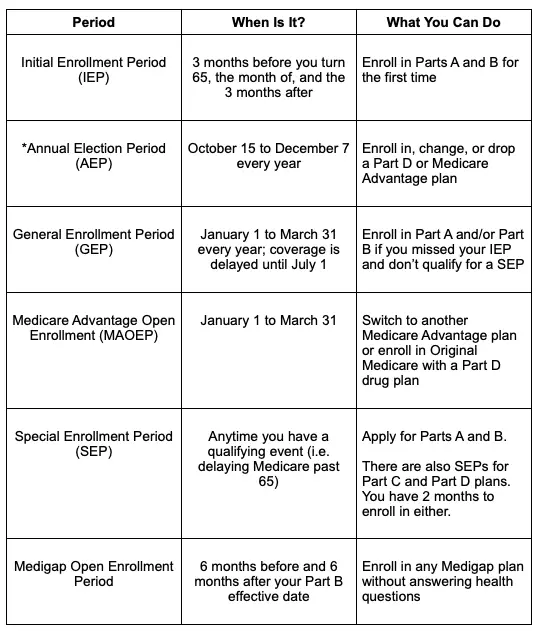

What Is The Medicare Enrollment Period

Medicare enrollment periods can be confusing because different enrollment periods have different dates for various purposes. There are many enrollment periods for people signing up for Medicare benefits for the first time. When you are new to Medicare, you may not need to apply for benefits. You could be automatically enrolled in Medicare coverage if you meet a few requirements.

If you do not qualify for automatic enrollment, you will need to utilize the Initial Enrollment Period.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What If I Move And I Have Medigap Insurance

When you move to another state with Medigap you wont have to change your coverage if the plan is available in your new place of residence. Youll still want to notify Medicare and your supplement company that you moved so they can update their information.

Depending on where you move there may be a change in your premium even though your coverage stays the same since Medigap plans are standardized.

Now if youre moving to Massachusetts, Minnesota, or Wisconsin, youll notice they have their own state-specific plans, instead of the traditional letter plans available everywhere else.

Never drop your current Medigap policy until your new policy receives approval. When moving and having Medigap insurance, comparing plans in your new area could still be beneficial because another top company may have more competitive premiums in your new area.

Also Check: Is Portable Oxygen Covered By Medicare

What If You Miss Special Enrollment

If you miss special enrollment, youll have to wait for another enrollment period to make changes to or enroll in a plan. You can make changes to your coverage during the open enrollment period, during the Medicare Advantage open enrollment period , and you can enroll in Part B and a Medicare Advantage plan during general enrollment. However, you may have to pay a late penalty for failing to enroll on time.

How To Avoid Costly Gaps In Coverage When You Retire After 65

If you anticipate losing your employer-based health insurance, its best to enroll in Medicare before you lose that coverage. This will ensure that you dont experience any gaps in coverage. If you plan to retire, contact your or your spouses employer one or two months in advance to avoid costly gaps in coverage. The human resources department can help you time your Medicare enrollment to start once you lose your employer-based coverage.

Don’t Miss: Does Medicare Pay For Vascepa

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Whats The Special Enrollment Period For Part B

If you have coverage through your own or a spouses employer, the Medicare Part B SEP allows you to delay taking Part B without facing a penalty. When your employer coverage ends, youll have eight months to enroll in part B.

To be eligible for the Part B Special Enrollment Period you must have had credible employer group coverage when you first became eligible for Medicare or, youre eligible for Medicare due to a disability.

If more than eight months passed since your employer group coverage was canceled, youll no longer be eligible for this Special Enrollment Period.

Read Also: How To Apply For Help Paying Medicare Premiums

How Long Is The Special Enrollment Period

The length of your SEP will depend on the reason you qualify. Here are a few of the many situations that will create a SEP and the length of the SEP that applies to them:

|

Qualifying SEP event |

Length of SEP |

|---|---|

|

You move to a spot that isnt in your plans service area. |

If you alert your plan before the move, your SEP starts the month before the month you move and continues for two months after. If you alert your plan after the move, your SEP starts the month you tell your plan, plus an additional two months. If you dont enroll in a new Medicare Advantage plan, youll be enrolled in Original Medicare. |

|

You move back to the U.S. after time abroad. |

Two months after the month you return to the U.S. |

|

You move into a skilled nursing facility. |

The entire time you live there and the two months after you leave. |

|

You lose Medicaid eligibility. |

Three months from the date youre no longer eligible or the date youre notified, whichever occurs later. |

|

You end employer health coverage. |

Your SEP to join a Medicare Advantage plan or prescription drug plan lasts two months after the month your coverage ends. Your SEP to join Medicare Part B lasts eight months after group health coverage or employment ends. |

|

Medicare ends your plans contract. |

The two months before and one month after your contract ends. |

|

Youre eligible for both Medicare and Medicaid. |

You can join, switch or end your plan one time during each period from January to March, April to June and July to September. |

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

You May Like: Is Tori Removal Covered By Medicare

Read Also: How To Lower Medicare Premiums

Other Medicare Special Enrollment Periods

There are some additional circumstances that could trigger a special enrollment period for you. One relates to Medicare Star Ratings, which are released by CMS.

