Who Qualifies For Premium

For members who are interested in premium-free Medicare Part A coverage, those who are age 65 will qualify if they meet the following:

- Already receive retirement benefits from Social Security or Railroad Retirement Board

- Eligible to receive Social Security or Railroad benefits but havenât filed for them

- A member or their spouse were Medicare-covered employed through the government

And for members who are under 65 the eligibility requirements are:

- Received Social Security or Railroad Retirement Board disability for 24 months

- Person who has End-Stage Renal Disease and meets determined requirements

In addition, you must also pay the Part B premium each month. The standard premium is $164.90 in 2023.

Please keep in mind that individuals with a higher income may have to pay more for their Part B premium. Be aware that if you donât sign up for Medicare Part B when you first become eligible, you may have to pay a 10% penalty for each full 12-month period you could have had Part B but didnât sign up .

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you can qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time, based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

Receiving Social Security For A Disability

If youve received Social Security Disability Insurance for 24 months, youll automatically be enrolled in Medicare on the 25th month after your first SSDI check was received.

According to the Centers for Medicare & Medicaid Services , in 2019 there were 8.5 million people with disabilities on Medicare.

Also Check: Will Medicare Pay For A Tummy Tuck

How Does Medicare Affect Reimbursement

A: Medicare reimbursement refers to the payments that hospitals and physicians receive in return for services rendered to Medicare beneficiaries. The reimbursement rates for these services are set by Medicare, and are typically less than the amount billed or the amount that a private insurance company would pay.

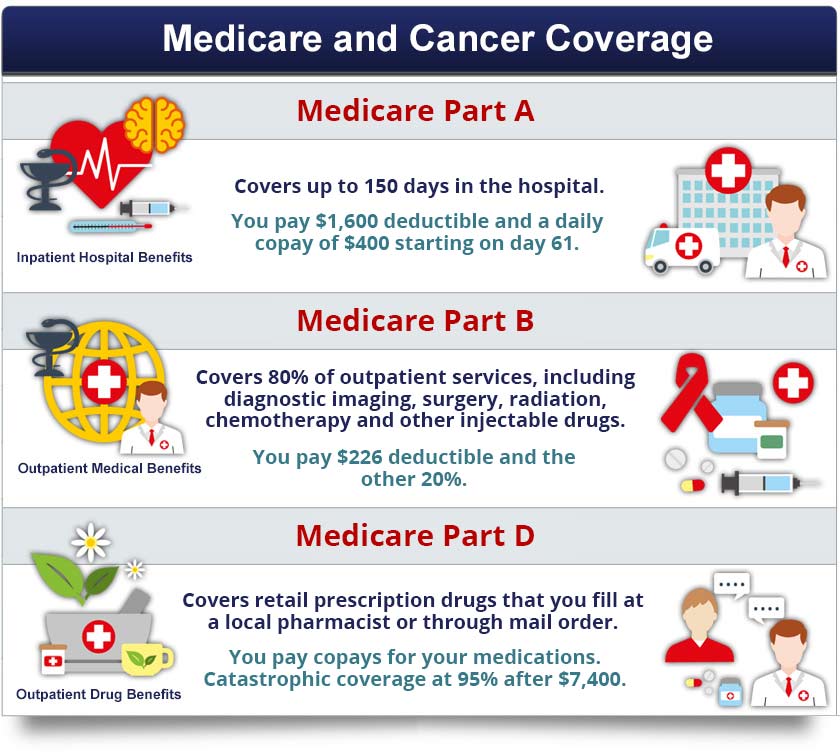

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Also Check: How To Enroll In Medicare Part B Special Enrollment

What You Need To Know Guide

Health insurance is often confusing. Medicare Part A, Part B, Part D, Medicare Supplement and Medicare Advantage probably add to the confusion. We’ve created an easy-to-read guide to help you navigate through these issues. If you are like everyone else, you have received mountains of information on Medicare and other health insurance options. The information in this publication can help you sort through important information as you work toward a decision. Click the link below to view and download it now.

After you have read through the guide, you may want additional information and we can help! SHIIPSMP has dedicated volunteer counselors trained and certified to personally assist you in evaluating your options. We can answer your questions about Medicare and other insurance choices. Call , or click the link below to find a SHIIPSMP volunteer near you.

When Do I Use My Medicare Cards

Everyone who enrolls in Medicare receives a red, white, and blue Medicare card. This card lists your name and the dates that your Original Medicare hospital insurance and medical insurance began. It will also show your Medicare number, which serves as an identification number in the Medicare system.

If you have Original Medicare, make sure you always bring this card with you when you visit doctors and hospitals so that they can submit bills to Medicare for payment. If you have a supplemental insurance plan, like a Medicare Supplement Plan, retiree, or union plan, make sure to show that plans card to your doctor or hospital, too, so that they can bill the plan for your out-of-pocket costs.

Note: Medicare has finished mailing new Medicare cards to all beneficiaries. You can still use your old card to get your care covered until January 1, 2020. However, if you have not received your new card, you should call 1-800-MEDICARE and speak to a representative.

If you are enrolled in a Part D plan , you will use the Part D plans card at the pharmacy.

Remember: Do not give your Medicare or Social Security numbers or personal data to strangers. Medicare will never ask for this information over the phone. If you believe you have been the target of Medicare marketing or billing fraud, contact your local Senior Medicare Patrol.

You May Like: What Is A Medicare Set Aside In Personal Injury

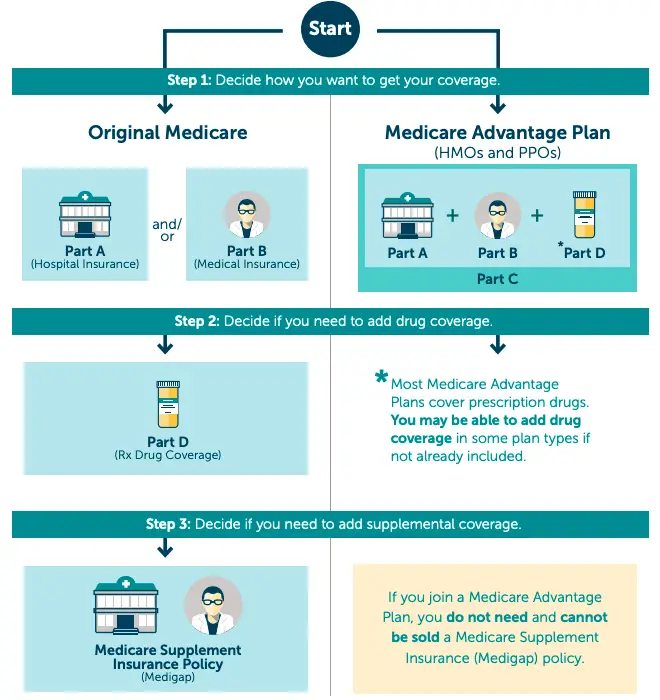

Enrolling In A Medicare Advantage Plan

If you want additional benefits beyond Original Medicare coverage, you can choose to enroll in a prescription drug plan or a Medicare Advantage plan. The best time to enroll is during your seven-month Initial Enrollment Period.

- Your enrollment period starts three months before your Medicare coverage begins. You can start looking for plans in month 21 of receiving SSDI, once you have your Medicare ID card.

- Your enrollment period includes the first month your Original Medicare coverage starts. This is usually month 25 of your SSDI.

- Your enrollment period ends three months after your Original Medicare coverage begins. This is usually in month 28 of receiving SSDI.

As soon as you get your Medicare ID card in the mail, you can enroll in a plan that provides additional services. Medicare Advantage plans often include benefits such as dental and vision coverage, as well as prescription drug coverage. Part C plans also have a yearly cap on out-of-pocket spending to help keep your healthcare costs affordable.

As Soon As You Are Automatically Enrolled In Medicare

You will no longer qualify for financial help to pay for your Covered California plan after your two-year waiting period ends. You will need to cancel your health plan through Covered California at least 14 days before you want your coverage to end. If you were enrolled in Medi-Cal instead of Covered California, you can ask your local county office if you will continue to qualify for other Medi-Cal programs that can lower your Medicare costs.

Don’t Miss: Why Sign Up For Medicare At 65

Who Is Eligible For Medicaid

You may qualify for free or low-cost care through Medicaid based on income and family size.

In all states, Medicaid provides health coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities. In some states the program covers all low-income adults below a certain income level.

- First, find out if your state is expanding Medicaid and learn what that means for you.

- If your state is expanding Medicaid, use this chart to see what you may qualify for based on your income and family size.

Even if you were told you didn’t qualify for Medicaid in the past, you may qualify under the new rules. You can see if you qualify for Medicaid 2 ways:

- Visit your state’s Medicaid website. Use the drop-down menu at the top of this page to pick your state. You can apply right now and find out if you qualify. If you qualify, coverage can begin immediately.

- Fill out an application in the Health Insurance Marketplace. When you finish the application, we’ll tell you which programs you and your family qualify for. If it looks like anyone is eligible for Medicaid and/or CHIP, we’ll let the state agency know so you can enroll.

What You Need To Know Before Signing Up For Medicare Part B

Before signing up for Medicare Part B, it is important to understand the costs associated with this coverage. Generally, there is a monthly premium that must be paid, as well as a deductible and coinsurance. Additionally, you may need to pay a copayment for some services. It is important to research the costs associated with Medicare Part B before signing up so that you know what to expect.