Star ratings are a way to compare how good different Medicare Advantage plans are. The lowest rating a plan can earn is one star, with the highest rating being five stars. The rating is based on how effective the plan is in serving its beneficiaries.

You may be eligible for a special enrollment period to switch to a five-star plan if one is available in your area. This period lasts from Dec. 8 to Nov. 30 each year and can only be used once.

You also can be eligible for a special enrollment period if you qualify for Extra Help to pay for drug coverage or if youre eligible for both Medicare and Medicaid.

If you have Extra Help or Medicaid, you can make changes to your coverage one time from January to March, April to June or July to September.

Special Enrollment Period For Medicare

One of the most complicated Medicare enrollment periods is the Special Enrollment Period. Not all Medicare beneficiaries will become eligible for a Special Enrollment Period, and those who do will need to prove their qualification.

A Special Enrollment Period happens when you delay Original Medicare enrollment when you were first eligible with creditable coverage in place. The most common reason for delaying Original Medicare coverage is because you have employer coverage in place at the time you turned 65.

Once your employer coverage is terminated, you will receive a Special Enrollment Period to enroll in Original Medicare. If you qualify, your Special Enrollment Period will last 8 months from the termination date of your employer coverage.

Once you have enrolled in Original Medicare, you will have a 63-day Special Enrollment Period to enroll in a Medicare Part D plan. It is important to enroll in drug coverage once you lose employer benefits to avoid paying the Medicare Part D late enrollment penalty.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Additionally, if you are on a Medicare Advantage or Medicare Part D plan and experience a life-changing event, you will qualify for a Special Enrollment Period to make a change to your plan.

These life-changing events include:

Also Check: What Does Medicare Part B Include

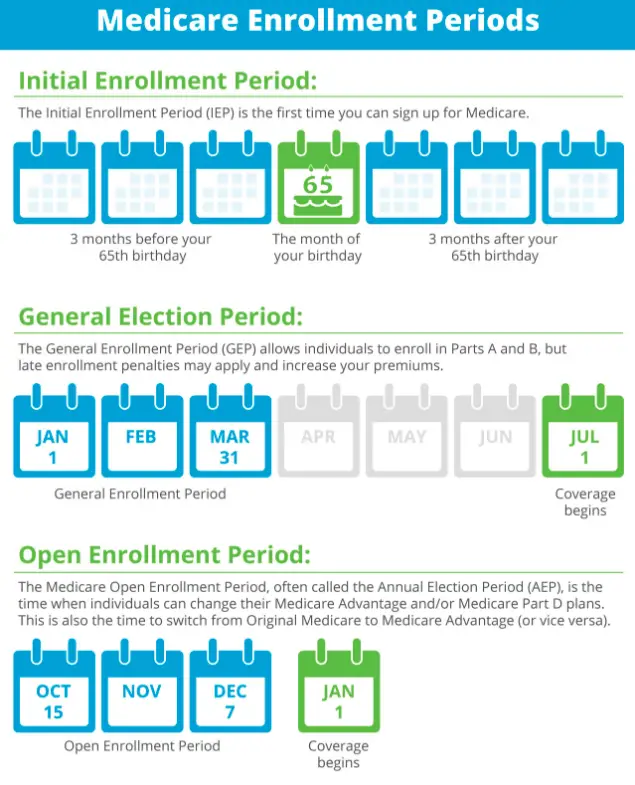

General Enrollment Period For Those Who Delay Medicare Coverage

Suppose you do not enroll in Original Medicare during your Initial Enrollment Period and do not have creditable coverage in place. In this case, you will need to wait until the General Enrollment Period to enroll in Original Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The General Enrollment Period runs annually from January 1 to March 31. When you enroll during this time, your coverage will go into effect on July 1.

Keep in mind, when you enroll in Original Medicare during the General Enrollment Period, you may be responsible for paying late enrollment fees. This depends on how long you delayed Medicare benefits without creditable coverage. Creditable coverage is health insurance that provides at least equal benefits to Original Medicare. We recommend that you enroll in Medicare coverage as soon as you are eligible or lose creditable coverage to avoid paying the late enrollment penalty.

Qualifying Life Events: Special Enrollment Periods For Medicare Advantage & Medicare Prescription Drug Plans

If you have Medicare and experience a Qualifying Life Event, you may qualify for a Special Enrollment Period . During that time, you can change your Medicare Advantage or stand-alone Medicare Part D Prescription Drug Plan coverage. The changes you can make and when are different for each Special Enrollment Period.

You May Like: When Are You Eligible For Medicare Part B

Is There A Special Enrollment Period For Medicare When Losing Coverage

There are several instances in which you may find you lose your current coverage. When a person loses coverage, that is an indication of eligibility for a Medicare Special Enrollment Period.

You lose employer health coverage

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

When you lose health coverage from an employer or union, you can join a different Medicare plan up to a full two months after.

You lose creditable prescription coverage, or it changes dramatically

Losing drug coverage equal to Medicares means you can switch to another plan with drug coverage or a stand-alone Part D. This Special Enrollment Period continues for two full months after the month you lose your drug coverage, or you get a notification.

You leave a Medicare cost plan

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you have Part D through a cost plan and you end up leaving that plan, you can enroll in a new policy for up to two months after you leave your old plan.

Your PACE coverage drops

Dropping your coverage in your PACE plan means you can enroll in a new plan for two months with a SEP.

Also Check: How To Change From Medicare Advantage To Original Medicare

What Are The Special Enrollment Periods By Medicare Plan And How Do I Qualify

You may qualify under a special enrollment period due to different reasons depending on the type of Medicare plan that you have. Generally, this period can be triggered by some sort of life event that has caused you to lose your current health care coverage.

But there are several different scenarios.

Read Also: Do You Pay For Medicare After 65

Initial Enrollment Period For Original Medicare And Medicare Advantage

If youre 65 or about to turn 65, youre eligible to join Original Medicare during your Initial Enrollment Period. This seven-month period includes:

- The three months before your birth month

- Your birth month

- The three months after your birthday month

During this time, you can apply for a Medicare Advantage plan if your Original Medicare Part A or B coverage has started and you are paying your Part B premium.

Recommended Reading: Will Medicare Pay For Handicap Bathroom

What Is Medicare Open Enrollment

Medicare open enrollment is a designated window of time each year when individuals can make changes to their Medicare coverage.

Open enrollment is primarily for people who already have Medicare. New applicants should sign up during their initial enrollment period, which starts three months before they turn 65 and ends three months after the month they turn 65. If they miss their initial enrollment period, they can sign up during open enrollment.

The fall open enrollment period for Medicare begins Oct. 15 and runs through Dec. 7 in 2021. This enrollment period is open to people who are covered by:

- Medicare Part A

- Medicare Part B

- Original Medicare

A separate Medicare open enrollment period applies to people who are covered by a Medicare Advantage plan . The open enrollment period for Medicare Advantage plans runs from Jan. 1 to March 31 each year.

Read Also: Does Medicare Pay For Repatha

You Lose Your Current Health Coverage

If you have some other types of health coverage when you turn 65, such as employer-provided group health insurance, you can delay enrolling in Medicare without having to pay a penalty later. Once you lose this coverage , you can enroll in Part A , Part B, Part C, and Part D plans without penalty until the end of your SEP.

Part A and Part B

If you qualify for premium-free Part A, you can enroll in Part A at any time without penalty. If you dont but were covered under a group health plan, you have eight months from the date you lose your coverage or your job ends, whichever comes first, to enroll in Part A. The same rule applies to Part B coverage . Your coverage will start anywhere from the first day of the month you sign up or, if you choose, during any of the three months after you sign up.

Medicare Advantage and Part D

You have two full months to enroll in a Medicare Advantage or Part D plan after the month your creditable drug coverage ends. If you dont have creditable drug coverage for 63 or more days once youre eligible for Medicare, you may owe a late enrollment penalty that permanently increases your Part D premium if you decide to get it.

What Does This Mean For Beneficiaries

- Beneficiaries who were eligible for a different SEP or aged into Medicare but were unable to enroll in a plan during the allotted time period due to the disaster or other emergency have until the extended deadline to enroll.

- Enrollments received are effective the first day of the following month.

1-800-978-9765711

Y0066_PHWEBSITE_2023

Don’t Miss: Does Medicare Pay For Stelara

Avoid Medicare Part D Penalties

Suppose you move from a Medicare Advantage Plan that includes prescription drug coverage to a stand-alone Medicare Prescription Drug Plan . In that case, youll be returned to Original Medicare.

Suppose you disenroll in a Medicare Advantage Prescription Drug Plan and lose your creditable prescription drug coverage. In that case, you may have to wait until your next enrollment opportunity to get drug coverage. This may cause you to pay a Part D late enrollment penalty.

Will I Pay A Penalty If I Enroll During The Gep

If you went at least a year without Part B after you were initially eligible to enroll, you may owe a late enrollment penalty. The penalty does not apply if you qualify for a Part B special enrollment period. But if youre enrolling during the GEP, you may find that you owe a penalty.

The penalties are different for Part A and Part B:

- Part A: The penalty is an additional 10% added to the premium, for twice the number of years you delayed Part A coverage. This is only applicable to people who have to pay a premium for Part A most people do not.

- Part B: The penalty is an additional 10% added to the premium for each year that you delayed your coverage . This penalty continues forever.

How to avoid common Medicare open enrollment mistakes

Medicareresources.org announced today the release of its 2022 Medicare Open Enrollment Guide and provided five tips for evaluating and selecting Medicare coverage.

How and when you can change your Medicare coverage

Learn how and when you can enroll in Original Medicare, Medicare Advantage, Part D and Medigap. Learn how to choose the best plan how to change your coverage.

The Medicare Part B special enrollment period

The Medicare Part B SEP allows people to delay Part B enrollment if they have health coverage through their own employer or a spouses current employer.

Read Also: Can I See A Doctor In Another State With Medicare