Don’t Miss: What Does Medicare Pay For Hospitalization

What Is Part B Premium Give Back

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

What Is The Income Limit For Extra Help In 2021

Youll still get a notice from your drug plan letting you know what your copayments for 2021 will be. What should I do if I dont qualify automatically? You should apply for Extra Help if: Your yearly income is $19,140 or less for an individual or $25,860 or less for a married couple living together.

You May Like: Can I Sign Up For Medicare Part B Online

Covered California And Medicare

Transitioning from Covered California to Medicare is an important step. Make sure you take action and keep track of important dates and deadlines to avoid unwanted consequences.

In general, people who are eligible for Medicare even if they do not enroll in it arent eligible to receive financial help to lower the cost of a Covered California health plan.

People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days and will usually need to cancel their Covered California. Your Covered California plan wont be automatically canceled when you become eligible for Medicare, even if you enroll in a Medicare plan with the same insurance company. You must cancel your plan yourself at least 14 days before you want your coverage to end by contacting Covered California.

If you are eligible for Medicare and you keep your Covered California plan, you may face serious consequences. For example:

- You may have to pay back all or some of your premium tax credits to the Internal Revenue Service .

- Or, there could be a delay in your Medicare coverage start date. If you dont sign up for Medicare Part B during your initial enrollment period, you will have to wait for the general open enrollment period , and then your coverage wouldnt begin until July of that year.

- In addition, you may have to pay lifetime penalties for late enrollment in Medicare and your premiums may increase by 10 percent or more.

End Stage Renal Disease

You can qualify for early Medicare coverage if you:

- have received a diagnosis of ESRD from a medical professional

- are on dialysis or have had a kidney transplant

- are able to receive SSDI, Railroad Retirement benefits, or qualify for Medicare

You must wait 3 months after starting regular dialysis or receiving a kidney transplant to qualify for Medicare coverage.

Your Medicare coverage will begin the first day of the fourth month of your dialysis treatment. You can get coverage as soon as your first month of treatment if you complete a Medicare-approved training program to do your own at-home dialysis treatment.

Providing coverage to those with medical disabilities and some chronic health conditions has even increased access to healthcare and reduced the number of deaths. An estimated 500,000 people with Medicare have ESRD, according to a 2017 article. The researcher determined that the ESRD Medicare program prevents up to 540 deaths from ESRD each year.

Recommended Reading: When To Apply For Medicare When Turning 65

How Much Does Medicare Cost

Medicare costs depend on which parts youre enrolled in and how long you worked and paid Medicare taxes.

For 2023, the monthly premiums are:

-

Part A: $0 if you paid Medicare taxes long enough while working . Either $278 or $506 per month if you dont qualify for premium-free Part A, depending on how long you worked and paid Medicare taxes.

-

Part B: $164.90 or more per month, depending on your income.

-

Part C: Varies by plan

-

Part D: Varies depending on which plan you choose, but the average is around $43 per month

Important Information:

Like employer-sponsored health plans, Medicare has an open enrollment period. For Original Medicare, enrollment is from Oct. 15 to Dec. 7 each year. For Medicare Advantage, its Jan. 1 to March 31.

Check Out: The 10 Best & Worst Medicare Advantage Plans

When Does Coverage Begin

Medicare eligibility after disability usually doesnt start right away. The date your Medicare coverage will start depends on your disability.

- For most qualifying disabilities, youll need to wait for two years to receive Medicare benefits. Your Medicare coverage begins after youve received SSDI for 24 months.

- If you have Lou Gehrigs Disease, also known as ALS, youll get coverage right away. Your Original Medicare Part A and Part B coverage starts the first month you get your Social Security disability benefits.

- If you have end-stage renal disease , your Medicare coverage starts after three months of regular dialysis treatment.

Find a local Medicare plan that fits your needs

Read Also: Does Medicare Pay For Varicose Veins

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

How Much You Will Receive

The amount of your monthly SSDI benefit is based on your lifetime average earnings covered by Social Security.

If you don’t already have an estimate, you can get your Social Security Statement online with your personal mySocial Security account or use our Benefit Calculators to determine how much you could get if you became disabled right now.

Don’t Miss: Is Mutual Of Omaha A Good Company For Medicare Supplement

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

How Can Shiip Help

Get answers to your Medicare questions.

We offer free, objective information about Medicare, Medicare Advantage plans, Medicare claims, Medicare supplement insurance, Medicare Prescription Drug Plans, fraud and abuse prevention and long-term care insurance. Trained SHIIP volunteer counselors are available for one-on-one counseling in every county in the state.

You May Like: Does Medicare Part A & B Cover Prescriptions

Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .